Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Dec, 2025

By Iuri Struta

| Investments in data centers set records in 2025. Source: funky-data/iStock via Getty Images. |

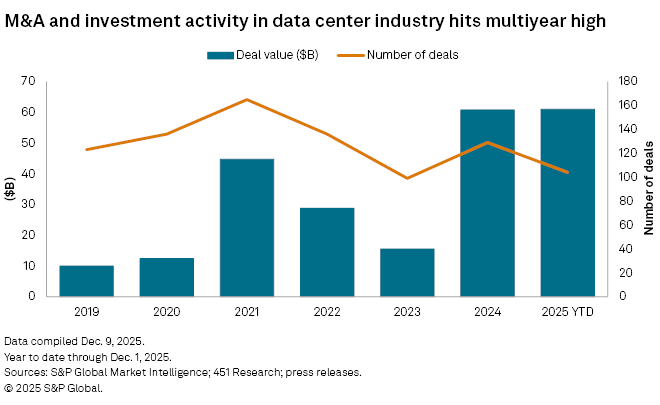

Data center M&A and investment set records in 2025, with more than $61 billion flowing into the market as demand for AI triggered a global construction frenzy that shows no signs of slowing.

There were more than 100 data center transactions in the first 11 months of the year, including M&A, asset sales and equity investments. The 11-month total value for 2025 already exceeds the full-year 2024 record of just under $61 billion, according to S&P Global Market Intelligence data. Data centers are at the center of the AI boom, leading to a global build-out as nations and corporations race to meet surging demand for energy-intensive generative AI applications.

The trend is being fueled by a combination of factors, including hyperscaler expansion, private equity interest and a surge in debt financing. While build-outs are occurring across the globe, the data shows that some geographies are receiving greater investment than others for transactions and new construction.

"We're seeing enormous growth in data centers and even acceleration," said Wim Steenbakkers, managing director at ING, during a recent press briefing. "We do see a trend where the US has taken a lead, with Middle East growth eclipsing Europe at the moment."

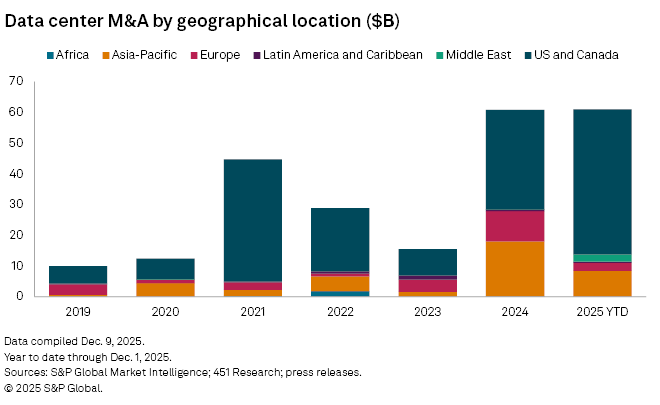

US leading the way

The US has led in total deal value over the last two years, followed by Asia-Pacific. Since 2019, data center deal value in the US and Canada has totaled about $160 billion, with Asia-Pacific reaching nearly $40 billion and Europe totaling $24.2 billion.

In 2025, the US deal total was boosted by the $40 billion acquisition of Aligned Data Centers LLC from Macquarie Infrastructure Partners Inc. by a consortium of private equity (PE) firms and AI companies including X.AI LLC, NVIDIA Corp., BlackRock Inc. and Microsoft Corp. The transaction not only represents the largest data center deal on record, according to S&P Global Market Intelligence's 451 Research M&A KnowledgeBase. Headquartered in Texas, Aligned's portfolio includes 50 campuses across the Americas and over 5 GW of operational and planned capacity.

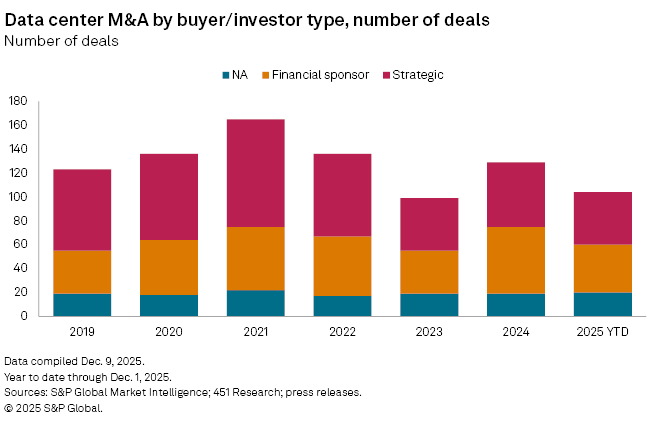

The Aligned deal highlights the growing interest in AI infrastructure among PE and strategic buyers. PE buyers view data centers as an asset class offering an attractive mix of revenue growth and stability, even in economic downturns. Since 2024, financial sponsors have acted as the seller in 26 transactions and the buyer in more than 100, according to Market Intelligence data.

This trend suggests that PE firms are keeping data center assets for much longer than a typical private equity play, in which assets are typically exited on a five-year time frame.

"If you look at large PE buyers, they want to deploy capital at scale, but there isn't enough supply of the right quality and size," Anuj Bahal, a tech M&A adviser at KPMG LLP, told Market Intelligence.

Click here to download the data in Excel format.

Data includes data center industry capital markets activity from 2019 to 2025.

Growth accelerating

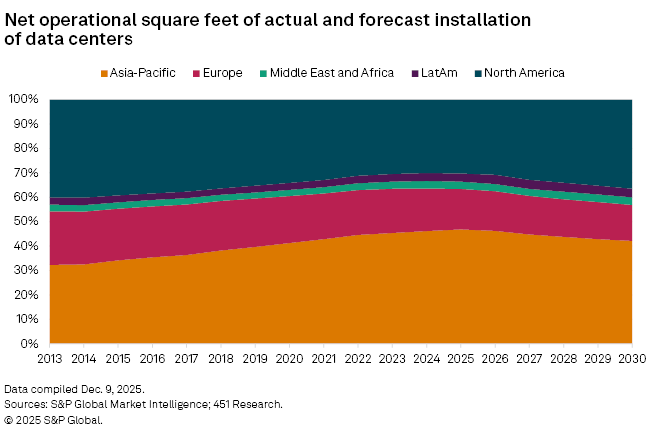

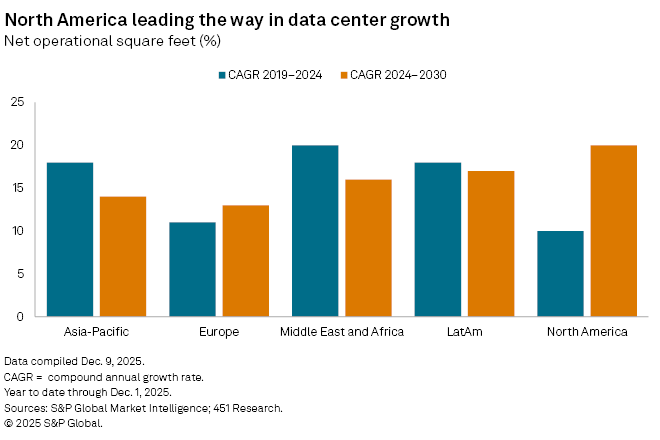

Unable to buy, many investors are turning to new builds. The global data center footprint is projected to expand at a faster rate over the next five years than it did in the previous five, spurred by demand for energy- and compute-intensive AI workloads.

451 Research forecasts an average compound annual growth rate of 16% over the next five years, up from 14% between 2019 and 2024.

The growth is not uniform across all regions. Europe, for instance, is expected to grow by 13% per year, while North America's growth is forecast to reach 20% annually, according to 451 Research analysts.

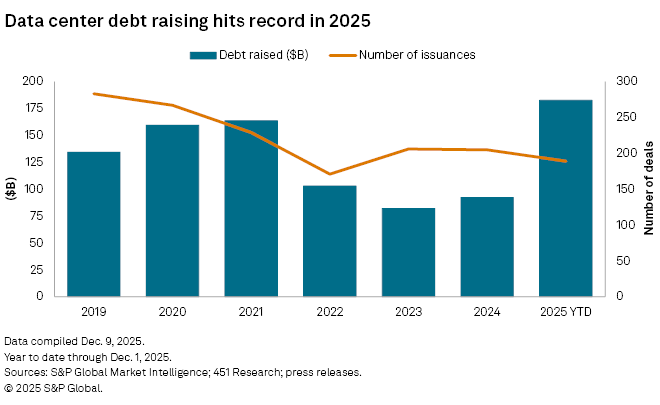

Hyperscalers are making major investments, leveraging strong balance sheets and massive free cash flow to build new data centers. They are also looking for outside capital in the form of debt and collaboration with financial sponsors.

According to Market Intelligence data, debt issuance by data center owners and operators has nearly doubled year over year, climbing from about $92 billion in 2024 to $182 billion in 2025. This surge has been largely driven by US-based companies, whose debt issuance grew from a multiyear low of $38.7 billion in 2024 to $135 billion in 2025.

Among the hyperscalers, Meta Platforms Inc. has been the most active debt issuer. The company has raised $62 billion in debt since 2022, with nearly half of that total issued in 2025. Alphabet Inc. and Amazon.com Inc. also tapped the debt markets this year, raising $29 billion and $15 billion, respectively. Hyperscalers and frontier AI labs such as OpenAI LLC and Anthropic PBC have also been leveraging their financing networks to spread debt out of their balance sheets.

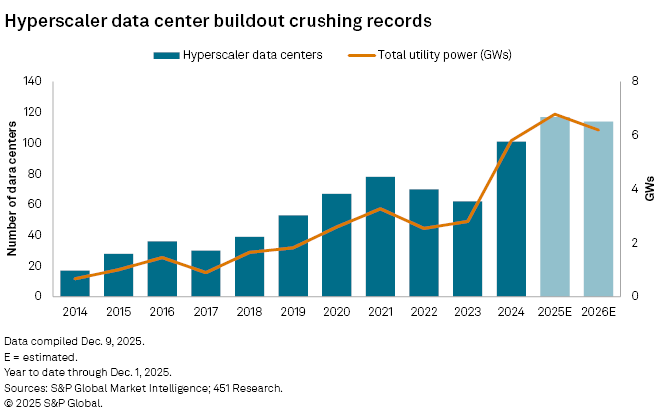

The number of data centers being built by hyperscalers nearly doubled in 2024 from a post-pandemic low, while their total utility power more than doubled, according to 451 Research data. This growth is expected to extend into 2026, with 114 hyperscaler data centers planned or under construction.

Hyperscalers, frontier AI labs and chipmakers are teaming up to buy assets or finance their construction, in an unusual arrangement indicative of the significant capital requirements needed to achieve the desired data center growth. For instance, Meta partnered with Blue Owl Capital Inc. to build its 2.4-GW Hyperion data center. Such arrangements were pioneered by BlackRock, Global Infrastructure Partners Inc., Microsoft and MGX Fund Management Ltd., which in late 2024 teamed up to create a $100 billion fund that would invest in data centers and power infrastructure. The resulting AI Infrastructure Partnership is the buyer in the Aligned Data Centers transaction.

"The challenge is building capacity fast enough to meet demand. We're now seeing the full ecosystem — hyperscalers, operators, developers and infrastructure players — tapping private capital to accelerate the build cycle," Bahal said.

Neoclouds

In the meantime, as new data centers are built, hyperscalers are increasingly turning to cryptocurrency miners to rent data center space and compute. Access to energy sources is the strongest selling point of the miners. According to 451 Research, cryptocurrency miners collectively have 398 data centers operating or in planned construction, with total utility power of 22.1 GW.

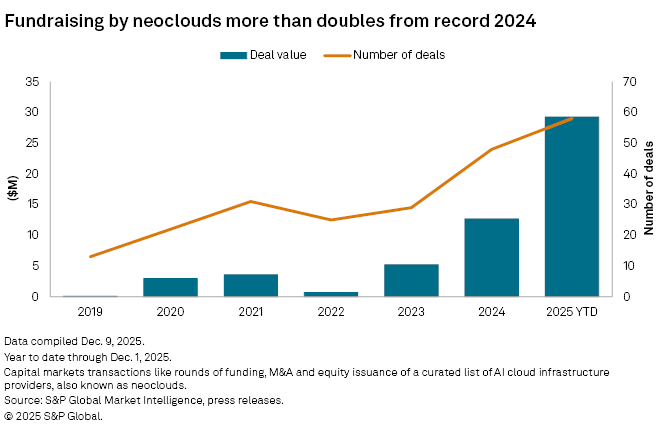

So-called neoclouds such as CoreWeave Inc., Nebius Group NV and NScale Global Holdings Ltd. are capitalizing on large spending commitments from hyperscalers and raising funds from private investors and public markets to build capacity. According to data compiled by Market Intelligence, neoclouds have raised $23.6 billion through a mix of funding rounds, equity and debt issuance — nearly double the 2024 record.

The long-term economic viability of neoclouds remains unproven, however, as most, including CoreWeave and Nebius, are not yet profitable. Some have close ties to major GPU manufacturers, primarily NVIDIA and Advanced Micro Devices Inc. Neoclouds often derive a substantial portion of their revenue from a small number of key customers. CoreWeave, for instance, recognized 67% of its third-quarter revenue from just one: Microsoft.

Intense competition will likely lead to consolidation in the sector. This trend may already be underway: Five neoclouds have been acquired so far this year, compared to none in 2024. Notable deals include the acquisition of Brazil's Latitude.sh Ltda. by Megaport Ltd.