Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Dec, 2025

By Tom Jacobs and Malik Ozair Zafar

|

Shareholders pose for a picture with the GEICO mascot at the Berkshire Hathaway annual shareholders' meeting on April 30, 2022, in Omaha, Nebraska. Warren Buffett will step down as Berkshire Hathaway's CEO at the end of 2025 but will remain chairman. |

Nearly 30 years ago, Warren Buffett added Geico Corp. to his corporate empire because of his faith in the insurer's business model for competition within the US private auto insurance market.

The Berkshire Hathaway Inc. subsidiary experienced steady growth over the decades as it competed with State Farm Mutual Automobile Insurance Co., The Allstate Corp., and, more recently, The Progressive Corp. for the title of the country's largest property and casualty insurer.

Buffett, who announced on Nov. 10 that he is stepping down as CEO of Berkshire Hathaway at the end of 2025, helped make GEICO a contender for that title, but a wariness over innovations such as telematics and bundling auto and home insurance policies has diminished the insurer's standing in that competition.

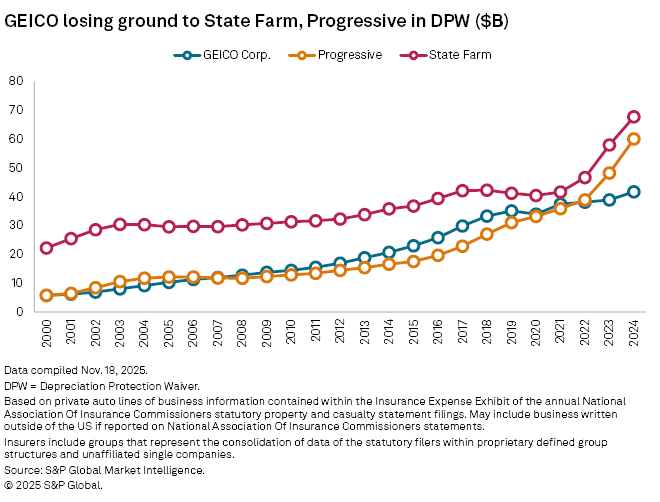

Failing to recognize the potential of innovations such as telematics or bundling auto and home insurance policies, GEICO was bumped from the No. 2 spot in 2022 by Progressive, which had $38.93 billion in direct premiums written that year compared with GEICO's $38.12 billion, according to an S&P Global Market Intelligence analysis. This gap has only widened in recent years as Progressive increased its premiums by 54.3% to $60.05 billion by the end of 2024, while GEICO grew by just 9.4% to $41.71 billion.

However, the departure of Buffett and the promotion of Nancy Pierce to CEO of GEICO may signal a fresh run at State Farm and Progressive. Pierce, previously GEICO's COO, succeeds Todd Combs, who is leaving the company for J.P. Morgan.

The shake-up has the potential to usher in new ways to get GEICO back into title contention, said Tim Zawacki, principal research analyst for S&P Global Market Intelligence.

"In terms of having a new executive come in when someone who's had a very strong opinion on a particular subject is no longer in charge, that does give them some additional options to consider things in the past that might have been taboo," Zawacki said in an interview.

New driver after missing the bus

The mistake of ignoring the impact of telematics was acknowledged at Berkshire's 2021 annual meeting, two years after GEICO initiated its first telematics project with the DriveEasy app. Ajit Jain, Berkshire Hathaway's vice chairman for insurance operations, said that the insurer "clearly missed the bus" and was late in appreciating the value of telematics in matching rates to risk.

Buffett's decision to have Combs become GEICO's CEO in January 2020 represented a step toward changing that strategy. Combs came to Berkshire as a portfolio manager in 2010 and was still in that position when he announced his departure for J.P. Morgan.

Bringing in Combs was an example of Buffett's confidence in GEICO's top executives as the telematics problem was "fixable and they fixed it," but the damage was done, according to Keefe Bruyette & Woods analyst Meyer Shields.

"The huge gap of market share that emerged in recent years between Progressive and GEICO is because GEICO underestimated the need for telematics," Shields said in an interview. "It's one example of that strategy not working too well."

Slow to change

While Progressive has made extensive use of telematics since adopting them in 1996, Buffett's attitude toward the practice had been, at times, dismissive.

Buffett was asked at Berkshire Hathaway's 2012 annual meeting about any initiatives for GEICO to adopt telematics to match rate to risk. He said he didn't see it as "a major change" and expressed confidence in the company's risk selection.

"We'll keep looking at anything, but I do not see ... in this new experiment anything that threatens GEICO in any way," Buffett said.

That was the wrong attitude to take, said Keefe Bruyette & Woods' Shields, because risk selection is "a relative game, not an absolute game."

"GEICO was like a wizard at using credit score as a rating variable and as an underwriting tool," Shields said. "But when telematics came in, then they all of a sudden became not good enough."

Zawacki said that Progressive's decision to focus on "bundling" various insurance policies to offer discounts to customers further altered the personal auto landscape.

"Their success was when they pivoted to focus on bundled business for customers ... who buy auto and home policies from the same company," Zawacki said. "They've really been successful with that, and GEICO did not follow them down that road."

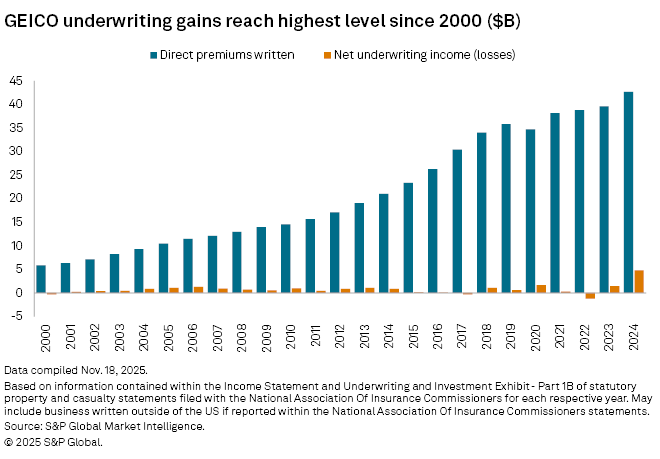

Despite falling further behind Progressive in direct premiums written in 2024, GEICO had a record year in terms of underwriting. It logged a 221% year-over-year increase in net underwriting gains to a record $4.8 billion from $1.5 billion.

Direct sales to independent agents

One area where the Buffett-led GEICO was a pioneer was in using direct channels to sell insurance. When competitors saw that strategy was working for GEICO, they tried their hand at it and found out a harsh reality, said Brian Sullivan, editor and publisher for Risk Information Inc.

"Everybody who tried it, with the exception of Progressive, really got their head handed to them because [direct sales] requires a tremendous amount of capital up front and you don't have the longevity in the customer," Sullivan said. "It takes a financial person with a bigger world view like Warren Buffett ... to stomach the enormous cost of acquiring customers without agents in order to renew them."

Now, as Buffett leaves the stage, GEICO is following Progressive's lead by taking steps to break into the independent agency channel. Shields said that a significant market share shift to the direct-to-consumer channel at the expense of the captive agency channel has helped open some eyes to the potential of the independent agency channel.

From potential to proven

Buffett has had a connection with GEICO that has endured for more than three-quarters of a century. The "Oracle of Omaha" made his first investment in what was then known as the Government Employees Insurance Co. in 1951 when he was a graduate student at Columbia University.

Forty-five years later, in 1996, Buffett and Berkshire acquired the insurer, making it an indirect, wholly owned subsidiary of his holding company.

Buffett's decision to acquire GEICO was based on his belief that the insurer had the potential to improve its standing in the auto insurance market, said Sullivan.

"I think the single most important thing that Buffett did with GEICO is recognizing its potential," Sullivan said. "What he saw was potential that hadn't been proven. That's classic Warren Buffett."

However, while companies such as Progressive were constantly evolving, GEICO believed in their "own press clippings and let the industry get away from them," according to Sullivan.

"Telematics was representative of the fact that they had stopped innovating in underwriting and pricing," Sullivan said. "They were still really good at managing costs and ... at marketing, but they had stopped innovating."

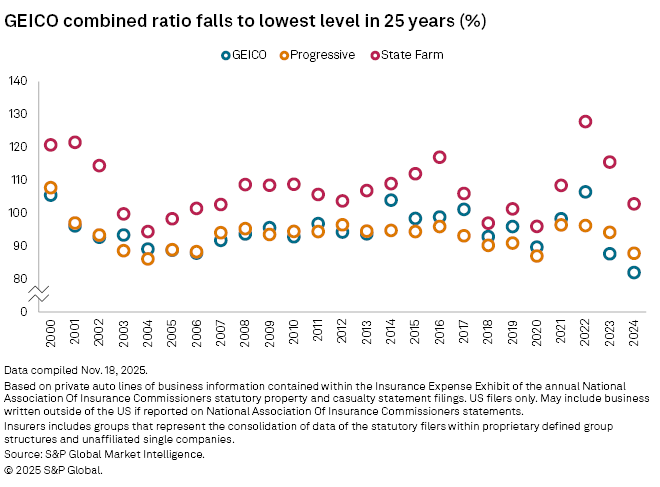

While GEICO may have lagged behind Progressive and State Farm in terms of growth and innovation during Combs' tenure, it was certainly effective at managing costs. GEICO was in the driver's seat in terms of profitability in 2024. Its combined ratio, a key measure of underwriting profitability, of 82.0% was its lowest in 25 years and better than State Farm's 102.85% and Progressive's 87.8%.

Zawacki said that Combs, through very disciplined expense management, brought GEICO back to underwriting profitability in the aftermath of the COVID-19 pandemic. However, the market is pivoting to a new phase.

"Being able to ... defend and grow the book of business will be a key priority for 2026 and beyond," Zawacki added.