Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Dec, 2025

By Brian Scheid

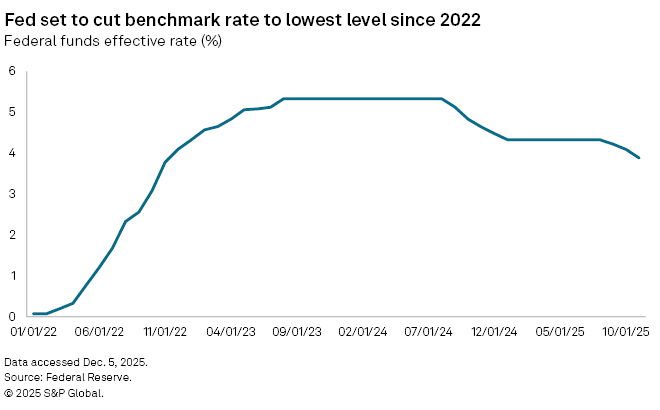

Federal Reserve officials will meet this week for what is expected to result in the third interest rate cut since September and what could be one of the most contested decisions in the central bank's history.

With limited government data due to the longest federal government shutdown in history, members of the rate-setting Federal Open Market Committee (FOMC) will likely face off over whether the Fed should focus its policy efforts on cooling inflation or bolstering a teetering labor market.

At issue is the Fed's dual mandate to both maintain price stability and promote maximum employment. Votes on this latest possible rate hike will hinge on what side of that mandate officials are most concerned with.

"The FOMC has grown increasingly split over its near-term course of action, and multiple dissents seem likely," said Sarah House, a senior economist with Wells Fargo.

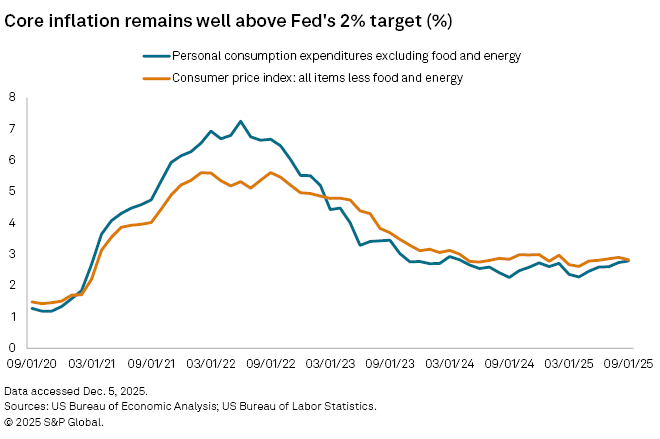

On the hawkish side, several Fed members are most worried about inflation, which remains stubbornly above the central bank's 2% target. The personal consumption expenditures (PCE) price index increased 2.8% from September 2024 to September 2025, while core inflation, which removes volatile energy and food prices, also rose 2.8%, The Bureau of Economic Analysis reported Dec. 5.

Since slipping to 2.6% in April, the lowest point since March 2021, core PCE has averaged 2.8% and made no progress toward the Fed's 2% goal.

Hawkish Fed members are likely to push against the need for another rate cut, given stickier and more elevated inflation from tariffs still being a possibility, higher insurance costs weighing on Americans, unemployment staying at a relatively low rate of 4.4% and the domestic economy still growing with stock markets nearing all-time highs.

Still, dovish members, more worried about the other prong of the Fed's mandate to promote maximum employment, will push for another cut as the labor market has shown signs of weakness. While unemployment has yet to rise much, job growth has been concentrated in leisure and hospitality, healthcare and government. The remainder of sectors have seen job losses over the past five months, and companies including Amazon.com Inc., United Parcel Service Inc. and Target Corp. have announced layoffs.

"The jobs mandate, therefore, argues for further rate cuts from the Fed," said James Knightley, chief international economist with ING.

Fed officials will almost certainly approve another 25-basis-point cut at this December meeting, but they could likely then signal that a pause in rate moves will take place after the impacts the 75 bps of cuts since September have had on the economy, said Michael Hewson, an independent market analyst.

This potential pause will likely force Fed Chairman Jerome Powell into a delicate balancing act, as he attempts to set policy expectations for 2026.

"The central bank will want to retain optionality and not pre-commit, which means they are likely to err on the side of caution," Hewson said.

Rate projections

After this week's meeting, Fed officials will release their latest summary of economic projections, with views on where inflation, GDP, joblessness and rates may be headed. In September, when the last projections were released, Fed officials projected only one rate cut in 2026.

Without much new inflation or jobs data since that September meeting, Fed officials may change these projections little, said Knightley with ING.

"The most dovish they could possibly be is to put a second rate cut for their 2026 forecast, but they will be reluctant," Knightley said.