Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 Dec, 2025

By Brian Scheid

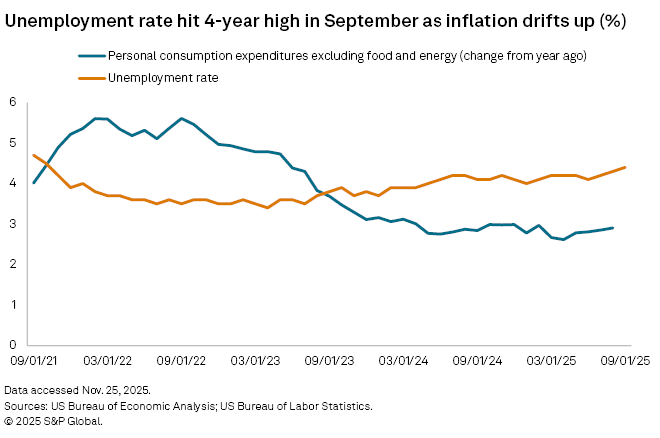

Fears of a weakening jobs market are colliding with concerns of higher inflation as a dearth of government data on either is setting the stage for one of the most contested interest rate decisions in Federal Reserve history.

The longest US federal government shutdown of all time caused delays and cancellations of key government reports on inflation, labor, GDP and more. The September jobs report was delayed nearly seven weeks, the October report will not be released and the November report will not be unveiled until Dec. 16. The consumer price index, the market's preferred inflation measure, will also not have an October report, and the November report will be released Dec. 18.

The cancellation of the October reports and the delays in the November data will leave the Fed with very little government-backed data as it decides whether to cut interest rates at its Dec. 10 meeting. Fed officials will likely argue for cutting rates to protect the labor market or push to hold rates steady to keep inflation from rising further, with months-old data on much of the domestic economy.

"The range of possibilities is very wide, and the direction of how things might go could come down to some personal biases and political views," said Thomas Simons, chief US economist at Jefferies. "I don't have any specific evidence to suggest that this might be the case, or any specific individuals in mind, but the lack of data makes it that much easier for previously held views to fill in the blanks."

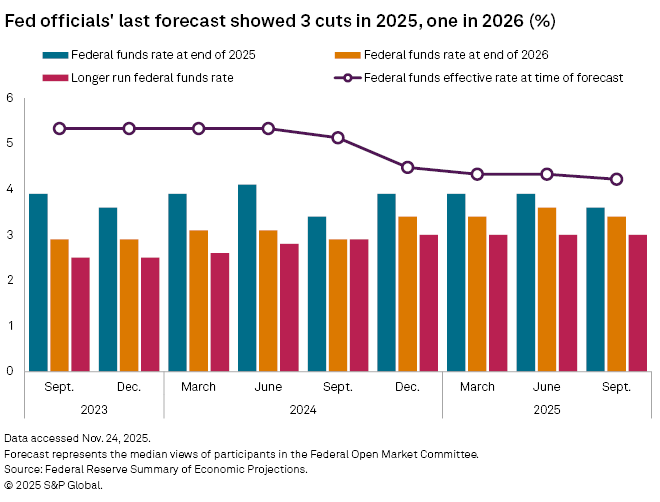

Based on an analysis of recent comments by members of the rate-setting Federal Open Market Committee, Simons expects a 25-basis-point rate cut to be approved on a 7-5 vote at the committee's Dec. 10 meeting, a vote outcome that has never happened at a Fed meeting. Simons sees at least four committee voters potentially on the fence, but a cut is currently the expectation.

Shifting odds

The likelihood of a 25-bps cut at the Fed's December meeting was seen as highly certain back in October, with more than 90% of the futures market betting on such a cut, according to CME FedWatch. However, the odds shifted substantially throughout November, with the odds of no change in rates at the December meeting becoming the majority view in mid-November before moving to a more than 80% likelihood of another cut.

"Whether they cut or hold, they'll have to make a decision based on the information they have at hand," said Derek Tang, an economist with LHMeyer/Monetary Policy Analytics. "But this is simply another version of what they always do: fill in the gaps with their judgment. It does seem that they might catch more heat by acting with a cut than without, especially if it turns out to be a mistake in retrospect."

The Fed is likely to approve a cut at its December meeting, but there is a growing risk that Fed officials may wait on all rate moves until "the data fog clears," according to Oren Klachkin, a financial market economist at Nationwide.

In September, when the Fed released its quarterly economic projections, the expectation from Fed officials was a 25-bps cut each in September, October and December, but just one 25-bps cut at some point in 2026.

Data desert

These rate expectations, along with projections on unemployment, inflation and GDP, will be updated at the upcoming December meeting, but it is unclear how these forecasts could be impacted by the lack of new government data.

"The projections are always difficult, but lack of data will make them even more difficult," said Kathy Jones, chief fixed income strategist for the Schwab Center for Financial Research. "It will be interesting to see how wide the dispersion is around GDP growth, unemployment and inflation. My guess is that we'll see some very different views."

Private and regional data will offer Fed officials "a decent flashlight to guide them through the data desert," said Klachkin at Nationwide.

And while official data has been scarce, the economy has clearly shifted since the last quarterly projections came out in September, according to Tang of LHMeyer/Monetary Policy Analytics.

Still, it is possible that Fed officials will essentially repeat their forecasts from September, said Simons at Jefferies.

"There is a binary dynamic in the economy, where it is either the case that the labor market ran out of gas and is poised to decline further, or the weakness over the summer was just an echo or ripple effect of 'Liberation Day' that is now behind us," Simons said. "Both have different policy prescriptions."