Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Dec, 2025

By Rica Dela Cruz and Ayesha Shahbaz

Illinois community banks are lowering certificate of deposit rates at a slower pace than their national peers.

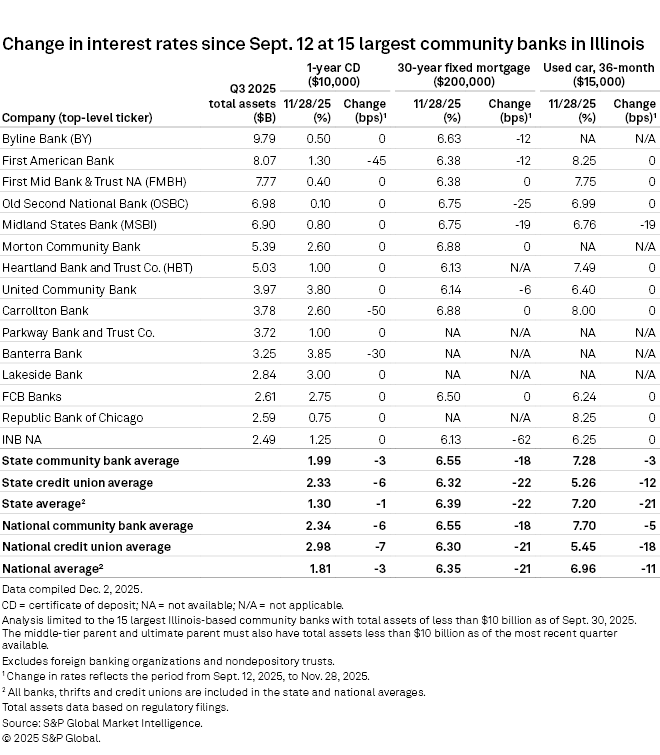

The average rate on one-year certificates of deposits (CDs) among Illinois community banks was 1.99% as of Nov. 28, down 3 basis points from Sept. 12, according to S&P Global Market Intelligence data. Across all US community banks, the average rate stood at 2.34%, representing a 6-basis-point decline. The declines come after the Federal Reserve kicked off another round of rate cuts in September.

Meanwhile, Illinois credit unions nearly matched the pace of their national peers, with an average one-year CD rate of 2.33% as of Nov. 28, down 6 basis points from Sept. 12, compared to that of US credit unions, which fell 7 basis points to 2.98%.

Among all banks and credit unions in Illinois, the average one-year CD rate was 1.30%, down just 1 basis point, compared to 1.81% for banks and credit unions nationwide, a decrease of 3 basis points.

Among the 15 largest community banks headquartered in Illinois, all but three held their one-year CD rates steady between Sept. 12 and Nov. 28.

Byline Bancorp Inc. subsidiary Byline Bank, the largest Illinois community bank, had one of the lowest one-year CD rates on the list at 0.50%. Even so, the bank has "some room" to reduce CD costs even as deposit competition heats up, CFO Thomas Bell said during an Oct. 24 earnings call.

Old Second Bancorp Inc. unit Old Second National Bank's CD rate was also unchanged at 0.10%, the lowest among the 15 largest community banks based in Illinois. But Old Second's cost of interest-bearing deposits increased by 61 basis points in the third quarter, reflecting the acquisition of Evergreen Bank Group, COO and CFO Bradley Adams said during an Oct. 23 earnings call.

Old Second is allowing Evergreen's brokered CDs to run off as it aims to rely less on wholesale funding, Chairman, President and CEO James Eccher said. Until the company can adjust its funding mix, its loan-to-deposit ratio will likely increase over the next several quarters, Adams said.

But "I have no issue with the loan-to-deposit ratio moving slightly higher ahead of any strategic opportunities that may present themselves," Adams added.

Among the 15 largest community banks in Illinois, Carrollton Bank logged the biggest one-year CD rate decline at 50 basis points to 2.60%. Banterra Bank marketed the highest rate of 3.85%, down 30 basis points.

Used car loan, mortgage rates

On 36-month used car loans, Illinois community banks were offering an average rate of 7.28% as of Nov. 28, down 3 basis points from Sept. 12, a smaller decline than Illinois credit union peers and national peers.

At US banks, auto delinquencies have increased and are significantly higher than levels observed after the global financial crisis, particularly among subprime borrowers, J.P. Morgan analyst Vivek Juneja said in a Nov. 25 research report. Used car prices declined slightly in October and have fallen modestly year to date, remaining 21% lower than their peak in 2022, the analyst added.

Republic Bank of Chicago and First American Bank marketed the highest rate on 36-month used car loans among the 15 largest community banks in Illinois at 8.25% each, while FCB Banks had the lowest rate at 6.24%. Only Midland States Bank's rate moved, falling 19 basis points to 6.76% from Sept. 12 to Nov. 28.

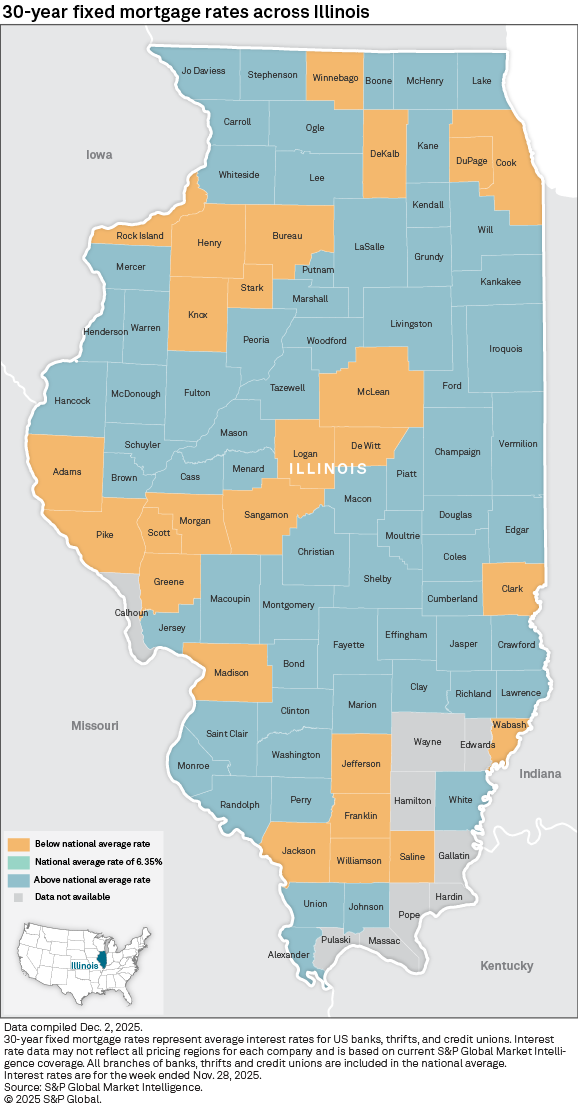

As US home prices increase, the average 30-year fixed mortgage rate at Illinois community banks declined 18 basis points from Sept. 12 to Nov. 28 to 6.55%. That rate was the same as the national community bank average but was higher than the US average of 6.35%.

Morton Community Bank and Carrollton Bank offered the highest rate on a 30-year fixed mortgage among the 15 largest Illinois community banks at 6.88%, both maintained from Sept. 12. INB NA and Heartland Bank and Trust Co. were marketing the lowest rate at 6.13%, with INB's rate declining 62 basis points from Sept. 12.

During the week ended Nov. 28, the 30-year fixed mortgage rate offered in Lawrence County was the highest among the counties in Illinois at 6.96%. The rate marketed in Franklin and Rock Island counties was the lowest at 6.06%.

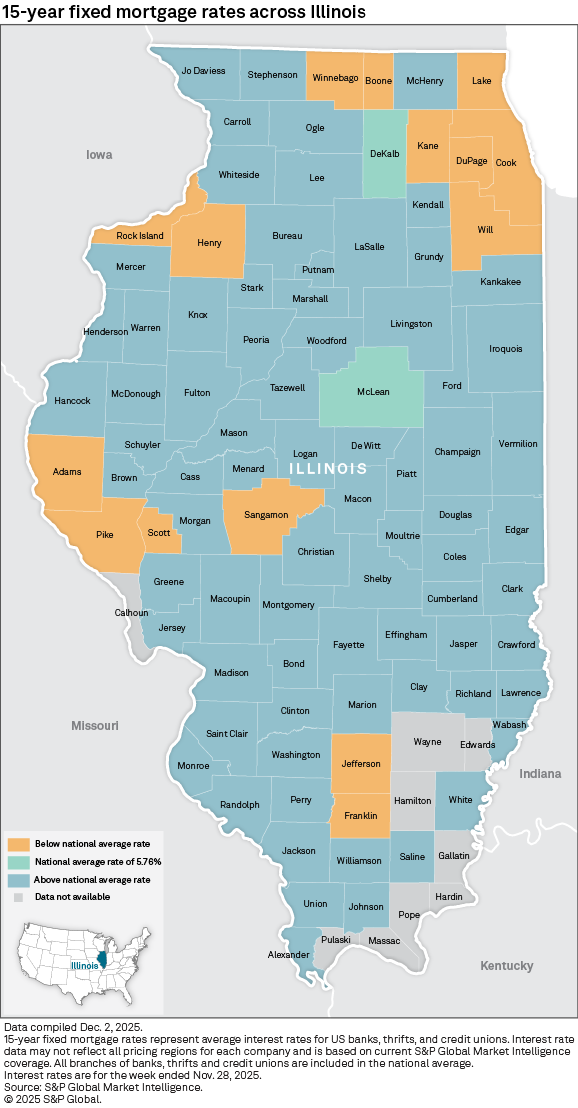

For 15-year fixed mortgage rates, the rate offered in Lawrence County was the highest among the Illinois counties at 6.64%. Pike County marketed the lowest rate at 5.52%.

The national average 15-year fixed mortgage rate during the period was 5.76%. The same rate was marketed in the Illinois counties of DeKalb and McLean.