Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Feb, 2025

This story is part of a short series exploring supply, demand and price implications of President Donald Trump's January national energy emergency declaration. Follow this link to read about oil implications and this link to read about natural gas.

With a steady influx of datacenters seeking interconnection with the nation's electricity grid, there appears to be little doubt about the need for more energy infrastructure to serve this power demand.

There is, however, less consensus around whether the US power sector is facing an energy emergency.

President Donald Trump on Jan. 20 declared a national energy emergency in one of his first official actions after being sworn in for a second, four-year term.

"The policies of the previous administration have driven our nation into a national emergency, where a precariously inadequate and intermittent energy supply, and an increasingly unreliable grid, require swift and decisive action," the order states. "Without immediate remedy, this situation will dramatically deteriorate in the near future due to a high demand for energy and natural resources to power the next generation of technology."

The Electric Power Supply Association (EPSA), a trade group that represents competitive power providers, said it "supports the thesis that load growth is coming … and that it's vitally important that we respond."

"Our challenge … is we're just not sure how fast and how much," EPSA President and CEO Todd Snitchler told Platts, part of S&P Global Commodity Insights.

"But broadly speaking, I'm not sure that there is an emergency at the moment only because of the uncertainty that exists with exactly what the load growth numbers will look like," Snitchler said in a phone interview.

National picture

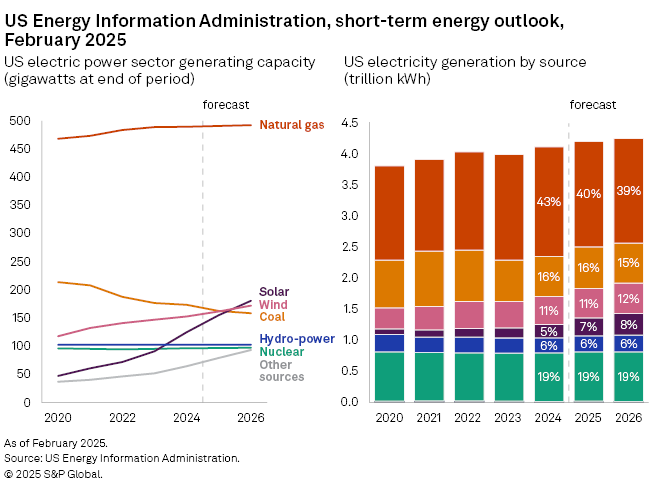

The US Energy Information Administration forecast in its February Short-Term Energy Outlook that nationwide retail sales to ultimate customers would rise to about 4,043 terawatt-hours in 2025, up more than 2% from 2024, and to 4,100 TWh in 2026, representing another 1% climb. Nationwide retail sales of 3,947 TWh in 2024 were a nearly 2% increase over 2023. Nationwide retail sales data is the EIA's proxy for power demand.

The EIA's forecast portends the continuance of mostly climbing demand — with the notable exception of a pandemic-dominated 2020 — that followed a stretch of relatively stable demand from 2010 to 2017, when annual retail sales to ultimate customers averaged 3,742 TWh. Should the EIA's 2025 forecast of 4,043 TWh come to fruition, it would mark a nearly 9% increase in annual demand since 2017. If both the 2025 and 2026 forecasts hold, it would mark the first time since 2005-2007 that the US has experienced three consecutive years of demand growth.

A surge in US power generation has also emerged. Overall US power supply rose nearly 3% to 4,320 TWh in 2024, and the EIA forecasts it will rise 2% to 4,408 TWh in 2025 and by another 1% to 4,450 TWh in 2026. Should the forecast for US power generation growth hold in 2025 and 2026, it would mark the first time since 2005-2007 that the country has experienced three consecutive years of generation growth.

James Preedy, vice president of energy management at developer REV Renewables Inc., said the US is "not there yet" as far as a potential grid emergency but added that certain factors, such as the growing datacenter demand and retirement of fossil fuel-fired generation, are compounding the challenges grid operators already face in maintaining reliability.

"If you started in the industry in the last 20 years, in most US markets, you're not accustomed to seeing appreciable load growth," Preedy said in a Feb. 14 email.

Datacenter demand wildcard

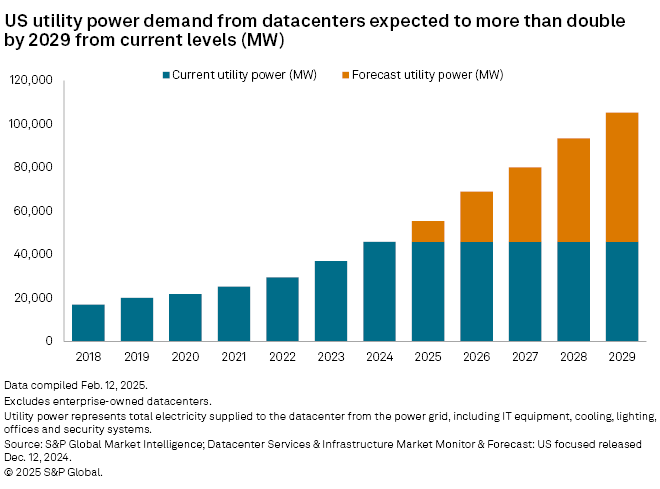

Datacenter power demand is a major piece of the long-term planning puzzle.

Dominion Energy Inc. utility subsidiary Dominion Energy Virginia — which serves the largest concentration of datacenters in the US and, by many accounts, the world in Loudoun County, Virginia — has about 40.2 GW of datacenter-contracted capacity seeking interconnection to its grid, up from about 21.4 GW in July 2024, executives said on a Feb. 12 earnings call.

China-based Hangzhou DeepSeek Artificial Intelligence Co. Ltd.'s launch of a cheaper and more energy-efficient AI model could shift the trajectory, but Dominion Chair, President and CEO Robert Blue said that datacenter growth in Virginia is "not slowing down."

"In fact, it is accelerating."

Datacenter power demand across the PJM Interconnection LLC's Dominion Energy transmission zone alone is expected to "nearly quadruple over the next five years," to about 26.7 GW by 2029, Commodity Insights analysts wrote in a January report based on 451 Research data.

Transmission, dispatch considerations

There are issues and constraints, both procedural and substantive, on how the power system is built that have resulted in the current circumstances, said Nathan Howe, a partner at law firm KL Gates where he is a member of their power practice.

The speed of transmission development is a major impediment to serving datacenter load. The grid needs significantly more investment, and its lack represents the biggest bottleneck to getting more power resources online, Howe said. And the regulatory framework nearly always lags technological innovation, he added.

Managing the buildout of datacenters has been a wildcard, and "if we can't figure that out, we could be in an energy emergency. That will be absolutely critical over the next five to 10 years," Howe said.

But the issues characterized by the executive order seem to ignore the important efforts already underway to modernize grid development, Howe said.

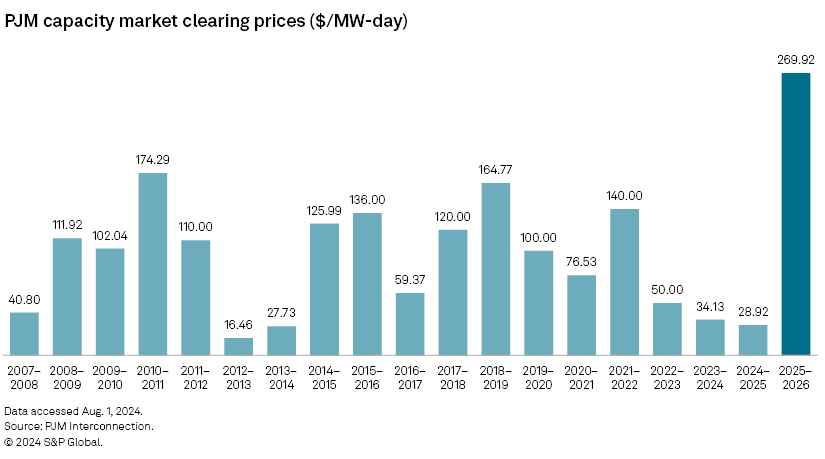

"I would not characterize the current situation as an emergency, but we do have a PJM capacity market that had exponentially higher prices in the last auction. Capacity markets can be quite volatile, and price is driven by marginal resources, so a few big resources can significantly affect price," Howe said in a phone call.

"The executive order strikes me as very political in how it characterizes the issues facing the grid," Howe said.

Newly appointed US Energy Secretary Chris Wright said in a day-one order that the department will "bring a renewed focus to growing baseload and dispatchable generation to reliably meet growing demand."

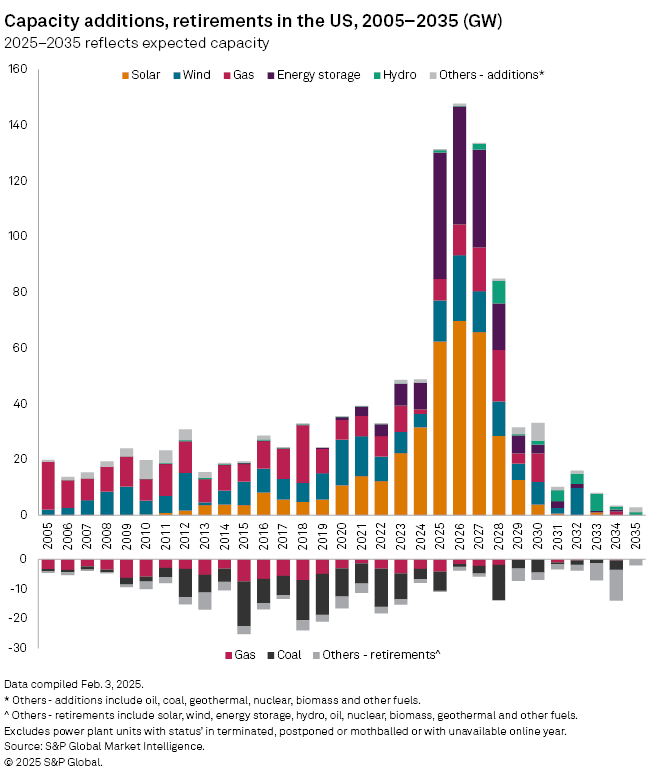

The US ended 2024 with around 312 GW of net capacity of combined solar, wind and battery storage resources, representing a little more than 24% of the nation's total net generation capacity, according to an analysis of S&P Global Market Intelligence data compiled Jan. 30. Market Intelligence forecasts that combined solar, wind and battery net capacity could rise to 434 GW, or nearly 31% of projected overall US net generation capacity, by the end of 2025.

The steady growth in renewables, however, may prove insufficient in the face of the datacenter surge, REV Renewables' Preedy said.

"While the demand for renewables and batteries will remain high, they alone won't sustain rapid datacenter load growth," Preedy said. "In recent years, there have been few dispatchable power generation assets constructed, but this may be changing. An 'all-of-the-above' approach is necessary to ensure clean power and support datacenter growth to maintain US global competitiveness in AI."

Howe questioned Wright's focus on baseload and dispatchable generation, though, noting that other measures, such as effective load carrying capability, can better qualify the quality of resources coming online and their value to the grid.

Investment in focus

Uncertainty around how the administration may approach the country's energy situation could stifle investment.

"When talking about investment in new generation of any resource type at scale, creating uncertainty makes it very difficult to invest in long-term projects that could face changing motivations from a future administration," Howe said.

Analysts and investors in the US utilities and power sectors also are keeping a cautious eye on electricity demand with some skepticism over whether the nation faces an energy emergency.

"Nobody sees anything close to an energy emergency on either [Wall Street] or Main Street and we are viewing this as a way for Trump to increase employment of the fossil industry by increasing LNG exports, which you can argue is very pro-climate as it displaces coal overseas, and refilling the [Strategic Petroleum Reserve], which you can argue is fairly anti-climate since it will all eventually be refined and burned," CreditSights analyst Andrew DeVries said.

Morningstar analyst Travis Miller said the administration needs to closely examine its energy priorities.

"Trump has been out there talking about wind as a less preferred source. But the fact of the matter is the US is going to need every energy source — wind, solar, gas, nuclear — to serve demand if the demand growth projections play out," Miller told Platts.

During his first week in office, Trump was joined by executives of prominent high-tech companies and equity investors in announcing the creation of the Stargate Project. The joint venture between OpenAI, SoftBank Corp., MGX Fund Management and Oracle Corp. expects to invest $100 billion initially in AI infrastructure, with plans to invest $500 billion over the next four years.

"If the administration is going to put out goals like $500 billion of investment in datacenters, they are going to need to back that up with some energy policies that accommodate the infrastructure necessary to support that investment in datacenters," Miller said. "You can't do $500 billion of datacenter development while constraining energy generation and distribution systems."

The Edison Electric Institute, the trade group that represents the nation's investor-owned electric utilities, did not respond to requests for comment on the energy emergency declaration.

PJM's challenges

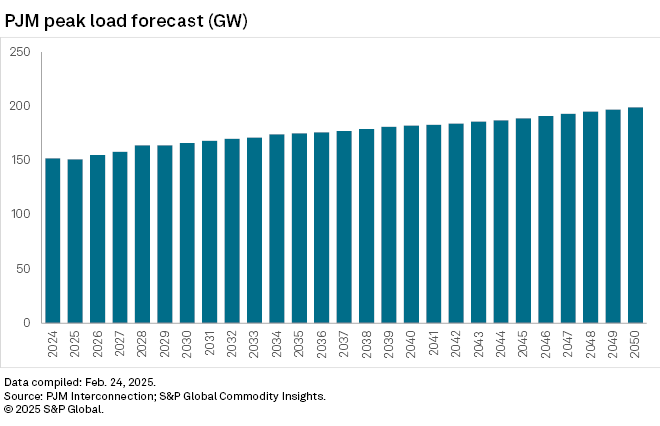

PJM Interconnection, which administers the largest US power market, serving 65 million customers across 13 states and Washington, DC, has been concerned about reliability for the past few years. PJM has pointed to increasing power demand from datacenters, among other sources; baseload power plant retirements; and increasing instances of extreme weather.

The grid operator released a study in 2023 showing that power generation resource retirements and load growth could potentially outpace new generation resource entry, and at the current pace of new entry, resource adequacy risks could emerge in the near future.

"Our reserve margin has dwindled, and we are at risk of not holding enough reserves as early as next year," PJM spokesperson Jeff Shields said in an email, noting the grid operator's efforts to delay retirements, expedite new resources and improve on market structure. "But much is in the hands of government officials in our states and the federal government."

Regarding datacenter power demand growth, Shields said PJM is focused on bringing on new generation of all resource types, with heavy emphasis on new large resources.

Capacity prices hit a historic high in PJM's most recent auction, compared to previously low prices. The capacity price reflects the tightening supply-demand conditions as that marketplace reflects resource adequacy, Shields said.

Still, PJM got through recent cold weather in January and earlier in February without any significant issues, said Joe Bowring, president of Monitoring Analytics, PJM's independent market monitor.

"It is not clear why PJM is emphasizing how tight we were. PJM managed the cold weather well. To meet the winter peak load of around 145,000 MW, we had about 180,000 MW of capacity, 5,000 to 10,000 MW of exports and more than 7,000 MW of demand response that was never called during the January cold snap," Bowring said.

That said, PJM needs dispatchable generation to be available when renewables are not producing, Bowring said in a phone call.

"We are not in an emergency, but we are in a situation where supply and demand are tight and the need for new supply needs to be addressed," Bowring said.