Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Dec, 2025

Private equity faced a challenging year in 2025, with exits and deals on two different tracks. Persistently high interest rates and uncertainties over tariffs pushed investors to reevaluate exit plans, while private equity-backed investments surpassed the full-year 2024 level, driven by high-value deals.

The top 10 most-read private equity stories of the year highlight interest in the tough exit and fundraising environment as well as investment bright spots, particularly in defense and AI.

Most read private equity articles

1. Private equity exits fall to 2-year low in Q1 2025

Global private equity exit activity slumped to its lowest level in two years in the first quarter of 2025 as tariff-related uncertainty rattled markets.

2. 2025 Private Equity and Venture Capital Outlook

The annual report summarizes findings from a survey of global private equity, venture capital and limited partner professionals on the issues facing private markets fund managers and investors.

3. Global private equity fundraising sinks for 3rd straight year

Global private equity fundraising declined for the third straight year in 2024, largely due to a weak exit environment that constrained liquidity.

4. US private equity AUM hits $3.128 trillion in 2024

Between 2022 and 2023, 37 US private equity and venture capital firms saw assets under management more than double, with median AUM growth at 8%.

5. PE defense investment surges in early 2025 as geopolitics drives change

Recent policy decisions are changing the field of play for private equity defense investors. Under President Donald Trump, the US is refocusing its defense priorities, while European countries are getting serious about boosting military budgets.

6. Global private equity deal value up 19% in H1 2025

The growth in deal value was driven by larger deals, which are less susceptible to market uncertainties such as tariffs.

7. Tariffs add new hurdle to private equity's exit challenge

Private equity firms positioning portfolio companies for sale need to quickly gain an in-depth understanding of those assets' exposure to tariffs.

8. Private equity exit value falls to 5-year low

Due to the weak exit market, the average holding period for private equity firms was 6.1 years in 2024, according to Preqin data.

9. Venture capital seeks AI winners as private equity makes infrastructure play

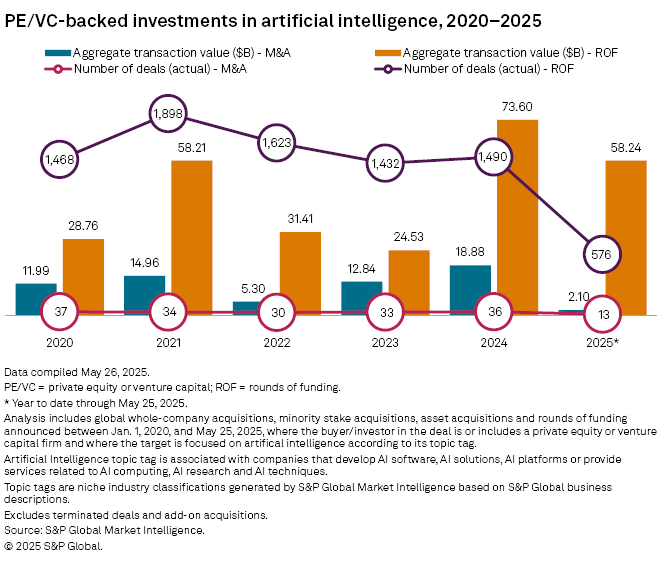

While venture capital competes to invest in AI, private equity is prioritizing investment in the infrastructure that underpins AI's expansion.

10. Private equity investment in India's healthcare sector lowest since 2020

Even with the decline in investment, India's healthcare companies remain attractive to investors due to the significant gap between the demand for healthcare and available facilities.