Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Dec, 2025

Revenues at investment banks globally are expected to grow about 10% in 2025, led by a surge in equities trading.

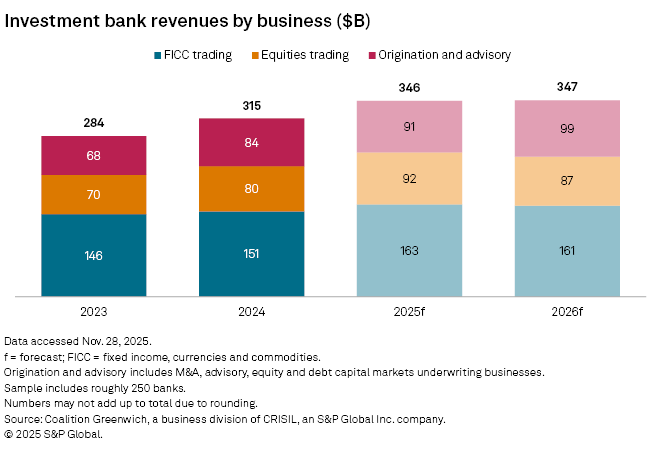

Investment banks are on course to book a total of $346 billion in revenue this year, up from about $315 billion in 2024, according to data by Coalition Greenwich, a business division of CRISIL, an S&P Global company. The sample includes roughly 250 banks worldwide.

Strong equities trading

While growth is expected across all core businesses, equities trading is projected to achieve the strongest increase in 2025 at 15% year over year, the data shows. Origination and advisory revenues are projected to rise nearly 8%, and revenues from trading in fixed income, currencies and commodities (FICC) are forecast to grow more than 8% from 2024.

The key revenue drivers within equities trading are expected to be equity derivatives, prime services and cash equities, with estimated year-over-year gains of about 20%, 14% and 13%, respectively.

Most major global banks booked double-digit growth in equity trading revenues in the third quarter, with Morgan Stanley logging the strongest rise of 35%, according to earnings data compiled by S&P Global Market Intelligence.

"Prime brokerage revenues drove results as average client balances and financing revenues reached new records," Morgan Stanley CFO Sharon Yeshaya said during the US group's earnings call Oct. 15. Higher activity in Europe, the Middle East and Africa drove the company's equity derivatives business, while revenues from cash equities grew on higher client activity and increased global market volumes, the CFO said.

2026 outlook

Current Coalition Greenwich estimates for global investment bank revenues in 2026 point to a stabilization versus 2025, with equities trading results set to fall back about 6%. FICC trading revenues are expected to edge lower by more than 1%, while advisory and origination is set to grow roughly 9% in 2026.

Banks' advisory and origination activities were hit by US tariff announcements in early 2025 that triggered a spike in market volatility and slowed dealmaking. Since then, the business has been recovering, with market observers projecting a rise in M&A and IPO activity going into 2026.

Third-quarter advisory and origination revenues were higher year over year at most major US and European investment banks, Market Intelligence previously reported.

Morgan Stanley and UBS booked the strongest growth in advisory and origination over the quarter.

UBS CFO Todd Tuckner said during the group's Oct. 29 earnings call that there was growth in both M&A and IPO business after the tariff announcements in the second quarter.

Several banks, including BNP Paribas and Deutsche Bank, pointed to a strong pipeline for the coming quarters.