Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2025

| Australian Prime Minister Anthony Albanese discusses steel and aluminum tariffs with US President Donald Trump on a call. |

Australia's government and industry are uniting to ensure the country's steel and aluminum are exempt from the 25% tariffs imposed by US President Donald Trump, as these materials are strategically essential for the US.

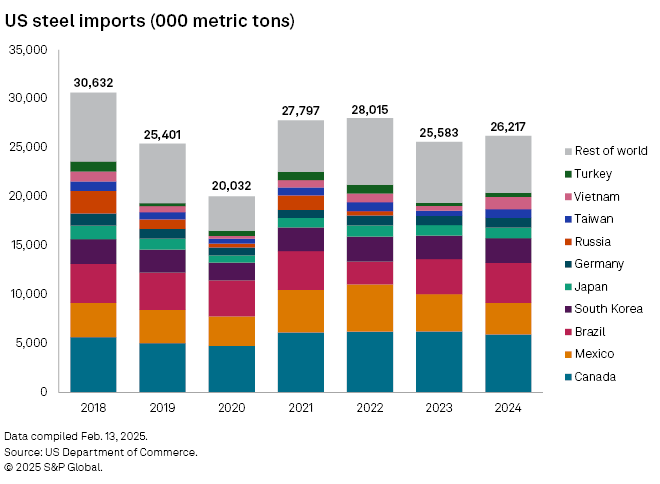

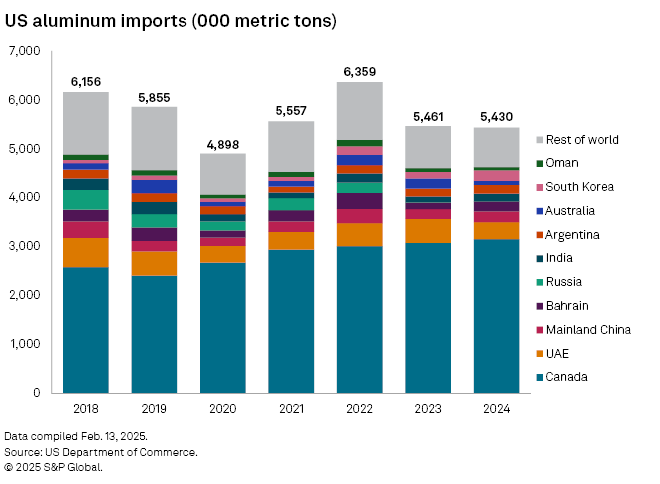

Trump signed proclamations on Feb. 11 to close existing loopholes and exemptions on steel and aluminum imports, restoring a 25% tariff on steel imports from his first term and raising the tariff on aluminum imports from 10% to 25%, effective March 12.

Australia exported 1.9 million metric tons of the 183.7 MMt of steel that the US imported from 2018 to 2024, according to US government data. Meanwhile, Australia is a top-10 exporter of aluminum into the US, contributing 1.1 MMt of the 39.7 MMt in total imports over that period.

In his first term, Trump exempted Australia from US tariffs on steel and aluminum, and Australian Prime Minister Anthony Albanese said in a Feb. 11 post on social media platform X that he had a "great conversation" with Trump about the possibility of exemptions this time around, to which the US president said he would give "great consideration."

Yet Trump's top trade adviser Peter Navarro also told media in a same-day interview that "Australia is just killing our aluminum market, and Trump says 'no, we're not doing that anymore.' We're going to back to ... [the] golden age of [US-made] steel and aluminum."

Amid these conflicting signals, Australia remains hopeful that the US administration sees enduring value in the technology within the steel and aluminum products Australia has to offer for niche requirements.

"We are in a good position, I'm hopeful, but it is a 'Team Australia' moment ... It's important for Australia to get this right and to have a victory on this," Australian Senator Dean Smith told ABC Radio Perth on Feb. 12.

"We've got to protect our national interest and make sure that we put the best case forward, but we've also got to have a very, very keen eye to how those tariff decisions affect and impact our trading partners, because as an export-orientated nation ... we do believe that an open globalized trading system is in the best interests of consumers, whether they're in the United States, China or Australia."

Australia's technological edge

|

| Simon Ringer, pro-vice-chancellor at the University of Sydney. |

Simon Ringer, pro-vice-chancellor for research infrastructure at the University of Sydney, told S&P Global Commodity Insights that while Australia is a "fairly small but still notable exporter of steel and aluminum to the US, it's the nature of the technology in those exports that makes them so valuable to [the US]."

This will be a key role in determining whether the US sticks with the tariffs.

"The Australian aluminum billets that we export to the US are very high quality, and are used in the manufacture of advanced high-strength aluminum alloys that go into strategic applications. It's in the US' interest to have diversity in the supply chain of strategic materials," Ringer said.

Ringer also cited BlueScope Steel Ltd.'s roofing and cladding solution, Colorbond Steel, known for its durability, which is "a somewhat famous Australian steel technology, which will be critical to the building and reconstruction going on in Los Angeles after the destruction caused by recent tragic wildfires."

"You've got to ask yourself: How does it serve the US' interest to make the rebuild in California even more expensive than it would otherwise be by putting tariffs on Australian technology that can support the building and construction supply chains in California?" Ringer said.

Steel hopes

An Australian Steel Institute (ASI) spokesperson told Commodity Insights that, "aside from BlueScope, other Australian steel producers do not substantially export to the US." Less than 10% of BlueScope's Australian steel production is exported to the US, the bulk of which is fed to its US plants.

The ASI is "hopeful that BlueScope's strong investment in the US economy is recognized by the Trump administration, which saw fit to exempt Australia from steel tariffs in the last Trump administration," the ASI said in an emailed statement.

BlueScope "will continue to work with the Trump administration and the Australian government as we await further details," the company said in an emailed statement.

"BlueScope has been investing in the US for 30 years. Most recently, we have spent A$2 billion on acquisitions and brownfields expansion of our operations there. BlueScope is now the fifth-largest steel producer in the US, employing 4,000 American workers. BlueScope abides by all trade rules and agreements," the company said.

Aluminum growth

Vladimir Tyazhelnikov, an expert in international trade from the University of Sydney's School of Economics, said Feb. 12 that Australian aluminum exports to the US have grown significantly in recent years to become the country's ninth-largest export.

"While Australia's overall aluminum exports have remained stable, shipments to the US have been highly volatile," which Tyazhelnikov partly attributed to fluctuations in aluminum prices.

"The Australian aluminum billets that we export to the US are very high quality and are used in the manufacture of advanced high-strength aluminum alloys that go into strategic applications. It's in the US' interest to have diversity in the supply chain of strategic materials," Ringer said.