Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Dec, 2025

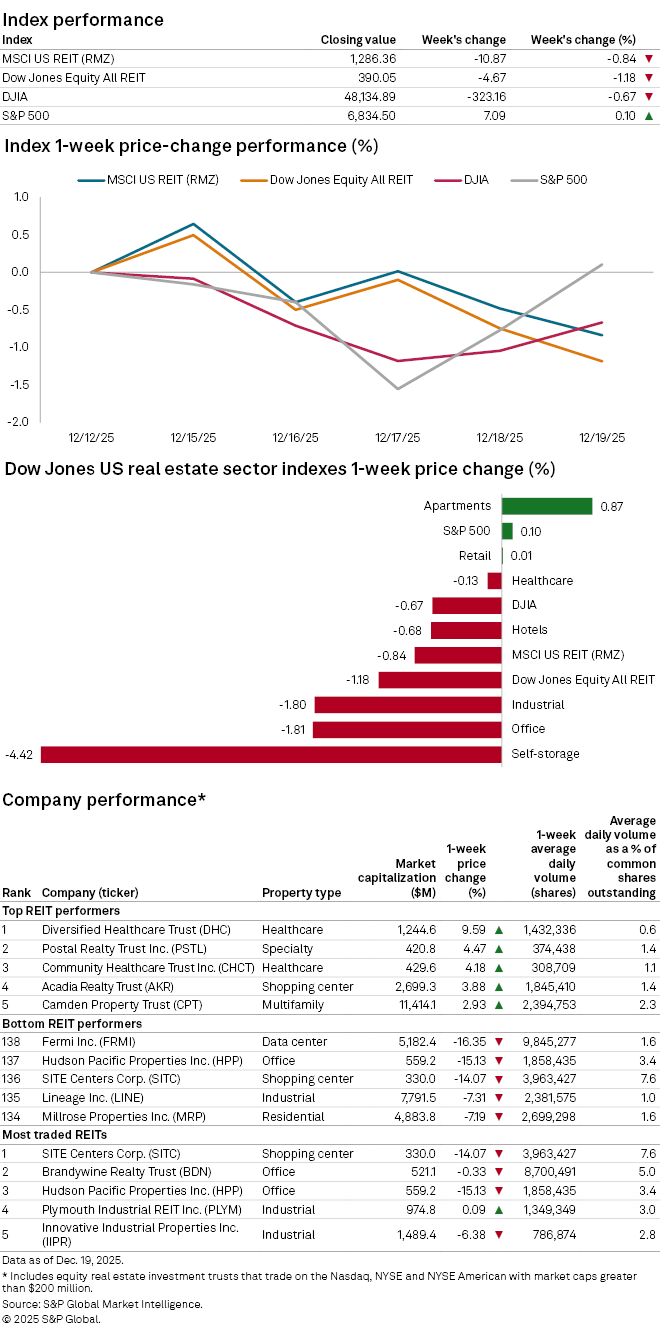

Indexes for US real estate investment trusts fell during the week ended Dec. 19.

The Dow Jones Equity All REIT index dropped 1.18% over the recent week, while the MSCI US REIT (RMZ) index also fell 0.84%.

The broader stock market indexes diverged for the week, with the S&P 500 up a slight 0.10% but the Dow Jones Industrial Average down 0.67%.

Looking at the Dow Jones US real estate property sector indexes, the self-storage REIT index logged the largest decline for the week, down 4.42%. The office and industrial REIT indexes followed next with declines of 1.81% and 1.80%, respectively. On the other end, the apartment REIT index recorded the largest increase for the week, up 0.87%.

Data center REIT Fermi Inc. once again logged the largest share-price decline of all US REITs with at least $200 million in market capitalization, down 16.35% for the week. Fermi's share price closed Dec. 19 at $8.44 per share, nearly 60% below its IPO price of $21 per share.

Office REIT Hudson Pacific Properties Inc. and shopping center REIT SITE Centers Corp. followed next with share-price declines of 15.13% and 14.07%, respectively.

On the other hand, healthcare REIT Diversified Healthcare Trust recorded the largest share-price increase for the week, up 9.59%. Postal Realty Trust Inc., which primarily leases properties to the United States Postal Service, and healthcare REIT Community Healthcare Trust Inc. ranked second and third with share-price increases of 4.47% and 4.18%, respectively.