Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Feb, 2025

By Hailey Ross and Noor Ul Ain Adeel

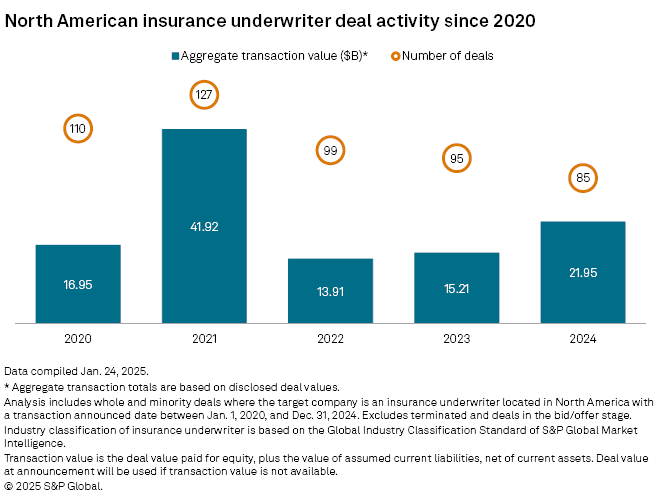

North American insurance underwriters focused on bigger deals in 2024 as the industry's aggregate transaction value jumped while deal announcements declined year over year.

Insurance carriers announced an aggregate transaction value of $21.95 billion in 2024, a 44% increase from $15.21 billion in 2023.

In contrast, deal frequency fell: North American insurance underwriters announced 85 transactions in 2024 compared to 95 in 2023.

The deal activity among insurance underwriters tracks with a wider, yearslong trend of fewer but bigger deals across all industries in Canada and the US. For North American insurance underwriters, deal activity peaked at 127 transactions in 2021 and has fallen every year since, according to S&P Global Market Intelligence data.

Bigger deals with big players

A number of major deals helped to push the total announced value among North American insurance underwriters to a three-year high in 2024. Japan-based companies, in particular, have been expanding their reach in the US insurance market, and they are expected to continue to grow their US footprint into 2025.

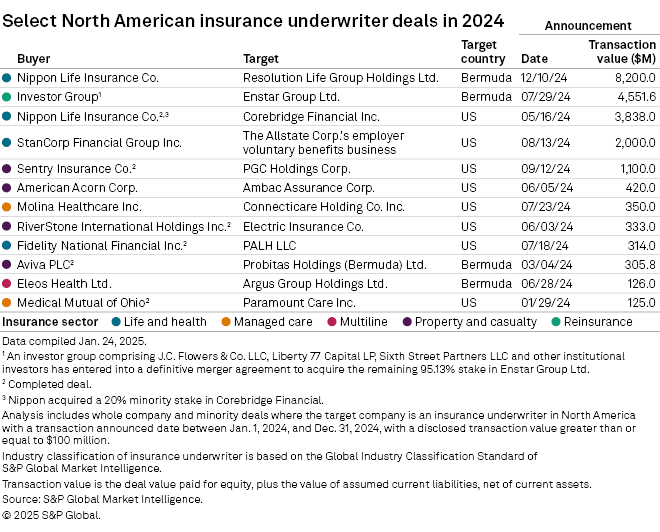

Several of the biggest deals announced in 2024 involved major players in the Japanese insurance market.

The largest deal announced among the group in 2024 was Japan-based Nippon Life Insurance Co.'s $8.2 billion bid for Resolution Life Group Holdings Ltd., a Bermuda-based entity that acquires and manages a portfolio of life insurance policies in Bermuda, the UK, the US and the Australasia region.

Nippon Life will acquire Resolution Life shares from shareholders including Blackstone Inc. in a transaction that is anticipated to close in the second half of 2025. Resolution Life will become Nippon Life's wholly owned subsidiary following the deal's completion.

Nippon Life also took the spot for the third-largest deal announced in 2024 with its purchase of a 21.6% ownership stake in Corebridge Financial Inc. The transaction was completed Dec. 9 as Nippon Life bought roughly 120 million shares of Corebridge's common stock at $31.47 per share, resulting in a total value of $3.8 billion.

Meiji Yasuda Life Insurance Co. also made a notable move this year to expand its presence in the US life insurance market. Meiji Yasuda Life's US unit, StanCorp Financial Group Inc., said in August that it would acquire The Allstate Corp.'s employer voluntary benefits business, which includes American Heritage Life Insurance Co. for $2 billion. The deal ranked as the fourth-largest announced acquisition in 2024.

Out of the 12 largest deals announced among North American insurance underwriters in 2024, four targeted companies based in Bermuda while the rest targeted companies based in the US.