Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2025

By Brian Scheid

The Federal Reserve's interest rate path appears murky heading into 2026, complicating the outlook for the US dollar, which has slumped for much of this year.

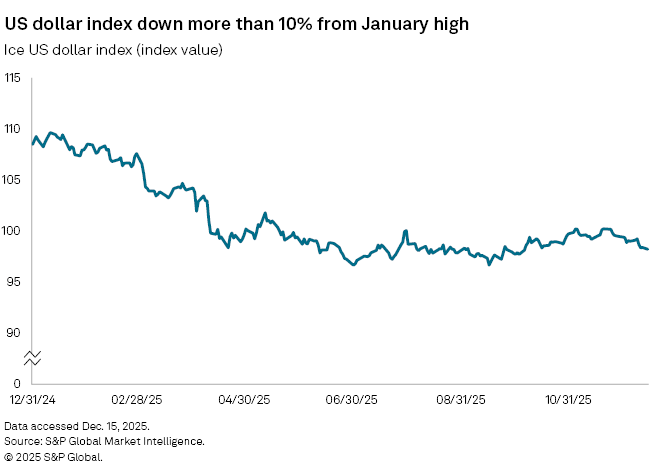

The ICE US dollar index is down about 10.3% from its year-to-date high in January. Its movement has slowed since the Fed began its current rate-cutting cycle in September. The Fed has cut a total of 75 basis points, one cut at each meeting, since Sept. 17, while the dollar index is up about 1.4% over that time period.

The dollar, which tends to weaken as the Fed cuts rates, will likely see declines next year if hiring slows and unemployment rises, which may prompt Fed officials to approve more than the one rate cut they currently anticipate. For now, with Fed officials signaling that rate cuts are on hold amid mixed economic signals, the dollar's next moves are difficult to predict.

"The path of least resistance of the US dollar remains down," said Elias Haddad, global head of markets strategy with the foreign exchange team at Brown Brothers Harriman & Co. "In my view, the Fed will deliver more than the one cut it has penciled in for next year. US labor demand is weak, and upside risks to inflation are not materializing."

Lower interest rates lead to a weaker US dollar as global investors turn to assets denominated by currencies with higher yields. While lower rates can lower borrowing costs and boost the US economy, they also reduce the dollar's appeal to global investors.

Still, if inflation heats up, the Fed could hold its benchmark interest rate at the current range of 3.5% to 3.75% for the foreseeable future, potentially reversing the dollar's downward momentum.

"If inflation proves stickier, or tariff-related price pressures re-accelerate, the Fed will become far more cautious about additional cuts, and therefore rate-cut expectations would retrace, and the dollar would likely strengthen as US yields rebound," said Daniela Hathorn, a senior market analyst with Capital.com. "A shift toward higher-for-longer or fewer cuts would be broadly dollar-supportive."

As Fed officials debate which of their concerns is most pressing — a sinking jobs market or rising inflation — the dollar could be trapped in limbo.

"The Fed is signaling a pause rather than a full easing cycle, which could leave the dollar in a range-bound, directionless phase," Hathorn said. "Neither strongly bearish nor bullish."

Still, if the jobs market continues to weaken, Derek Halpenny, head of research at MUFG, expects the Fed to cut rates again in March. If inflation eases, further cuts are feasible later in 2026, the analyst said. Halpenny expects the Fed to make three cuts in 2026.

"The dollar is indeed in a holding pattern," Halpenny said. "The dollar remains over-valued and has been broadly trading in a range since June — so we still see another leg lower in 2026."

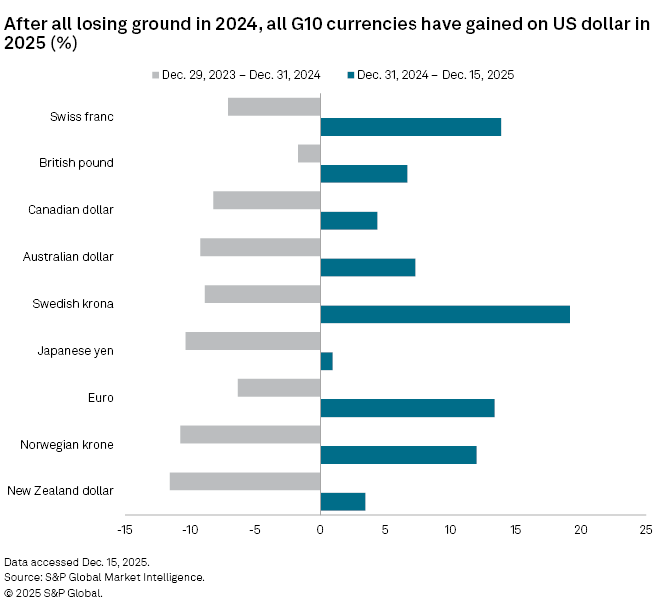

The dollar, which rallied against all of its G10 peers in 2024, has lost ground to all of them in 2025.

That is likely to continue in 2026, Haddad said, particularly with the Japanese yen expected to outperform most major currencies as the Bank of Japan hikes rates and the government's latest fiscal stimulus package supports the yen.

The Australian dollar also looks to improve in 2026 as the Reserve Bank of Australia may look to hike in 2026, Halpenny said.