Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2025

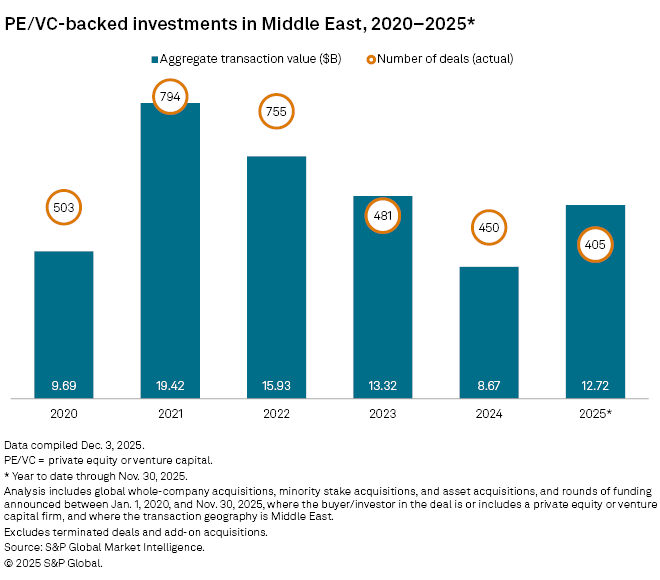

Private equity and venture capital deal value in the Middle East reached $12.72 billion year to date through Nov. 30, exceeding the full-year 2024 total by more than 46%, according to S&P Global Market Intelligence. Deals numbered 405 compared to 450 for all of 2024.

Economic diversification away from oil has generated a large pool of capital in the region, primarily from sovereign wealth funds, attracting more private equity and venture capital investment, according to Santiago Castillo, Middle East managing director at consulting firm Roland Berger.

Saudi Arabia is driving interest with plans to channel investments into manufacturing, renewable energy, industrial equipment, tourism, technology and mining under its Vision 2030 plan. The Public Investment Fund, Saudi Arabia's $925 billion sovereign wealth fund, has been acting as a co-investment partner with private equity, while government efforts have worked to encourage M&A, according to a report from USPEC.

International private equity players are focusing on the diversification drive. "They're seeing that this is the right time to invest in the market," said Hogan Lovells partner Walid Salib.

However, headwinds complicate the growth of private equity activity.

In Saudi Arabia, for example, reduced government spending and rising liquidity pressures on the banking sector could limit investment, Castillo added. "The growth trajectory for 2026 will be driven by a combination of local capital strength, ongoing reforms and global geopolitical uncertainty," he said.

– Download a spreadsheet with data featured in this story.

– Read more about joint investments of sovereign wealth funds and private equity firms in the Middle East.

– Catch up on the latest private equity deals.

Among the other regional countries, Abu Dhabi's Economic Vision 2030 aims to reduce oil dependency, while Kuwait's New Kuwait Vision 2035 prioritizes non-oil sector growth. Qatar is also working to lessen its reliance on hydrocarbons.

Top sectors

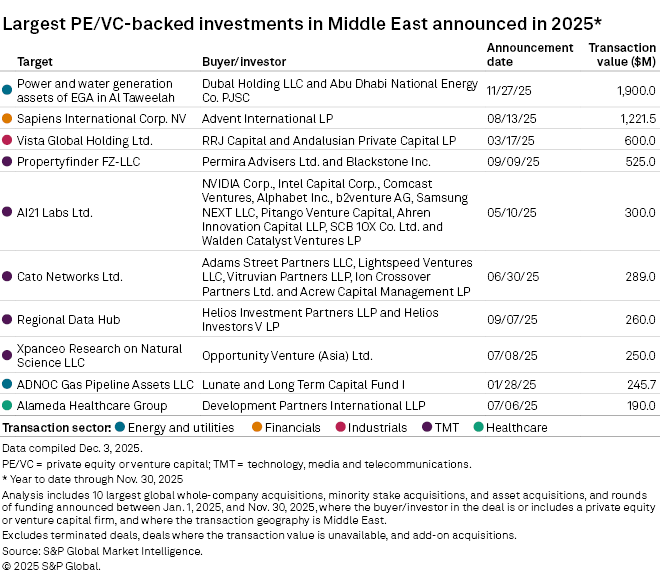

Abu Dhabi hosted the region's largest deal of the year to Nov. 30: Emirates Global Aluminium PJSCs $1.9 billion sale of its Al Taweelah power and water generation assets to Dubal Holding LLC, a subsidiary of Dubai's sovereign wealth fund Investment Corporation Of Dubai Service Company LLC and Abu Dhabi National Energy Co. PJSC.

The technology, media and telecommunications sector recorded the most deals in the top 10, with five transactions.

In 2025, the region saw significant advancements in AI and technology partnerships, including Brookfield Asset Management Ltd.'s strategic partnership with Qatar Investment Authority's subsidiary, Qai, to establish a $20 billion joint venture focused on AI infrastructure in Qatar and selected markets.

Additionally, Saudi Arabia is emphasizing digital transformation in the economy, "fueling a surge in M&A activity within the tech sector," according to a PWC report on Vision 2030.

Fundraising growth

Private equity fundraising for the region appears set for a down year, despite a surge in capital raised in the third quarter, Preqin data shows.

Venture capital fundraising is faring better in 2025, up 58.7% for the year to Nov. 30 to $2.19 billion, compared to $1.38 billion the same period in 2024.

Salib anticipates both fundraising and investments in the Middle East will grow in 2026. "There's a huge focus on fundraising and capital deployment over the next 12 months at least," he said.