Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Dec, 2025

By Karl Angelo Vidal and Shambhavi Gupta

South Korea has the highest percentage of private equity- and venture capital-backed private companies in Asia-Pacific as of November.

The private equity penetration rate measures the percentage of total private companies in a market that have private equity or venture capital investment.

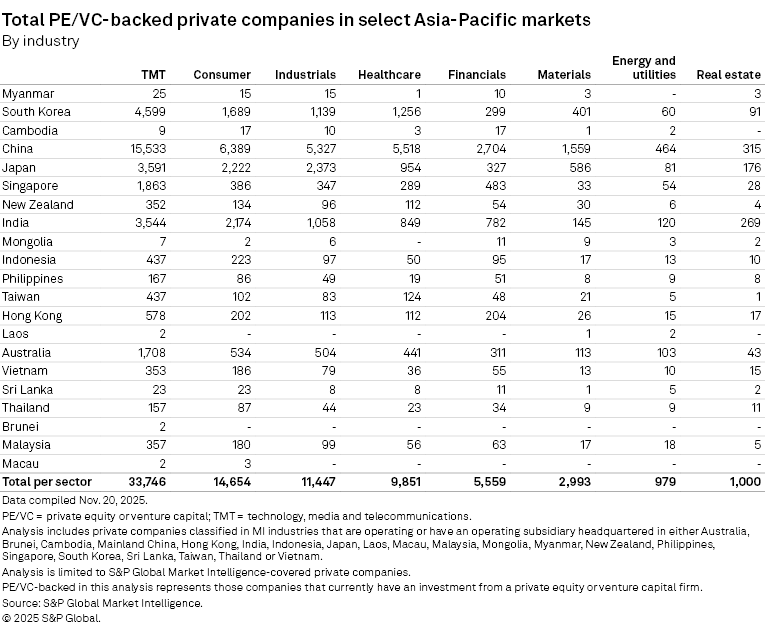

South Korea's penetration rate was 6.81% as of Nov. 20, and investment in the country was mainly concentrated in the technology media and telecommunications (TMT) sector, according to S&P Global Market Intelligence data.

Southeast Asian economies Myanmar, Singapore and Cambodia ranked second, third and fourth, with penetration rates of 5.14%, 4.47% and 4.04%, respectively. Japan placed fifth with a penetration rate of 3.87%.

The 21 selected Asia-Pacific markets in the analysis had an aggregate penetration rate of 2.86%, lower than 3.39% in mid-2023. Malaysia saw the largest increase in penetration rate, rising to 0.70% from 0.56% in 2023.

By comparison, in 2025 the European Union's penetration rate was 0.54%, while the UK had a penetration rate of 0.36%.

Private equity drivers

Large family-owned conglomerates in South Korea, known as chaebols, have created strong demand for private equity investment as they restructure their portfolios and plan leadership succession, said Yonggun Kim, Korea private equity sector leader at EY-Parthenon.

"As chaebols streamline by divesting noncore units, [private equity] firms are seizing carve-out opportunities to acquire undervalued businesses with growth potential," Kim said.

In a large chaebol divestiture this year, Seoul-based private equity firm Hahn & Co. completed the 2.6 trillion won acquisition of SK Specialty Co. Ltd., the specialty gases unit of industrial conglomerate SK Inc., The Korea Economic Daily reported in April. SK Group retained a 15% stake in the company following the deal.

In another notable carve-out deal, VIG Partners agreed in August to buy the aesthetics business unit of LG Chem Ltd. for $144.4 million, Market Intelligence data shows.

Singapore, which logged the third-highest Asia-Pacific private equity penetration, has established itself as a capital hub in the region, with stable governance, favorable tax treaties and a talent pool that attracts private equity and venture capital investments, said Luke Pais, ASEAN private equity leader at EY-Parthenon.

Singapore also has tax treaties with numerous countries, which ensures tax predictability for companies that expand operations into other economies. "That is very beneficial when you're investing," Pais said.

Pais added that many companies in Singapore are facing succession challenges, creating opportunities for private equity to step in as partners to support business growth.

In a report from HSBC, 81% of surveyed entrepreneurs in Singapore seek to keep their businesses within the family, yet 55% do not have a succession plan.

Japan, fifth on the list of high penetration rates in the region, is attractive in part due to the availability of acquisition financing, said Michihiro Nishi, a Tokyo-based M&A partner at Clifford Chance LLP.

"Every established private equity firm has one or two acquisition finance counsels that they can go to," Nishi said.

Succession-driven deals and corporate carve-outs are also driving private equity investments in Japan, added Kirk Shimizuishi, EY-Parthenon's Japan private equity leader.

"You see a lot of well-known companies [in Japan] trading at very low multiples, and a lot of that has to do with the fact that these companies hold noncore operations," Shimizuishi said. "You're seeing a big rush toward the divestment of those noncore assets as a lot of these corporates are getting pushed by their investors to do so. Naturally, the investors for these businesses are private equity funds."

Large carve-out deals in Japan this year included Bain Capital Private Equity LP acquiring Seven & i Holdings Co. Ltd.'s supermarket business York Holdings Co. Ltd. for $5.48 billion. The firm also bought Mitsubishi Tanabe Pharma Corp. from Mitsubishi Chemical Group Corp. for $3.36 billion.

– Read about the Big Four's latest private equity sentiment.

– Explore more private equity coverage.

Mainland China has the most number of private equity-invested companies in Asia-Pacific, at about 1.3 million, but the penetration rate fell to 3.38% from 4.38% in 2023.

Private equity- and venture capital-backed investments in mainland China totaled $39.84 billion in the year through Nov. 30, accounting for 84% of the $47.54 billion recorded for full year 2024, according to Market Intelligence data.

"A combination of changes in government policy, geopolitical tensions with global capital and a much slower economy has meant that there's been a very significant decline in Chinese private equity market activity," said Andrew Thompson, Asia-Pacific head of asset management and private equity sectors at KPMG LLP.

Sector preferences

The TMT sector has the largest number of private equity-backed companies across Asia-Pacific, followed by the consumer sector, according to Market Intelligence data.