Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Dec, 2025

|

The Berkshire Hathaway logo on a screen at the New York Stock Exchange during trading on Aug. 6, 2024. Warren Buffett will step down as the company's CEO at the end of 2025 but will remain chairman |

While the banking and technology sectors have long topped Berkshire Hathaway Inc.'s investment portfolio, this year saw financial services accounting for the largest share of the conglomerate's investment dollars.

Berkshire's investments in financial services — excluding banks and insurance companies — passed the information technology sector during the

In terms of individual companies in the sector, American Express Co. ($50.36 billion) was the largest holding, followed by Moody's Corp. ($11.76 billion), Visa Inc. ($2.83 billion), Mastercard Inc. ($2.27 billion), Capital One Financial Corp. ($1.52 billion), Ally Financial Inc. ($1.14 billion) and Jefferies Financial Group Inc. ($28.4 million).

As longtime CEO Warren Buffett prepares to hand the reins over to Greg Abel in 2026, the conglomerate's investment strategy is not expected to see a marked revision in the short term.

"Overall, the investment philosophy is not really going to change going forward, given that he is a homegrown ... CEO," Kevin Heal, an analyst at Argus Research, said in an interview.

Banking on it

The US banking industry has featured prominently in Berkshire's portfolio over the years, ranking as the largest industry the company invested in during two separate periods: the third quarter of 2012 through the second quarter of 2015, and again between the third quarter of 2017 and the third quarter of 2019.

The first stint was dominated by the sizable stake in Wells Fargo & Co. Berkshire further strengthened its position within Wells Fargo over two years from the second quarter of 2011, adding roughly 120 million shares to its already sizable position. The additional shares and rising stock price for Wells Fargo made it the largest holding for Berkshire during much of that period.

The banking industry was briefly surpassed by the food and beverage sector in 2015 when Berkshire's stake in the newly formed The Kraft Heinz Co. jumped to 325.4 million shares, or about 27% of the new company. At the end of the third quarter of 2015, that position was valued at approximately $23 billion.

Berkshire's large purchase of 679 million shares of Bank of America Corp. during the third quarter of 2017, valued at $17.21 billion at the end of that quarter, moved the banking sector back to the top for two years.

The conglomerate has exited most of its banking holdings over the past several years and has been trimming its position in Bank of America. The Charlotte-based bank was the lone banking company in Berkshire's portfolio at the end of the third quarter of 2025.

Technology

The banking industry was surpassed by its investment in information technology companies, namely Apple Inc., in the fourth quarter of 2019. Berkshire also held about 13 million shares of VeriSign Inc., valued at $2.50 billion at the end of 2019.

Berkshire's initial purchase of Apple occurred during the first quarter of 2016 and was valued at $1.07 billion at the end of the period. At the end of the fourth quarter of 2017, Apple became Berkshire's largest holding, a title it has held since.

The value of Berkshire's Apple holdings grew steadily, peaking at $177.59 billion at the end of the second quarter of 2023, accounting for roughly 51% of the company's entire reported investment portfolio. Berkshire has since been reducing its position in Apple, offloading about 789 million shares of Apple since the start of 2024, bringing its position to 238 million shares valued at $60.66 billion as of Sept. 30, 2025.

Hold forever

Warren Buffett's formula for successful investing favors a long-term outlook; the fabled Berkshire leader is known for saying his "favorite holding period is forever."

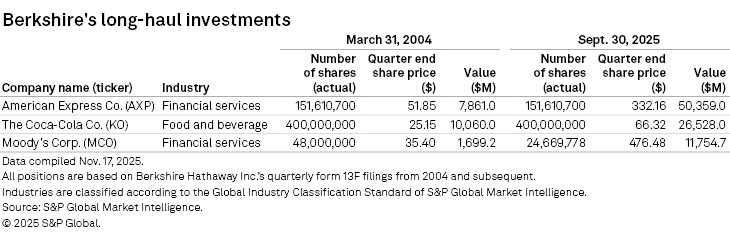

A review of Form 13F filings disclosures maintained within S&P Global Market Intelligence's database shows that American Express, The Coca-Cola Co. and Moody's have been ever-present for Berkshire since the first quarter of 2004. The multinational conglomerate's investments in Coca-Cola and American Express date back to at least 1995, while it has maintained its position in Moody's since it was spun off from Dun & Bradstreet Holdings Inc. at the end of the third quarter of 2000.

The American Express stake has seen the largest upside, growing to a value of $50.36 billion at the end of the third quarter of 2025, compared to $7.86 billion on March 31, 2004. Not only has the investment appreciated, but Berkshire has also collected about $4.16 billion in dividend payments since the start of 2004.

However, total dividends paid and received on its American Express holdings pale in comparison to the more than $9 billion collected from Coca-Cola during the same period. Berkshire Hathaway's position in Coca-Cola was valued at $26.5 billion on Sept. 30, 2025, compared to $10.1 billion as of March 31, 2004.

Among the group of three, only Moody's has seen its position in Berkshire's portfolio cut since 2004. For this analysis, the initial number of Moody's shares was 48 million. That figure now stands at roughly 25 million. The bulk of the sales, 19.5 million, occurred between the third quarter of 2009 and the fourth quarter of 2010. Berkshire's position in Moody's was valued at $11.75 billion on Sept. 30, 2025.

Cutting bait

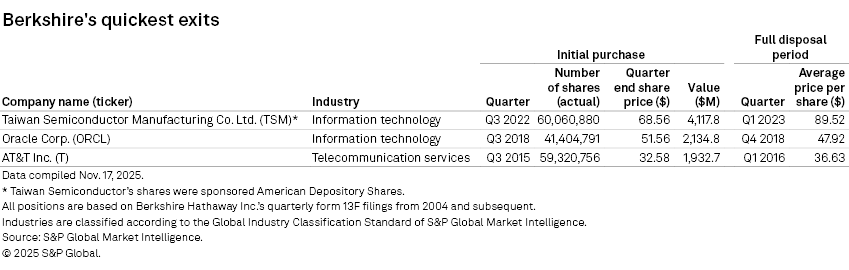

While Buffett's formula for success has been to buy and hold positions long term, he has not stuck with every big bet. In the past 10 years, there have been three instances where Berkshire made billion-dollar-plus investments, only to exit them completely within a quarter or two.

Berkshire made a $4.12 billion entrance into Taiwan Semiconductor Manufacturing Co. Ltd. during the third quarter of 2022. However, the conglomerate slashed its stake the next quarter and completely exited its position during the first quarter of 2023.

Oracle Corp. saw Berkshire buy $2.13 billion of its stock in the third quarter of 2018, only to exit its position during the following quarter. Berkshire's foray into AT&T Inc. lasted only a few months, moving in during the third quarter of 2015 and liquidating its position by the time it filed its Form 13F during the first quarter of 2016.

Entire industries have fallen completely out of Buffett's favor. For example, starting at the end of 2016, Berkshire made a bet in the transportation or airline industry, taking at least a $2 billion stake each in Delta Air Lines Inc., Southwest Airlines Co., United Airlines Holdings Inc. and American Airlines Group Inc. Upon the onset of the COVID-19 pandemic at the start of 2020, the company fully exited its position within each airline during the second quarter of that year. Berkshire has not invested in any airline since.

Berkshire also made some sizable investments in several pharmaceutical or biotechnology companies during the third quarter of 2020, only to essentially reverse course a year later.

Methodology

This analysis is based on the equivalent number of shares reported in each respective quarterly Form 13F filing submitted by Berkshire Hathaway Inc., multiplied by the company's stock price at the end of the quarter. The number of shares has been adjusted to account for any stock splits a company performed and may not match the number of shares reported in Berkshire's quarterly filing.