Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Dec, 2025

By Audrey Elsberry and Umer Khan

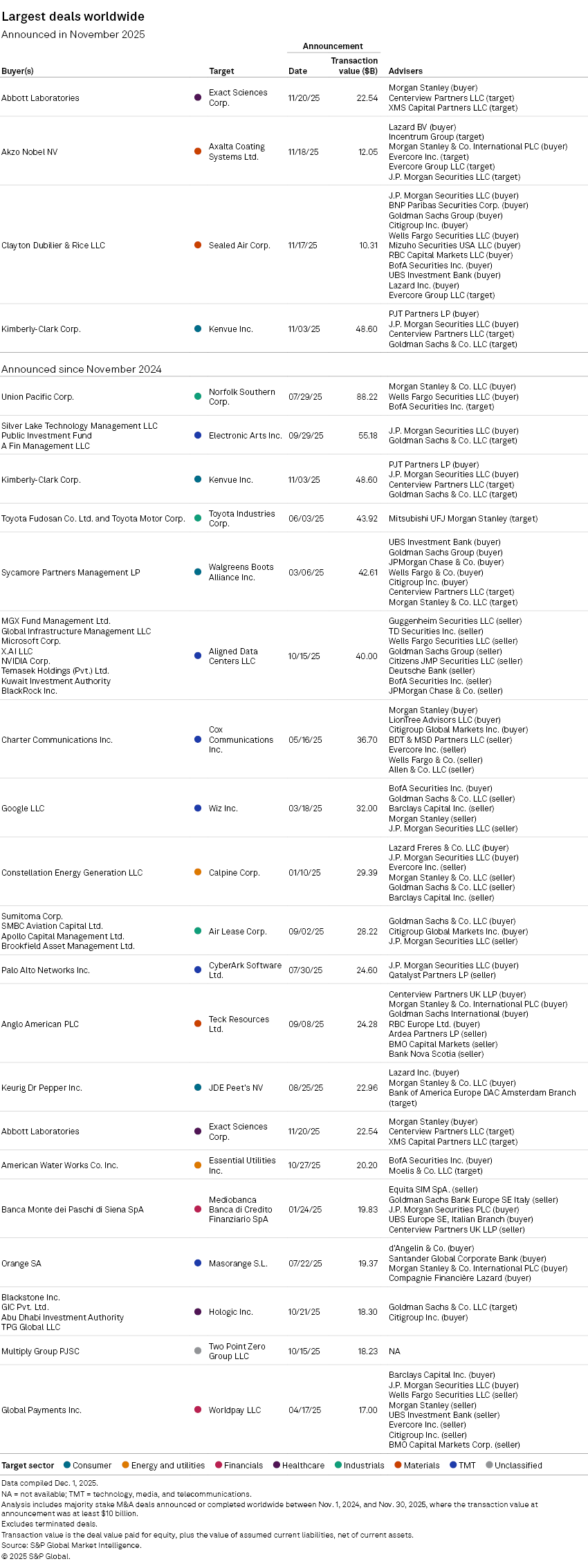

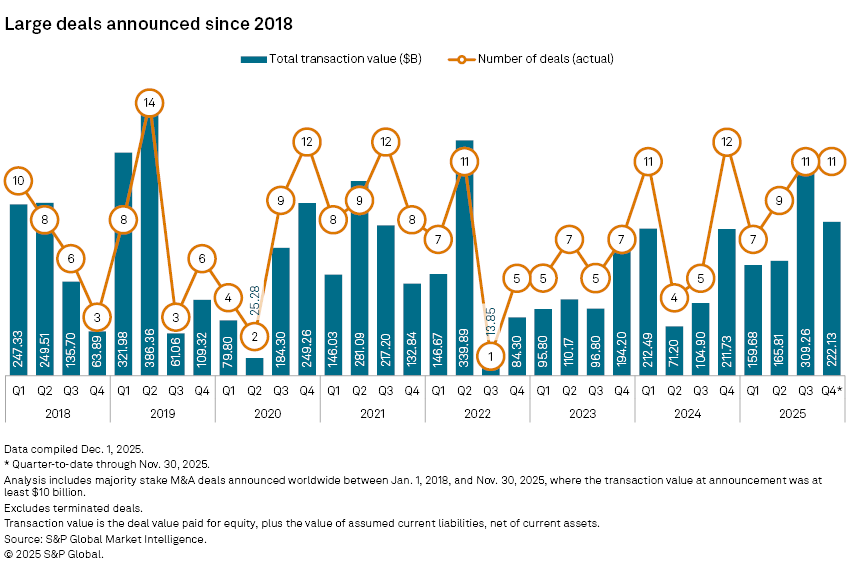

November's announced M&A deals of more than $10 billion in transaction value brought the fourth quarter's worldwide tally to 11 deals.

Through the first two months of the period, the fourth-quarter deal count already equaled the third quarter's, but the third quarter's deals were larger in transaction value, with the fourth quarter's total announced transaction value lagging behind the third quarter's total by $87.13 billion, according to S&P Global Market Intelligence data.

The largest deal of the month and the third-largest announcement of the past 12 months, with a transaction value of $48.6 billion, combines two US-based consumer product companies. Dallas, Texas-based Kimberly-Clark Corp., maker of products such as Huggies diapers and Kleenex tissues, plans to acquire Summit, New Jersey-based Kenvue Inc.

The acquisition of Kenvue, maker of products such as Tylenol and Band-Aids, will create a consumer goods giant in the US, executives said during a merger call Nov. 3.

The deal announcement came roughly a month after a Trump Administration announcement urging pregnant mothers to avoid taking acetaminophen, citing Kenvue's brand Tylenol and a purported possible link between the drug and autism. The US Food and Drug Administration published a note to physicians on Sept. 22 stating there is not an established causal relationship between acetaminophen and autism.

Barclays analyst Lauren Rae Lieberman referenced the Tylenol headlines during the companies' merger call, asking executives if the noise factored into the deal consideration.

"We reviewed this transaction in the same way that we run the business, with incredible rigor, right, thoughtfulness and discipline," Kimberly-Clark Chairman and CEO Michael Hsu said.

"There is nothing that is more important to us [than] the health of the people who use our products," Kenvue interim CEO Kirk Perry added. "These things have been studied for decades, and we continue to stand by that science as the medical community does as well."

|

– View – Read the M&A and equity offerings research paper. – Read more |

In another of the 20 largest deals announced in the past 12 months, Chicago, Illinois-based Abbott Laboratories plans to acquire Madison, Wisconsin-based Exact Sciences Corp. in a deal with a transaction value of $22.54 billion.

Abbott Laboratories is a healthcare and medical devices company, and Exact Sciences has a portfolio of cancer diagnostics technologies, including Cologuard, the leading noninvasive test for colon cancer screening.

The all-cash deal will pay Exact Sciences shareholders $105 per common share, according to the merger announcement.

"This acquisition further strengthens Abbott's leadership position in diagnostics and expands our presence into one of the fastest-growing areas of healthcare," Abbott Laboratories Chairman and CEO Robert Ford said during the company's M&A call Nov. 20.

In a deal announced Nov. 17, New York-based asset manager Clayton Dubilier & Rice LLC plans to acquire Charlotte, North Carolina-based packaging services company Sealed Air Corp. The deal has a transaction value of $10.31 billion.

Sealed Air stockholders will receive $42.15 in cash per share, a premium of 24% to Sealed Air's 90-day volume-weighted average price as of Nov. 12, according to the merger announcement. Upon the deal's closing, Sealed Air, which currently trades on the New York Stock Exchange, will become a privately held company, according to the merger announcement.

In a specialty chemicals deal announced Nov. 18 with a transaction value of $12.05 billion, Netherlands-based Akzo Nobel NV plans to acquire Philadelphia-based Axalta Coating Systems Ltd.

The combination will create a global leader in paints and coatings with $17 billion in revenue and an enterprise value of roughly $25 billion, Akzo Nobel Chairman and CEO Gregoire Poux-Guillaume said during a deal call with analysts.

The all-stock merger of equals provides no premium, Poux-Guillaume said. Axalta shareholders will receive AkzoNobel shares and will own 45% of the combined company, while AkzoNobel shareholders will own 55% of the combined company, Poux-Guillaume said.