Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 Dec, 2025

By Garrett Hering and Susan Dlin

| Ameresco recently completed this 50-MW/200-MWh behind-the-meter battery system, above, at a Nucor mill in Kingman, Arizona. |

Large-scale battery storage resources continue charging rapidly into US power markets, needing just three quarters of 2025 to exceed last year's record installation volumes, according to S&P Global Market Intelligence data.

Developers added 4.5 GW in this year's third quarter, a 24.5% increase from a year ago, pushing annual installed battery power storage capacity in 2025 to nearly 11.6 GW, the data shows. That is up from 7.8 GW through the first three quarters of 2024 and 11.5 GW for the full year. Entering the fourth quarter, cumulative installed battery power capacity stood at 41.5 GW, consisting mostly of lithium-ion battery systems with a capacity of up to four hours.

Battery storage has emerged as a top choice for US utilities racing to meet rising electricity demand, fueled by data centers and manufacturers. But increasingly, in areas experiencing grid constraints, tech and manufacturing giants are dealing directly with developers to quickly build big battery systems at their facilities, often combining them with other onsite resources.

Ameresco Inc., for instance, in October completed a 50-MW/200-MWh battery array at US steel maker Nucor Corp.'s expanding mill in Kingman, Arizona. Touted as the biggest behind-the-meter storage project in the state, and one of the largest nationwide, it relies on Megapack systems from Tesla Inc. to support Nucor's new electric arc furnace. Ameresco plans to bring online a 25-MW solar farm at the site in 2026, augmenting the colocated batteries and grid power.

"We're starting to see a lot more of these opportunities pop up, and we're actually actively going after more," Jonathan Mancini, senior vice president of solar and battery storage development at Ameresco, told Platts, part of S&P Global Energy. "We are working right now, whether it's in the design phase or in the contracting phase, with other opportunities that are this size, if not bigger, behind-the-meter industrial users."

Major industrial energy users, ranging from petroleum and plastics facilities to steel mills and AI data centers, are exploring ever larger onsite battery systems to smooth power loads, provide emission-free backup power and create flexibility.

Ameresco is partnering with the US Navy and data center developer CyrusOne Inc. to build a 100-MW data center along with a mix of onsite resources at Naval Air Station Lemoore in California, which is also served by Pacific Gas and Electric Co., the utility subsidiary of PG&E Corp.

Planned to come online in phases between 2027 and 2030, the colocated data center and hybrid energy project will include approximately 200 MW of solar, up to 150 MW of four-hour battery systems and 50 MW to 100 MW of fuel cells, according to Nicole Bulgarino, Ameresco's president of federal solutions and utility infrastructure.

"We've tried to optimize it with what makes the most sense for having not too big of an oversized system, but enough that matches the profile very well to minimize where the customer would have to pay peak pricing from the utility," Bulgarino said in an interview. "So it's all about that time of use."

Ameresco is in talks on additional projects at data centers in Texas and the Western US, according to the executive, who views batteries as critical to the further evolution of artificial intelligence and data centers.

Grok, an AI chatbot that is partially powered by Tesla batteries, agrees with that assessment.

Developed by X.AI LLC, a company founded by Tesla CEO Elon Musk, Grok says it relies on grid power, onsite natural gas turbines and Megapack battery units at X.AI's Colossus data center in Memphis, Tennessee. A 150-MW battery system was integrated in May with full operations at Colossus phase 1, partially replacing temporary gas turbines, with more batteries planned, according to Grok.

X.AI did not respond to a request to confirm details about its operational and planned batteries at Colossus. But the Greater Memphis Chamber of Commerce, which includes an X.AI official on its board of directors, said in a press release in May that the first 150-MW battery system was fully operational, helping the facility ride through outages or flex its load during periods of peak grid demand.

Subsequent social media posts from Musk and X.AI show a significant expansion in progress.

The Ameresco-CyrusOne and X.AI-Tesla battery projects are part of an expanding relationship between data center and battery storage developers. Google LLC, for example, in November disclosed it is building three new data centers in Texas, including one colocated with a solar-plus-storage project in a partnership with Intersect Power LLC.

Such cross-sector collaborations could further solidify the US battery storage pipeline, which is supported by US tax credits available into the mid-2030s under the sweeping budget bill enacted in July.

Through 2030, battery storage developers plan to bring online an additional 185 GW of new battery power storage, more than four times the existing installed capacity entering the fourth quarter of 2025, Market Intelligence data shows.

As of Nov. 17, 13.2 GW had come online so far in 2025 at over 160 projects or major phases, with another 20.2 GW under construction, 3.9 GW in advanced development and 107.8 GW in early development.

By starting construction before the end of this year, developers can avoid new US restrictions that start in 2026 on components sourced from foreign entities of concern.

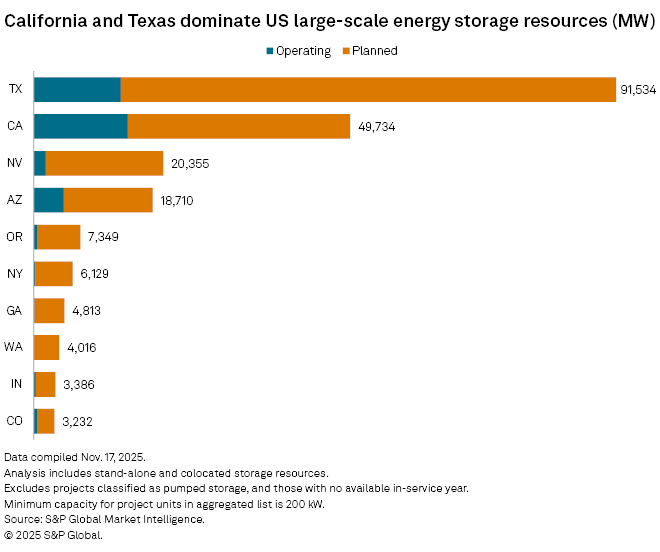

Most operating battery resources in the US are in California and Texas.

With 14.8 GW online as of Nov. 17, California continues to maintain a narrow lead over Texas on completed large-scale battery power capacity, according to Market Intelligence data.

But Texas, which is experiencing a stronger surge in electricity demand from data centers, has a 77.9-GW battery project pipeline through 2030. That is more than double California's.

"What I keep waiting for with the storage industry is, where is it going to next?" said Sam Huntington, director of North American power and renewables analysis at S&P Global Energy.

Markets have emerged in some other areas of the West, particularly in Arizona, which has 4.7 GW online and almost 14 GW planned. Nevada has 1.9 GW online and another 18.5 GW under development.

Significant pipelines also have emerged in Oregon, New York, Georgia and Washington, each of which has at least 4 GW of battery storage capacity under development, according to Market Intelligence data.

"But what about the rest of the country?" said Huntington. "When do we see PJM or MISO really go for it?"

Huntington co-authored a recent report that found batteries to be the least-expensive new source of supply across the US in 2030, based on the levelized cost of capacity, 30% to 40% cheaper than solar-plus-storage and natural gas plants.

Market Intelligence considers a project as announced when it has a listing in an interconnection queue with an accompanying public announcement or permitting action. A project is considered in early development after permitting begins. For a project to be considered advanced development, it must meet two out of five criteria: financing is in place, power purchase agreements are signed, equipment is secured, required permits are approved or a contractor has signed on to the project. A project is under construction when building activity begins; site preparation does not qualify a project for this status.