Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Dec, 2025

By Brian Scheid

Bubble fears and a potentially hawkish Federal Reserve are threatening to spoil Wall Street's dreams of a holiday season rally this December.

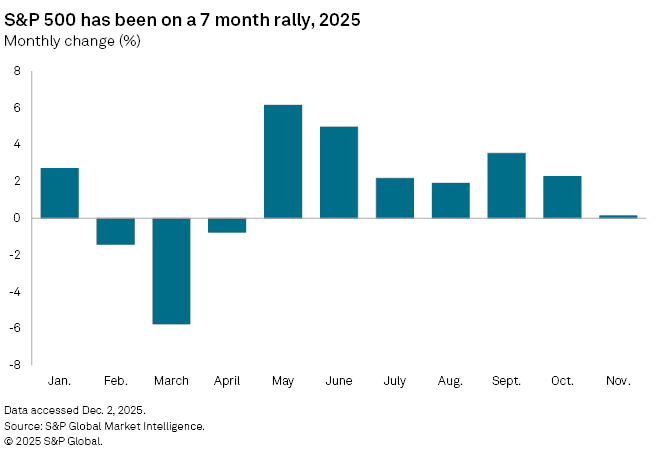

US equities have a tendency to rise from Thanksgiving into the New Year. The S&P 500, for example, has made gains in four of the past six years from the day over that time frame, according to S&P Global Market Intelligence data. This year, however, uncertainty across the economy could cause a seven-month stock market rally to sputter.

Financial market strategists believe that a continuation of the rally in US equities depends on a number of factors, particularly how much the Fed plans to cut interest rates, whether the ongoing surge in artificial intelligence stocks can persist, and what new government jobs and inflation data reveal in coming weeks.

"The stock market has powerful momentum coming into a seasonably favorable time of the year, and that bodes well for December," said Sonu Varghese, global macro strategist with Carson Group Inc.

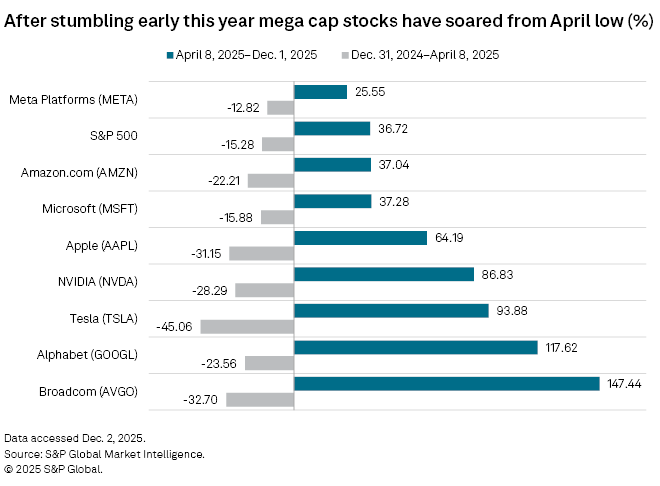

After stumbling for much of the spring, the S&P 500 rose for seven straight months. In the 16 seven-month win streaks since 1950, the eighth month has followed with an average return of 0.7%, according to Varghese's analysis.

The consensus among investors is for stocks to continue to drift higher into the end of 2025, despite rising recession risks and widening cracks in corporate credit markets, said Tyler Richey, a co-editor with Sevens Report Research.

Investors increasingly believe that a soft economic landing into 2026 is likely with the labor market remaining resilient, inflation soon to cool, and enthusiasm and revenue growth expectations surrounding AI fueling a "risk on" sentiment in the stock market, Richey said. But they may be underpricing many of these risks, and bullish momentum may be slowing.

"I continue to see markets as one materially negative catalyst away from a cyclical bear market taking shape," Richey said. "But again, the market resilience in 2025 makes it very difficult to establish an expected timeline for such a market downturn to play out."

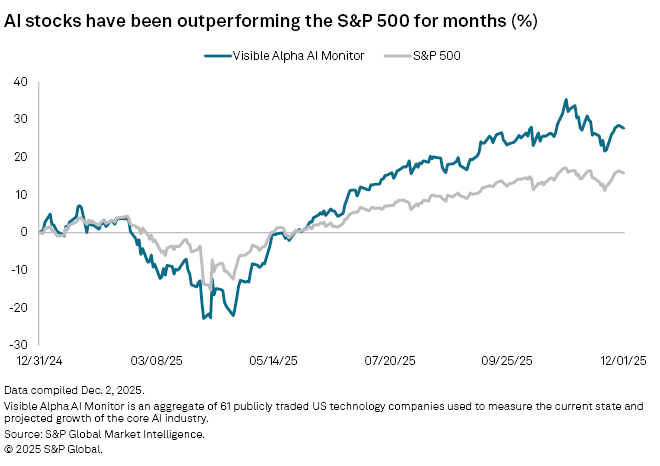

Much of the rally's potential hinges on the viability of AI, which has largely fueled the market's gains this year and has triggered comparisons to the dot-com bubble of the early 2000s.

"I think the AI bubble is real and a challenge," said Michael O'Rourke, chief market strategist with JonesTrading.

The sector will likely face additional scrutiny from investors, he added.

"While there has been a minor pullback, the recent move is more reflective of rotation," O'Rourke said. "Google's emergence as a potential AI chip could prove disruptive by driving chip prices lower."

The AI trade "still has legs," said Varghese with Carson Group, as mega-cap tech companies continue to boost spending in the sector, but much of this trend is being driven by individual companies, and there is a lot of idiosyncratic risk and volatility at play.

"We think being diversified here is key, even while riding the AI wave," Varghese said.

Rate cuts

A potential December rally could depend on the Fed's meeting next week. Central bank officials are expected to lower interest rates by 25 basis points, its third such cut this year, and release quarterly projections signaling expectations for rates in 2026 and over the long term.

"The market is expecting [a 25-bps cut] now and several more next year," said Paul Schatz, founder and president of Heritage Capital. "Not cutting now or cutting and pausing will hurt stocks, at least temporarily, although the economy continues to surprise to the upside."

The impact that the Fed's next move has on the market will depend on how it is interpreted, Richey said. The rally could sputter if investors see the Fed not doing enough to cool inflation or bolster the labor market, Richey said. If the central bank is seen as making both inflation and the jobs market worse, that would be a "worst case scenario" and could trigger a stretch of economic stagflation, Richey said.

A lot depends on monthly inflation and jobs data, delayed by the government shutdown, which could feed into fears of a recession and even boost the odds of rate hikes if inflation accelerates beyond expectations, Richey said.

"With markets being forward-looking, such a development could turn risk-assets lower well before evidence of an economic downturn shows up in the data," Richey said.