Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Dec, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Japan's share of private equity investment in Asia-Pacific grew in 2024 and is on track to increase again in 2025.

Private equity and venture capital deal value in Japan totaled $28.95 billion in the year through Dec. 14, up 52.5% from the full-year 2024 total of $18.98 billion, according to S&P Global Market Intelligence data. Deals targeting Japanese companies accounted for more than a quarter of the $112.07 billion in reported private equity transaction value for Asia-Pacific between Jan. 1 and Dec. 14.

Japan's conglomerates offer ample carve-out opportunities for private equity investors, and financing conditions are conducive to dealmaking. Private equity's rebounding reputation among business owners and entrepreneurs is also part of the story.

"There's a real openness to foreign capital coming in, and that is unlocking all sorts of assets," Blackstone Inc. President Jonathan Gray told a conference audience in December.

Read more about private equity investments in Japan and Asia-Pacific.

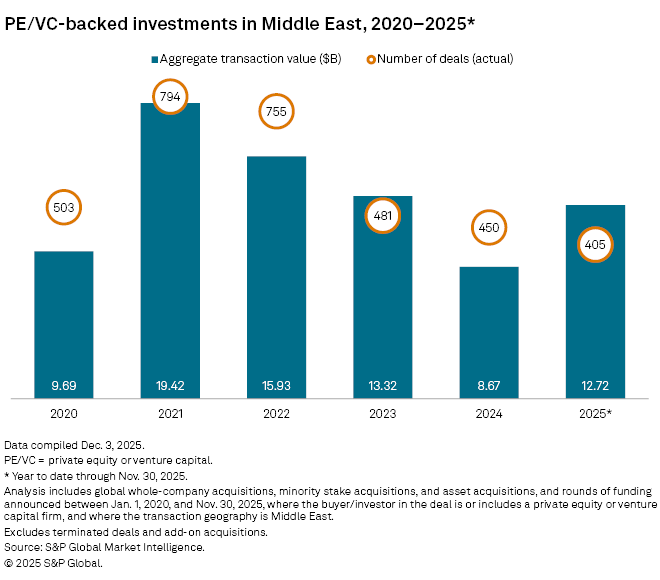

CHART OF THE WEEK: Rising private equity deal value in the Middle East

⮞ Private equity and venture capital investments in the Middle East totaled $12.72 billion for the year through Nov. 30, more than 46% higher than the $8.67 billion in investment recorded for full year 2024, according to Market Intelligence data.

⮞ Private equity coinvestments with regional sovereign wealth funds, including Saudi Arabia's $925 billion Public Investment Fund, contributed to the increase.

⮞ Government efforts to diversify regional economies away from oil are attracting private capital.

TOP DEALS

– SK Capital Partners LP agreed to invest in pharmaceutical commercialization company Swixx Biopharma SA in a deal valuing the company at more than €1.5 billion. Existing institutional investors HBM Healthcare Investments AG and Mérieux Equity Partners SAS will remain as shareholders in Swixx. Rothschild & Co was financial adviser to SK Capital, and Bär & Karrer and Kirkland & Ellis were legal advisers. Jefferies and Centerview Partners were financial advisers to Swixx, and Walder Wyss was legal adviser.

– Blackstone Inc. is leading a $400 million investment in cybersecurity startup Cyera US Inc., The Wall Street Journal reported. The investment values Cyera at $9 billion.

– KKR & Co. Inc. made a $220 million growth investment in Premialab HK Ltd., a provider of investment data, analytics and risk management solutions. The transaction involves a significant growth investment alongside existing investor Balderton Capital (UK) LLP. Premialab was advised by Rothschild & Co as financial adviser and A&O Shearman as legal adviser. KKR received legal advice from Gibson Dunn.

– Apollo Global Management Inc. agreed to acquire a majority stake in France-based Prosol Gestion SA, a retailer of fresh food, from Ardian SAS. Prosol's existing shareholders and management will reinvest alongside Apollo. The transaction is expected to close in the second quarter of 2026. UBS AG was lead financial adviser to Apollo, with Royal Bank of Canada and Lazard also advising. The legal counsels for Apollo included Sidley Austin LLP, Paul Weiss Rifkind Wharton & Garrison LLP and Cleary Gottlieb Steen & Hamilton LLP.

TOP FUNDRAISING

– Venture capital firm Lightspeed Ventures LLC closed more than $9 billion in committed capital across six funds. The fundraising included $3.3 billion for Lightspeed Opportunity Fund III, $1.8 billion for Lightspeed Select VI, $1.2 billion for Lightspeed Venture Partners Fund XV-B, $980 million for Lightspeed Venture Partners Fund XV-A and $600 million for Lightspeed Co-Investment Fund I. The firm also closed $1.25 billion in single-investor vehicles in 2025.

– JP Morgan Asset Management's private equity group closed its 12th flagship fund, PEG Global Private Equity XII, at $1.44 billion. The fund will invest globally across buyout and venture capital strategies.

– MML Capital Partners raised €935 million at the final close of MML Keystone I and related vehicles. The fund targets high-growth asset-backed firms and will make investments ranging from €30 million to €200 million. Proskauer was legal adviser on the fundraising.

– Fortino Capital Partners NV raised €700 million at the final close of Fortino PE III. The firm invests in software companies across Europe.

MIDDLE-MARKET HIGHLIGHTS

– H.I.G. Capital LLC completed the acquisition of Shore Excursions Group LLC, a provider of onshore tours and excursions for cruise passengers.

– Fengate Capital Management Ltd. acquired the remaining equity interest in Freeport Power Ltd., bringing its ownership to 100% of the 440-MW cogeneration facility in Texas. Terms of the deal were not disclosed.

– Consortium Brand Partners LLC, along with Eldridge Industries LLC, Aurify Brands LLC and Convive Brands LLC, agreed to acquire California Pizza Kitchen Inc., with Convive Brands overseeing global operations. Aurify Brands advised on the transaction, with Winston & Strawn LLP as legal counsel to CBP, and Reed Smith LLP advising Eldridge Industries and Convive Brands.

FOCUS ON: PRIVATE EQUITY INVESTMENTS IN PAYMENT PROCESSORS

Private equity- and venture capital-backed investments in payment processors surged to $2.19 billion in the year through Dec. 18, surpassing the 2024 full-year total of $473.4 million, according to S&P Global Market Intelligence data.

In the largest private equity-backed deal in the sector so far in 2025, Smith Ventures LLC is buying the nonbank assets and operations of Green Dot Corp. for $690 million in an all-cash deal set to close in the second quarter of 2026.

Another notable deal involved Imprint Payments Inc., which develops and manages credit cards, deposit cards and installment loan products for partner brands. The company raised $150 million in a series D funding round led by Khosla Ventures LLC. Thrive Capital Management LLC, Ribbit Management Co. LLC, Kleiner Perkins Caufield & Byers, Hedosophia, Spice Expeditions LP and Timeless participated in the round.

______________________________________________

For further private equity deals, read our latest "In Play" report , which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter issued twice per month.