Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Dec, 2025

By Nick Lazzaro

Job seekers attend a career fair in New York City on Dec. 10, 2025. US employers have slowed hiring and layoff activity in recent years amid economic uncertainty and a recalibration after labor demand distortions experienced during the COVID-19 pandemic. Data and sentiment surveys provide a mixed outlook on how these trends could evolve in the coming months. Source: Spencer Platt/Getty Images News via Getty Images. |

The US labor market's steady balance in 2025 between low rates of hiring and firing faces uncertainty in 2026 as layoff announcements and key metrics present competing views on employment trends.

The hires rate among total US nonfarm payrolls fell to 3.2% in October from 3.4% in September, marking one of the lowest monthly levels over the past decade, according to the latest US Bureau of Labor Statistics (BLS) data released in December. The rate has dipped to 3.2% only two other times since 2015. It was below that only once, when the rate fell to 3.1% in April 2020 during the first month of the COVID-19 pandemic lockdowns.

The rate of layoffs and discharges rose on the month to 1.2% in October, marking a 13-month high. However, monthly layoff rates of 1.2% and 1.3% were reported frequently from 2016 to 2019 before the pandemic.

"Relative to a base year like 2019, hiring was a bit weaker in October and layoffs were a bit firmer," Avrio Institute CEO and President Shawn DuBravac told S&P Global Market Intelligence. "October data could offer an early signal that the low-hire, low-fire dynamic is starting to crack, a small but noteworthy shift that could hint at early stress headed into 2026."

A "low-hire, low-fire" environment could continue into 2026 if economic conditions improve as expected because "firms would rather hold payroll steady than risk trying to rehire later," DuBravac said.

Private sector data drew headlines in 2025 with warnings of increased layoffs. For instance, US job cuts were estimated to have risen 54% year over year to 1.17 million through November, the fifth-highest total since 2000, according to a monthly layoff report from recruitment firm Challenger Gray & Christmas.

This bearish view accompanied major layoff announcements from large companies such as Amazon.com Inc., Verizon Communications Inc., Microsoft Corp., Intel Corp. and Salesforce Inc. However, these workforce reductions may not be indicative of overall labor trends across industries and regions.

"High-profile layoff announcements and media coverage are dramatically skewed toward certain large companies and industries that are not accurate bellwethers for the overall economy," Michael Schultz, an economist with Staffing Industry Analysts, told Market Intelligence. "Nationally, job losses and unemployment insurance claims filings remain near all-time lows."

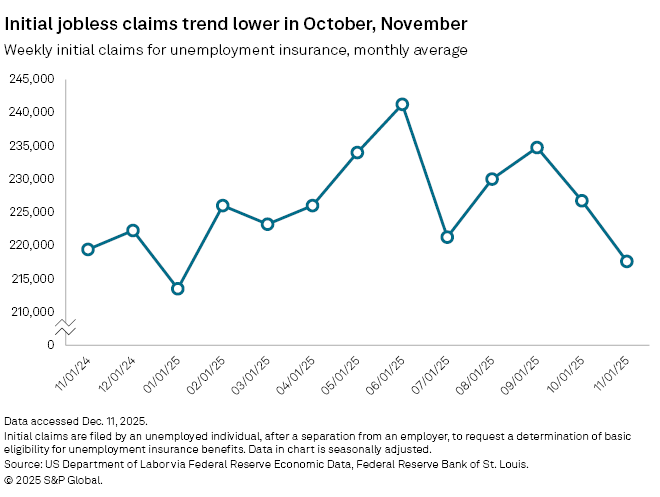

Weekly initial jobless claims averaged 217,600 in November, the lowest average since January, according to US labor data. The annual average for weekly initial jobless claims stood at more than 226,000 at the end of November. While elevated relative to recent years, this rate has still hovered near the lowest levels since the early 1970s.

Low firing trend likely to dissolve first

Paired with private sector layoff data, slowing payroll growth and low quit rates suggest that the trend of low job firing could end before hiring rates improve.

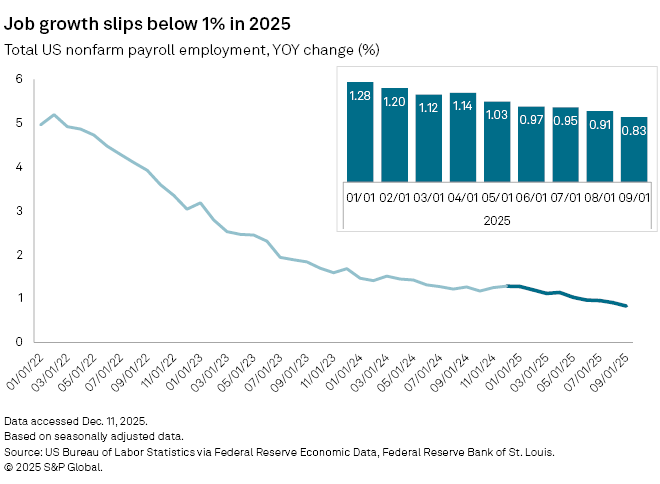

Total US nonfarm payrolls in September grew 0.8% year over year, the slowest pace since 2021, according to the most recent BLS data. Data on employment in November, delayed by the US government shutdown, will be released Dec. 16.

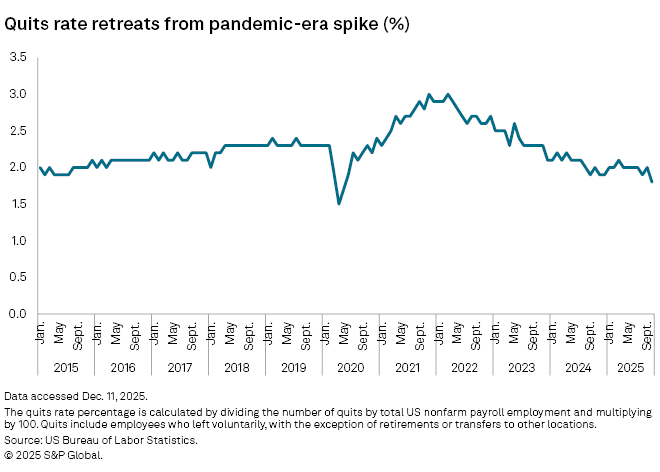

The quits rate among the US labor force was 1.8% in October, its lowest level for the month in the past decade. The lower rate likely marks an end to the post-pandemic era of employee leverage in which workers resigned and switched jobs at higher rates, prompting employers to take measures to retain workers.

Consequently, rising layoff data could indicate that employers are now overcoming their reluctance to trim payrolls, while slowing payroll growth could signal a ceiling for hiring activity, Doug Peta, chief US investment strategist for BCA Research, told Market Intelligence.

"It's possible that the labor market could bounce back, but it's increasingly unlikely that employers are ready to ramp up the pace, given that nothing suggests hiring was robust in October and November," Peta said. "The no-fire condition looks much more vulnerable to us than its no-hire opposite."

By contrast, stalled hiring trends are likely to persist as employers are more likely to retain employees instead of onboarding new ones, which would impact payrolls, according to Eric Croak, president of Croak Capital.

"I think this freeze will probably last until at least the first quarter of 2026," Croak wrote in an email. "We won't have a hiring breakout without margin pressure creating layoffs first."

A declining quits rate with consistent levels of job postings could imply that businesses are retaining talent while cutting back on investments for productivity, Croak said.

"In that scenario, the low-fire decision is about risk management and the low-hire decision is about protecting the margin," Croak said.

Sentiment signals also mixed

In November, consumers expressed mixed expectations for short-term employment conditions in The Conference Board's US Consumer Confidence Survey, a benchmark sentiment report.

In the survey, 27.5% of respondents in November anticipated fewer jobs would be available in the next six months, down from 28.8% and marking an improvement in sentiment. However, the share of respondents expecting more jobs to be available also dipped to 14.6% in November from 15.8% in October.

The Conference Board's overall Consumer Confidence Index declined 6.8 points to 88.7 in November.

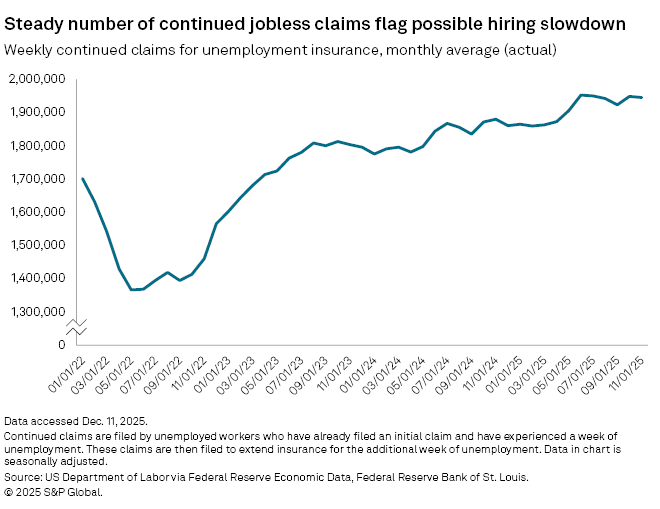

Rising weekly continued jobless claims indicate a growing number of unemployed workers experiencing longer periods without a job, which may serve as a leading indicator of softer job availability. Weekly claims averaged 1.95 million in November, the third-highest monthly level since the start of 2022.

Ultimately, leaner job availability could influence sentiment more than layoffs if an economic downturn occurs.

"Most of the increase in unemployment during recessions is not due to increased job losses but due to reduced hiring, leading to longer spells of unemployment and causing job losses to stack up," Schultz with Staffing Industry Analysts said.

"For those who lose their jobs in the present low-fire, low-hire environment, the difficulties they face are dramatically worse than what would typically be expected amid moderate economic growth."