Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Dec, 2025

By Tyler Hammel and Jason Woleben

|

|

Trying to second-guess Warren Buffett's M&A and investment intentions has been a perennial pastime in the financial world.

As the Berkshire Hathaway Inc. CEO prepares to step down from his executive role, analysts and investors are searching for clues on what the company's merger and acquisition strategy will be under incoming new chief Greg Abel. The difficulty in making any predictions about the future stems from Buffett's eclectic palette when it comes to deal-making.

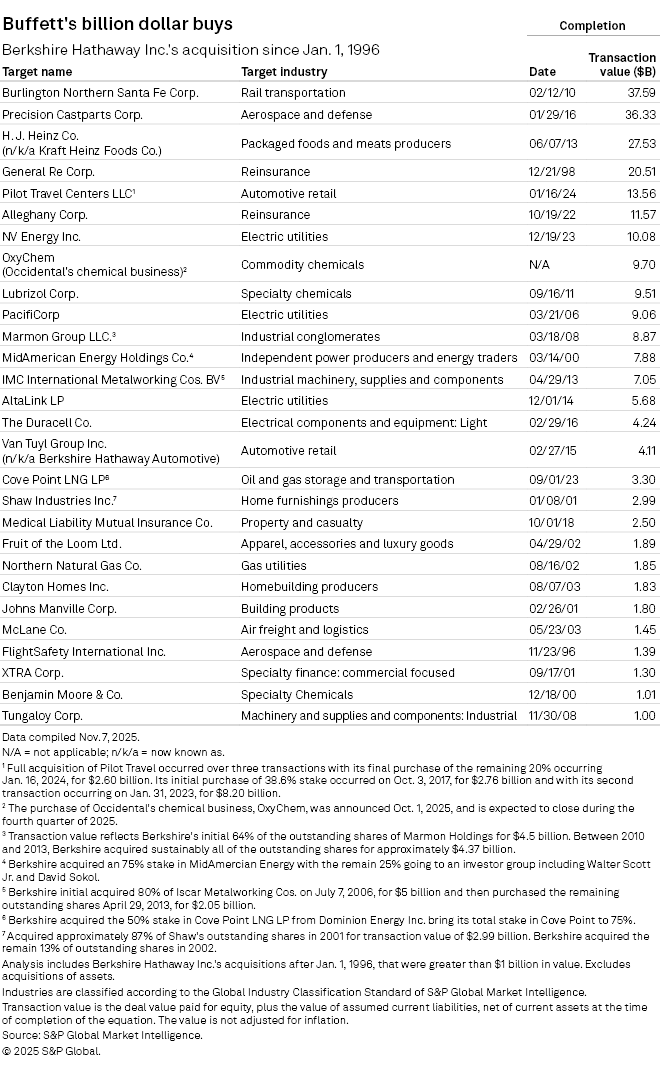

Since 1996, Berkshire has made 28 acquisitions with a transaction value exceeding $1 billion across a range of industries from reinsurance and packaged foods to rail transportation and specialty chemicals.

Drawing any sort of pattern can be difficult, according to CFRA analyst Cathy Seifert.

"Investors may wonder if Greg Abel tightens the focus a little and shifts the acquisition strategy to one that focuses on getting some economies of scale, as opposed to just buying up random businesses that drop on their doorstep," Seifert said in an interview.

Buffett has led Berkshire since 1970. Per the company's website, its acquisition strategy is guided by six criteria: large purchase size, demonstrated consistent earning power, whether a business is earning good returns on equity while employing little or no debt, good management in place, if there is an offering price, and if the business is simple.

"The larger the company, the greater will be our interest: We would like to make an acquisition in the $5-20 billion range," the website says.

In Buffett's final year, Berkshire's acquisitions have remained varied, with the largest reported deal value being the announced acquisition of chemical company Occidental Chemical Corp. in October for $9.7 billion. Other big-ticket deals included targeting fertilizers and agricultural chemicals company Neosyad and apparel, accessories and luxury goods company Olympic Manufacturing.

"Berkshire has used a specific strategy for a long time, but I think the one thing to pay attention to is the degree to which the acquisition strategy becomes more precise and more active," Seifert said.

Cash-in-hand, buying back shares?

Buffett will be leaving behind a mountain of amount of cash equivalents and short-term investments in US Treasurys, according to an analysis by S&P Global Market Intelligence.

By the end of the third quarter, Berkshire had about $77 billion in cash on hand and $305.4 billion in short-term investments in US Treasurys, representing about 10.9% and 43.1% of the company's investments, respectively.

Seifert does not expect a significant shift in M&A strategy but does see a possibility of louder calls from Berkshire's investor base to pay out cash dividends or alter its buyback policy.

"Pressure to pay a cash dividend may increase, but I also think that it may prompt a call to perhaps alter slightly their share buyback methodology," Seifert said. "[Set] aside X amount of money for share buybacks and then be opportunistic within the purchases within that allotment, as opposed to Berkshire's current system, which is buying back shares when its chairman believes they are undervalued."

Pulling the trigger

This large amount of cash Berkshire is sitting on, referred to by Buffett himself as his elephant gun, could be used for an opportunistic purchase of a larger company experiencing unexpected problems, according to Argus senior analyst Kevin Heal, pointing to Berkshire's recent investments in UnitedHealth Group Inc.

"Buffett has said before that if they buy a small company, it's not going to move the needle anymore," Heal said.

Berkshire's 2025 M&A has been opportunistic as well, Heal said, notably the acquisition of Occidental Petroleum's chemical business, OxyChem.

"It's not that it was a bad business, it was just that they like to come in on an M&A when stuff gets cheaper or they think they can do a better job of running the business," Heal said. "So unless there's some kind of catastrophe, I doubt there's gonna be any huge M&A, but I think that there'll be opportunities to scoop up a company that is within their business model."

As Buffett readies to step back, all eyes will be on his successor and when he decides to commit to his first big deal.