Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Dec, 2025

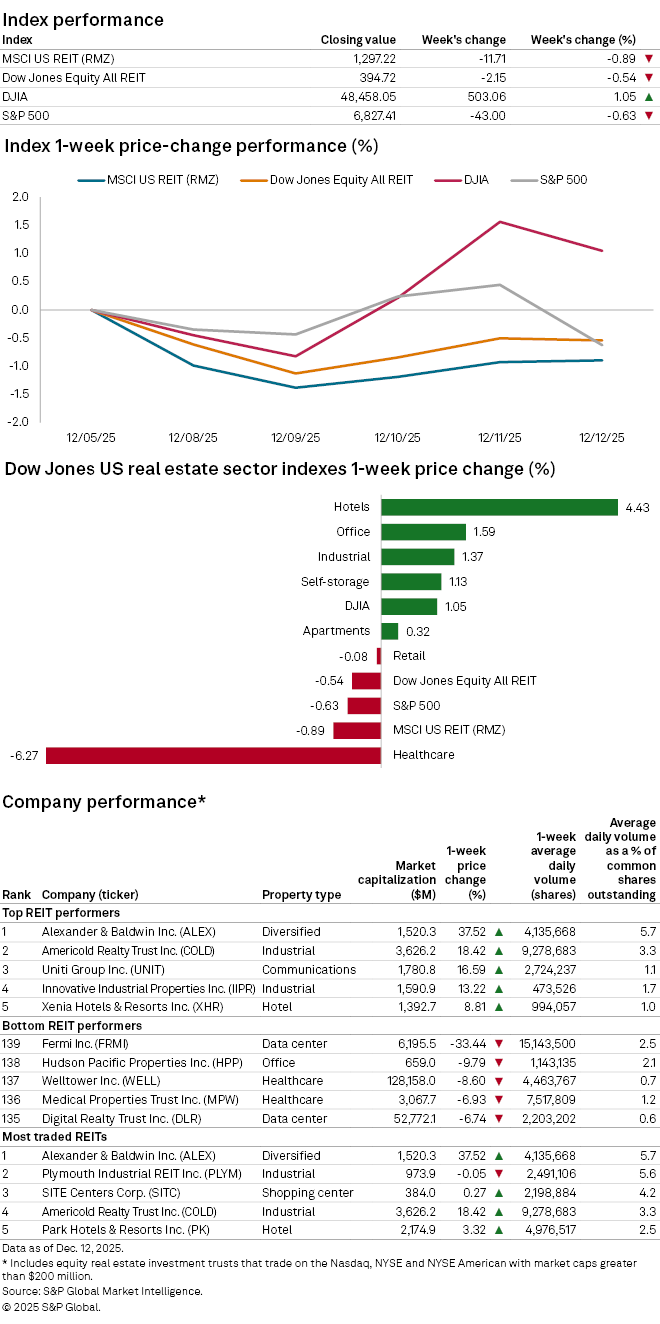

The Dow Jones Equity All REIT index logged a 0.54% decline for the past week, while the MSCI US REIT (RMZ) index also fell 0.89%.

Meanwhile, the broader stock market indexes posted mixed results, with the S&P 500 down -0.63%; however, the Dow Jones Industrial Average increased 1.05% over the week.

Looking at the Dow Jones US real estate sector indexes, the healthcare REIT index logged the largest decline for the recent week, down 6.27%. The retail REIT index also ticked down a slight 0.08%. On the other hand, the hotel REIT index increased by 4.43% over the week, followed by the office and industrial REIT indexes, which rose by 1.59% and 1.37%, respectively.

Data center-oriented Fermi Inc. recorded the largest share-price decline among all US REITs with at least $200 million in market capitalization, down 33.44%. Office REIT Hudson Pacific Properties Inc. and healthcare REIT Welltower Inc. followed next with share-price declines of 9.79% and 8.60%, respectively.

On the other end, Alexander & Baldwin Inc. logged the largest share-price increase for the week, up 37.52%. On Dec. 8, the Hawaii-focused REIT announced its definitive merger agreement to be taken private in a $2.3 billion transaction by a joint venture formed by MW Group Ltd., along with funds affiliated with Blackstone Inc. and Divco West Real Estate Services LLC.

Cold-storage REIT Americold Realty Trust Inc. and communications REIT Uniti Group Inc. followed next with share-price increases of 18.42% and 16.59%, respectively.