Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Dec, 2025

By Karl Angelo Vidal and Ronamil Portes

This Data Dispatch is updated monthly. The analysis includes publicly traded real estate investment trusts covered by S&P Global Market Intelligence that are based in the US or Canada and trade on the NYSE, Nasdaq, NYSE American, Toronto Stock Exchange or TSX Venture Exchange.

Four US real estate investment trusts increased their dividends in November, according to S&P Global Market Intelligence data.

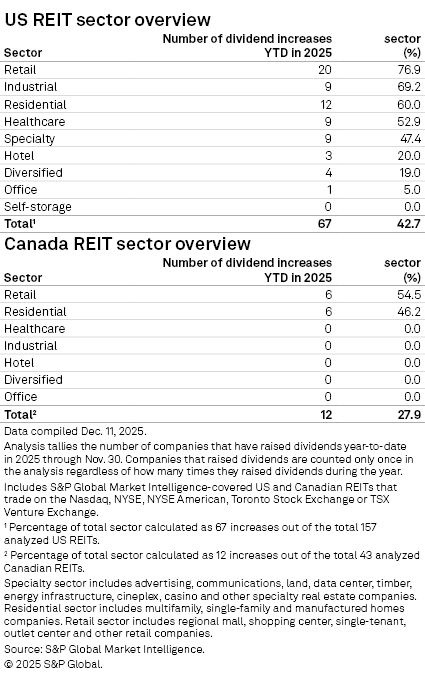

The dividend hikes in November brought the number of public US REITs that have declared regular dividend increases so far in 2025 to 67 companies, representing 43% of the REIT industry.

Medical Properties Trust Inc. declared a quarterly dividend of 9 cents per share, reflecting a 12.5% increase from its previous payout.

Single-tenant REIT Four Corners Property Trust raised its quarterly dividend to 36.65 cents per share, up 3.2% from its prior payout.

Storage and information management REIT Iron Mountain Inc. and regional mall REIT Simon Property Group Inc. also raised their quarterly dividends to 86.4 cents and $2.20 per share, respectively.

In Canada, multifamily REITs Minto Apartment Real Estate Investment Trust and Morguard North American Residential REIT raised their monthly dividends to 4.46 Canadian cents and 6.58 Canadian cents per share, respectively.

– For further dividend analysis, try S&P Global Market Intelligence's REIT Dividends template.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

Dividend increases by sector

Of the 67 US public REITs that declared higher dividend payouts so far in 2025, 20 are retail REITs, representing 77% of the subsector.

Nine industrial REITs also announced an increase in dividend payments, accounting for 69% of the subsector.

Twelve Canadian REITs, or 28% of the total, have increased their regular payouts year to date.