Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Feb, 2025

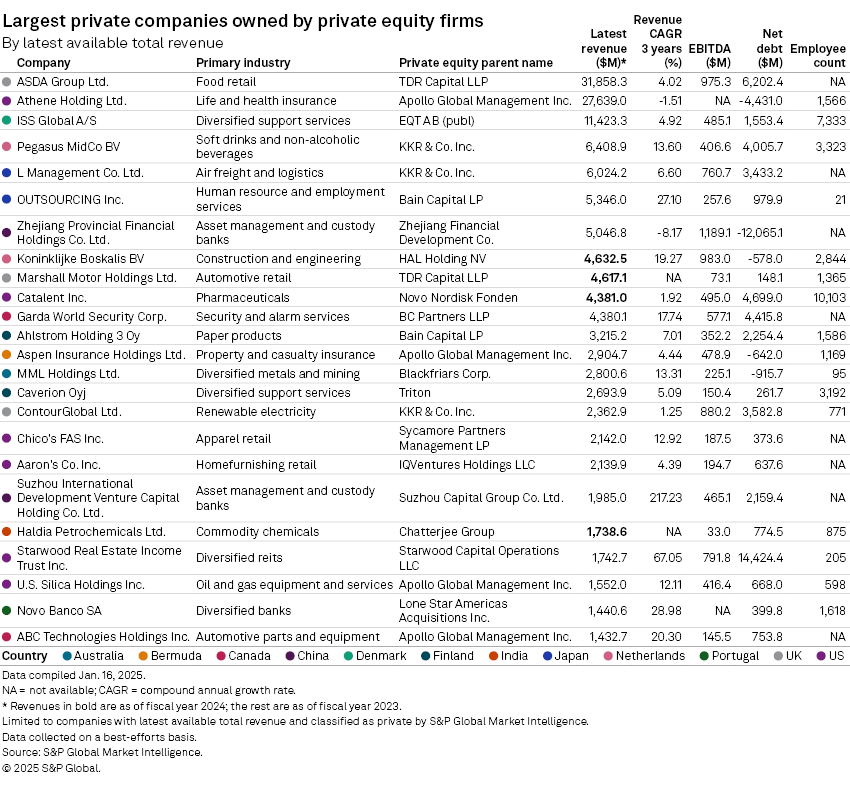

TDR Capital LLP-backed ASDA Group Ltd. is the largest private equity-owned private company based on the latest available revenue data.

The UK-based food and grocery retailer reported about $31.9 billion in revenue as of fiscal 2023, according to an S&P Global Market Intelligence analysis. TDR Capital owns 67.5% of Asda, which reported $975.3 million in EBITDA and $6.2 billion in net debt.

The second-largest private company by revenue is Apollo Global Management Inc.'s Athene Holding Ltd. In 2022, Apollo acquired and integrated Athene into its operations.

Athene, a US retirement savings firm with 1,566 employees, reported approximately $27.6 billion in revenue for the full year 2023.

Novo Holdings A/S-owned Catalent Inc., a pharmaceutical company with more than 10,000 employees, has the largest head count among the 24 companies. In terms of revenue, Catalent ranks 10th on the list with $4.38 billion for fiscal 2024.

Starwood Capital Operations LLC's real estate investment trust, Starwood Real Estate Income Trust Inc., while ranking 21st based on the latest available revenue figures, holds the most net debt at more than $14.4 billion.

– Download a spreadsheet with data featured in this article.

– Read an overview of private equity activity in 2024.

– Catch up on private equity trends in blockchain and cryptocurrency.

EQT's EdgeConneX leads in funding rounds

Based on rounds of funding, including debt rounds, EQT AB (publ)'s US-headquartered internet infrastructure company EdgeConneX Inc. was the top private equity-owned company in the past five years with more than $4 billion in funding, according to Market Intelligence data. Late in 2024, EQT agreed to divest a minority stake in EdgeConneX to San Francisco-based private equity firm Sixth Street Partners LLC.

Datacenter operator EdgeCore Internet Real Estate LLC, backed by Partners Group Holding AG, ranked second with $3.8 billion in total rounds of funding over the last five years.

Roark Capital Management LLC-backed Doctor's Associates Inc., doing business as Subway, ranked third with $3.8 billion. The sandwich chain had the most employees with a head count of about 28,000, significantly more than the combined head count of the other companies on the list.

US-headquartered companies dominated the funding rounds, with only six out of the 20 companies on the list located in other parts of the world. The Carlyle Group Inc.'s Netherlands-based crude oil refining company Varo Energy BV, with $3.3 billion in funding in the past five years, was the only non-US company within the top 10 of the list.

Overall, the value of private equity and venture capital deals worldwide jumped about 25% in 2024. Rounds of funding increased about 9% in transaction value year over year, while the number of funding rounds dropped.