Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Dec, 2025

| Lloyds' GenAI-powered customer knowledge hub, Athena, has cut the time staff spend searching for information to respond to a client query by 66%. |

European banks are starting to see tangible results from the deployment of AI across their organizations as the technology moves from pilot programs stage to day-to-day use.

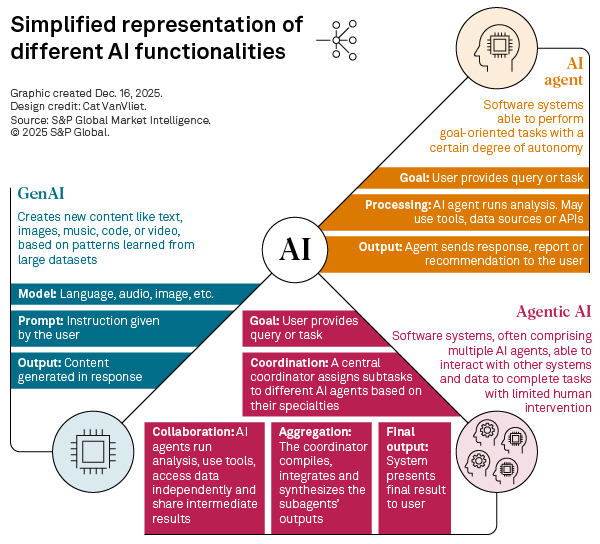

Since generative AI (GenAI) became mainstream with the launch of OpenAI LLC's ChatGPT in November 2022, the technology has advanced at breakneck pace, with agentic AI driving the latest growth phase. However, as investments in AI have increased, so have questions about the returns organizations are achieving from its use.

While deployment is still in the early stages, some banks are seeing measurable gains from AI use cases. Around 26% of senior banking and financial firm executives across Europe, the Middle East and Africa (EMEA) said they are already meeting their current financial- and cost-savings return on investment (ROI) goals thanks to AI, according to an IBM survey of 853 executives in September. The ROI achievement rate reported by banks and financial firms was higher than the 20% average rate reported by senior business leaders across sectors in EMEA, the survey shows.

"I genuinely think there's a myth about the ROI in some of our AI use cases because we're getting some brilliant returns," Tom Martin, business platform lead for economic crime prevention at Lloyds Banking Group PLC, said Dec. 3 during a panel discussion at the FT Global Banking Summit.

The group has financial results for each of the 50 AI use cases in operation as well as targets for next year, which will be made public soon, Martin said.

"The ROI is what's really pulling through the investments that we're making," Martin said.

Lloyds is tracking key performance indicators (KPIs) for knowledge management and call summarization tools introduced for client-facing staff, Martin said. Athena, its GenAI-powered customer knowledge hub, has cut the time staff spend searching for information to respond to a client query by 66%, according to a July statement.

Bottom line impact

ING Groep NV has focused on a select group of use cases "to learn quickly and scale effectively rather than spreading efforts thin," said Bahadir Yilmaz, chief analytics officer at the Dutch lender.

These include deploying GenAI chatbots across seven countries with hyper-personalized marketing, and integrating the technology into know-your-customer analysis, wholesale bank lending and software engineering, Yilmaz said in an interview.

A project launched three years ago to speed up unsecured consumer loan approvals resulted in 65% of such loans in the Netherlands being approved within five minutes, Yilmaz said.

"Our market share went up significantly: to over 25% from 9% when we started. Client experience improved and profitability went up," Yilmaz said.

ING wants similar results by using agentic AI in its mortgage business. It will start a project next year "to initiate and complete mortgage applications, transforming how we engage with customers by automating data collection and credit checks, while ensuring that personal advice remains human-led," Yilmaz said.

Agentic AI deployment here could move processing times "from weeks to days and eventually to minutes," he said.

Managing market expansion

London-listed TBC Bank Group PLC recently rolled out GenAI and agentic solutions across its domestic business in Georgia and its fast-growing second market of Uzbekistan, resulting in efficiency gains in client-facing operations, said George Tkhelidze, deputy CEO and head of CIB and wealth management.

In the second quarter of 2025, the bank started using AI in its customer relationship management (CRM) system to suggest "bundled offers" to corporate banking clients "based on their payments data, profitability, financial standing and sectoral presence," Tkhelidze said in an interview.

"In corporate banking, AI now produces 60% to 70% of the credit paper process, which includes industry and company analysis as well as financial assessments. This automation allows relationship managers more time to focus on client solutions and new proposals," Tkhelidze said.

TBC Bank will switch to a dual model from next year, "where the customers will be managed both by relationship managers and an AI assistant," Tkhelidze said.

In Uzbekistan — a much larger market, with a population of some 38 million people versus Georgia's roughly 4 million people — TBC has doubled its loan book within a year and now has 22 million unique registered users. To handle this rapid growth, the bank is integrating AI into its back office operations "to drive efficiency gains and improve unit economics," said Tkhelidze.

TBC Bank has "already launched AI agents for sales, which conduct 100,000 interactions per month, while AI agents now handle 90% of payment reminders for customers in early-stage delinquency," Tkhelidze said.

Adapting to change

Bankers are also confident that AI will help them adapt to emerging challenges. The UK's fifth-largest bank, Standard Chartered PLC, believes AI, layered over the more structured and granular data formats of the new ISO 20022 financial messaging standard, can transform payment services.

On Nov. 22, the ISO 20022 MX format became the exclusive mandatory format for all cross-border payment and cash reporting instructions exchanged by financial institutions on the SWIFT network, replacing legacy message type formats used in the old ISO 15022 financial messaging standard.

AI solutions based on ISO 20022 data will improve payment processing and analytics, and enable the bank to enhance financial crime controls, like anti-money laundering checks and fraud monitoring, Sunday Domingo, global head of digital channels and data analytics at Standard Chartered's corporate and investment bank, told S&P Global Market Intelligence in an interview. AI could add "a lot of value" in these areas, Domingo said.

UK-based Lloyds also sees potential to transform mortgage lending by the end of the decade through the use of agentic AI with tokenized deposits. The process of conveyancing document sharing, value exchange and payments could be built into a smart contract, which in turn can be guided by an AI agent that provides advice to customers, CEO Charlie Nunn said at the FT conference.

"You can redesign buying and selling homes completely with those two technologies, and we can do that in the next five years," Nunn said.

Further potential

Determining ROI from AI is hard because it is often challenging to decide where to start measuring, Matt Weaver, head of solutions engineering in EMEA for OpenAI, said at the FT conference.

A "dramatic" reduction in the time to complete manual tasks demonstrates there is ROI, he said. Yet there are also examples where AI enables a faster 24/7 customer service, and some banks are measuring the benefit not only as saved operational time, but also as "the increase on customer satisfaction scores and their ability to do more," Weaver said.

Furthermore, while banks may have previously abandoned projects around upgrading various back-end systems, deeming them "too big a job," they are now increasingly using AI "to get out to a modern infrastructure," said Weaver.

Across financial services, "there's already tremendous application of AI in fraud detection, risk mitigation, operational efficiency, process automation and then customer service, personalization specifically," said Kanv Pandit, head of global sales for banking and payments at financial services technology provider FIS.

The impact has been positive in typically "high-friction areas" such as lending, customer onboarding and document processing as moving to AI-assisted workflows has enabled banks to enhance fraud prevention and process applications faster, Pandit said in an interview.

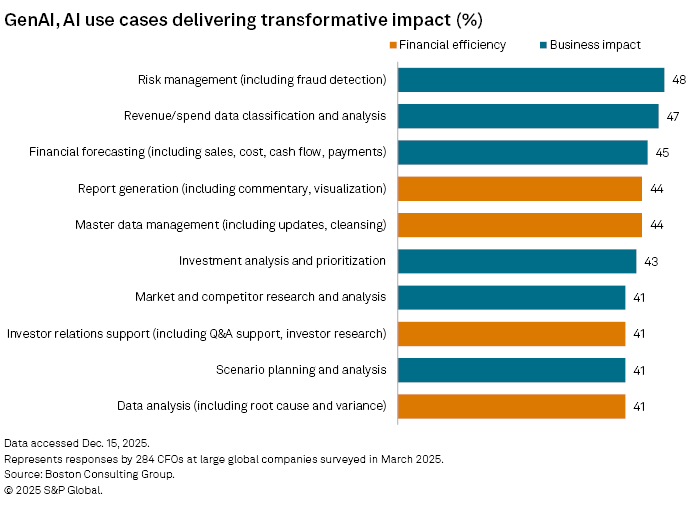

Still, lenders across the globe could realize more than $370 billion in additional profits annually in retail banking alone through large-scale AI deployment by 2030 and beyond, Boston Consulting Group said in a Nov. 2 report. This would come by reinvesting cost savings into innovation, new revenue streams and customer acquisition, it said.

The consultancy estimates that AI could reduce retail banks' costs by as much as 40%, primarily through the roll out of agentic tools in the coming years.

"[AI] is going to alter the world in ways that we can't even imagine...If you are a late adopter or a slow adopter, your business model is going to be severely challenged," Allied Irish Banks CEO Colin Hunt said at the FT conference.