Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2025

By Brian Scheid

Institutional investors sold off more of their US stock holdings amid signs of a market downturn in November, a largely rudderless month for US equities, as the S&P 500 gained just 0.1%.

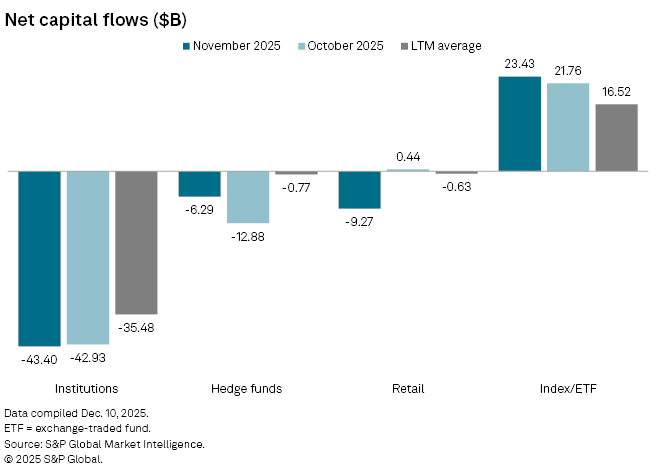

With rising expectations of a market reversal, institutions withdrew a net $43.40 billion from the stock market in November. Of that total, a net $22.03 billion, or more than half, was sold during the third week of November, when the S&P 500 fell nearly 2%, its largest weekly loss of the month, according to S&P Global Market Intelligence data.

"It was certainly a good time to book profits given the relentless run-up we've seen across the market since April's tariff-related volatility," said Julian van Rensburg, a senior analyst for Market Intelligence. "Coupled with the closing out of earnings season, we likely saw some managers taking money off the table as they perceive much of 2025's gains as already priced in."

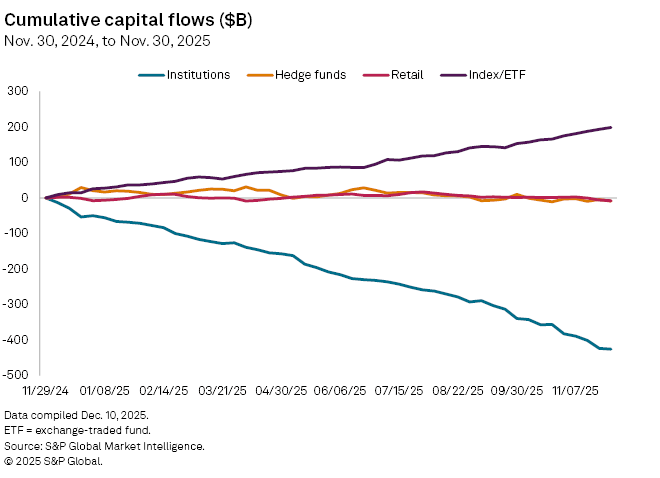

Institutional investors pulled a cumulative $425.77 billion out of the stock market from the end of November 2024 to the end of November 2025.

As skepticism of the stock market's rally mounted in November, investment managers seemed inclined to lock in healthy gains in anticipation of a future decline.

Institutions sold a net $2.40 billion during the final week of November, when the S&P 500 rallied more than 3.7%.

The $43.40 billion net sold by institutions in November was up slightly from October, when this group sold a net $43.93 billion, and above the 12-month average of a net $35.48 billion sold, according to the data.

Throughout November, institutions continued to increase their exposure to real estate stocks, as they had in October, while selling on net in all other sectors, a signal that long-only investors were looking for defensive equity exposure, van Rensburg said.

"This goes hand-in-hand with the broad shift to index investing that we are seeing across the market as investors either look for diversification across more cyclical sectors through ETFs, or to rotate capital into defensive sectors as a means of risk management," van Rensburg said.

ETFs continue buying

Net buying by index and exchange-traded funds also increased in November to a net $23.43 billion, up from a net $21.76 billion in October and a net $16.52 billion over the past 12 months. Buying by this group was relatively consistent each week of November, ranging from a net buying of $6.58 billion in the second week of November, when the S&P 500 gained less than 1%, to a net $5.13 billion in the last week of the month, when the large-cap index rallied about 3.75%.

Index and ETF flows are typically "smoother" than those of institutions, hedge funds or retail investors, which tend to shift flows in and out of passive investment vehicles simultaneously, van Rensburg said.

"While we may see institutions moving capital out of index funds, there is a likely an offsetting effect as hedge funds move into passive vehicles at the same time," van Rensburg said.

For example, index and ETF flows into stocks in the materials sector declined by 0.53%, after increasing by 0.73% in October. This move from net buying to net selling in materials was likely driven by a 0.54% increase in net buying in the materials sector by retail investors in November after a 0.32% decline in October.

Retail investors, typically more inclined to move with the market, sold a net $9.27 billion in stocks in November after buying just $444 million in October and averaging net monthly selling of $631 million over the past 12 months.

In November, retail investors, who had been net buyers since May, became net sellers of stocks over the past 12 months.

"This is likely reflecting profit-taking, as well as some of this capital shifting into index funds as stock picking becomes more complex for the average retail investor at current valuations," van Rensburg said.