Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Dec, 2025

Natural gas utility companies generally supported a proposed multiyear rate plan framework in Oregon, but they emphasized the need to balance consumer and utility interests.

The Oregon Public Utility Commission, gas and electric utility companies and environmental stakeholders had an open discussion Dec. 17 at the PUC's first workshop on proposed two rulemakings: one to establish a multiyear ratemaking framework and another to establish a rate revision filing schedule (AR 676, AR 677).

The commission said it aims to present phase one concepts of the ratemaking framework

Northwest Natural Gas Co., on behalf of itself, Cascade Natural Gas Corp. and Avista Corp., said the state commission needs to be "thoughtful and flexible" in the transition to multiyear rate plans.

"We are asking the commission to avoid a rigid process or schedule that could create winners or losers amongst the utilities," said Zach Kravitz, vice president of regulatory affairs and resource planning at the utility, which does business as NW Natural. "It's really important, too, that we prevent a situation where the utility enters its first multiyear plan filing with multiple years of regulatory lag of unrecovered costs, because that could lead to a very large initial [rate] increase."

Kravitz said NW Natural has not earned its authorized return on equity from any of its rase cases over the last five years. The company wants to see that change with the new framework.

NW Natural, Cascade and Avista are working with Concentric Energy Advisors Inc. as their consultants in the rulemaking process.

In a Dec. 12 filing with the PUC related to an integrated resource plan, NW Natural said joint system planning among gas and electric utilities can improve consumer affordability and equity if internal information is shared among utilities to reduce the risk of shifting costs from one group of customers to another.

The Great Plains Institute, an energy consultant group that the PUC hired to facilitate the workshops, presented survey results revealing the utility and advocate groups' initial perspectives on this proceeding. All participants said they want the regulatory framework to produce more predictable rates with less-frequent rate cases, more productivity and transparency, and fewer administrative burdens. Utility companies said they hope to see greater cost recovery and clarity in company reporting requirements due to implementing multiyear rate cases.

Other stakeholder input

Environmental advocacy groups said utility companies need to align their incentives with customer and policy goals and make investments that comply with the Oregon Energy Strategy and Climate Protection Program.

Jennifer Hill-Hart, a policy manager at the Citizens' Utility Board Of Oregon, said introducing multiyear rate plans will allow rate cases to be more customer-centered.

"We're looking forward to setting up something more predictable and less administratively burdensome for community representatives," Hill-Hart said.

Rules for rate plans

The multiyear rate plans, which are typically fixed for three to five years, must be designed in line with two new laws passed in the 2025 legislative session.

House Bill 3179 established new rules that regulate when electric and gas utilities may file for a rate increase, and when residential rate increases may be implemented. It also prescribed mandatory multiyear rate plans extending up to seven years and an annual limit on the number of companies that may file for a rate increase. The legislation, also known as the FAIR Energy Act, sought to address rising energy bills in Oregon. It specifically prohibits utilities from raising residential rates during peak winter months, when energy usage is highest.

Senate Bill 688 allowed the Oregon PUC to investigate, develop and implement performance-based regulation that rewards or penalizes electric utilities based on their compliance with state energy policies and goals.

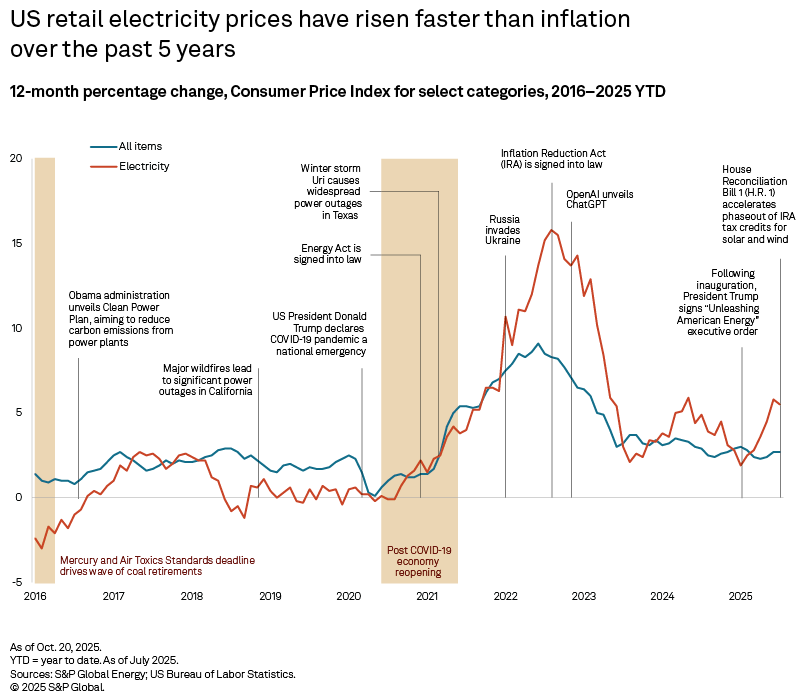

The average US residential energy price rose 32% from July 2020 to July 2025, outpacing inflation, S&P Global Energy data showed.

Natural gas prices are expected to escalate for fourth-quarter 2025, according to the US Energy Information Administration. The agency said the cold snap that hit the US in December will drive Henry Hub spot prices to average more than 40 cents/MMBtu above the November forecast.