Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Dec, 2025

By Vanya Damyanova and Cheska Lozano

| Customers queue at a branch of Fibank, Bulgaria's fifth-largest lender. Source: Nikolay Doychinov/AFP via Getty Images. |

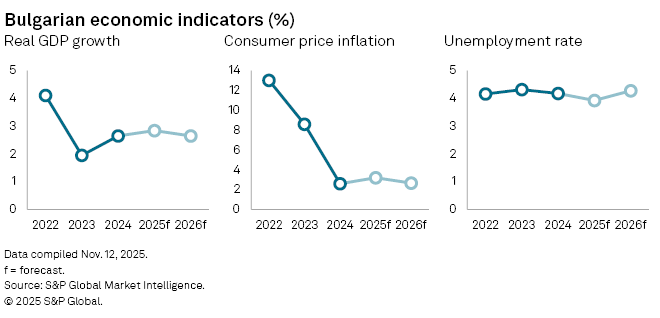

The challenges posed by Bulgaria's adoption of the euro in 2026 are unlikely to affect the robust profitability of the country's lenders.

Ample liquidity unlocked by reduced minimum reserve requirements, as the sector aligns with European Central Bank (ECB) rules, will be enough to offset the loss of foreign-exchange (FX) business and one-time costs of converting the Bulgarian lev to the euro, banks and analysts say.

Already better capitalized and earning more than most lenders in the eurozone, Bulgarian banks are well positioned to manage the transition to the euro without losing much performance momentum. The transition offers more benefits than drawbacks, and the sector outlook is positive.

Bulgaria's eurozone entry "will practically eliminate FX-related risks and materially lower funding risks" for banks, said Alexios Philippides, senior analyst of financial institutions at Moody's Ratings.

Sector profitability in 2026 is likely to be similar to 2025, with return on assets (ROA) and return on equity (ROE) expected to remain roughly stable, Philippides told S&P Global Market Intelligence in an interview.

Bulgaria will become the 21st country to join the eurozone on Jan. 1, 2026, following Croatia's entry in 2023. Its banking system will rank 15th in total assets within the zone, according to EU data.

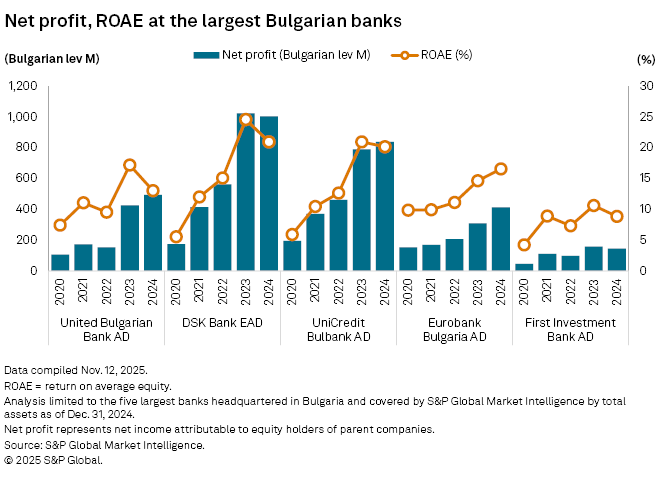

After achieving average annual growth rates of over 60% in the three years to 2023, Bulgarian bank sector profits rose more than 8% in both full year 2024 and the first six months of 2025, according to data from the country's central bank, the Bulgarian National Bank.

Banking sector profitability is expected to remain at current high levels and above the eurozone average over the next three to five years, Hristo Hristov, deputy director of corporate communications at Bulgaria's fifth-largest lender, First Investment Bank AD (Fibank), told Market Intelligence. Key drivers include the banks' strong capital position and stable lending, as well as the high efficiency and favorable structure of their assets, Hristov said.

Bulgaria's third-largest lender, UniCredit Bulbank AD, anticipates a continuation of its "robust profitability" over the next three years, a spokesperson for the bank said.

Net profit and return on average equity at the largest banks in Bulgaria — United Bulgarian Bank AD, DSK Bank EAD, UniCredit Bulbank, Eurobank Bulgaria AD and Fibank — have increased materially since 2020, Market Intelligence data shows. The five banks accounted for nearly 78% of total assets in the Bulgarian banking system in 2024.

Flush with liquidity

Euro adoption will boost the sector's liquidity in the short term as Bulgarian banks' minimum reserve requirement at the ECB is slashed to 1% from 12%. The currency conversion will also lower the deposit base to which the requirement applies. The reduced requirement will release about 16.3 billion leva, or roughly €8 billion, according to Bulgarian National Bank estimates from May 2025.

The release will likely drive new business volumes and strengthen banks' earnings capacity in the short to medium term, said Halil Senturk, vice president of global financial institutions at Morningstar DBRS. Sound economic growth, strong domestic loan demand and improved access to eurozone equity markets will also contribute to solid sector performance in the short term, Senturk said.

Although banks will be flush with liquidity, a surge in lending is unlikely. The 13%-14% annual credit growth seen in the last three to four years has already been "intense," Philippides said. This was driven by healthy household demand, a tight labor market and economic growth, as well as banks already having excess liquidity and capital, Philippides said.

Banks are likely to use the extra resources to raise their government bond holdings, especially if the finance ministry continues to actively fund itself through the domestic market, Fibank's Hristov said.

Investments in interest-generating assets, such as money market placements and bonds, would boost net interest income (NII) and offset the lost fees from euro-lev FX transactions, UniCredit Bulbank's spokesperson said. The net impact on UniCredit Bulbank's revenue would be neutral to slightly positive, given current ECB interest rates, the spokesperson said

With a 22.5% common equity Tier 1 (CET1) ratio, Bulgarian banks rank fourth in capitalization among credit institutions in the eurozone, EBA data shows. Their liquidity coverage ratio of 237.2% was the sixth-highest among banks in the zone.

Most of the country's largest banks have maintained CET1 ratios above 20% and problem loan ratios in the low single digits over the past five years, Market Intelligence data shows.

However, this headwind will be offset by the switch to ECB reserve rules, which would allow Bulgarian banks to earn interest on excess liquidity at the ECB deposit facility rate, currently at 2%, Philippides said. This would be a new income stream for banks, compensating for the loss of FX-linked fees and commissions.

"So, the impact of the euro adoption on bank profitability would likely be neutral overall," Philippides said.

Revenue and profit

Both NII and net fee and commission income (NFCI) at Bulgaria's five largest banks grew steadily in the five years through 2024, Market Intelligence data shows.

Euro area entry typically "eats into the profitability options when it comes to headline FX business, especially corporate business," said Gunter Deuber, managing head of research at Raiffeisen Bank International. Yet in Bulgaria's case, the FX part of the business is limited, while the banking sector has already been "largely 'euroized,'" Deuber said.

Bulgarian banks will retain parts of their FX business linked to foreign trade in non-eurozone countries such as Hungary, Romania, Turkey and the UK. After eurozone entry, banks could roll out new euro-denominated investment products, boosting NFCI, Deuber said.

"Access to the highly liquid euro-denominated derivatives market will provide banks with a broader set of tools for managing interest rate risk. This will enable the development of more diverse fixed-rate products, offering greater choice to both corporate and retail clients," UniCredit Bulbank's spokesperson said.

The short-term negative effects on bank profitability should be manageable, with through-the-cycle ROE expected to range from 11% to 15%, which is at the upper end for eurozone banking markets, Deuber said.

– Access aggregate industry data for Bulgaria's banking sector.

– View economic and demographic data for Bulgaria.

– Read more European Data Dispatches.