Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Nov, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

The scale of private equity and venture capital investment in India's space technology sector currently trails that of China.

Three China-based space tech companies raised over $330 million each in funding rounds in 2025 through mid-November, according to S&P Global Market Intelligence data. That is more than the total venture capital- and private equity-backed investment in India's space tech sector since 2022.

India, however, aims to boost private space tech investment with the launch of a new $112.2 million venture capital fund managed by an autonomous government agency. It has also loosened regulations on foreign investors in recent years, clearing a path for global venture capital firms to take a larger role in backing its emerging space tech sector.

The situation is very different in China, where geopolitical and trade tensions with the US have slowed the flow of capital from foreign investors.

Read more about private equity and venture capital space tech investments in India and China.

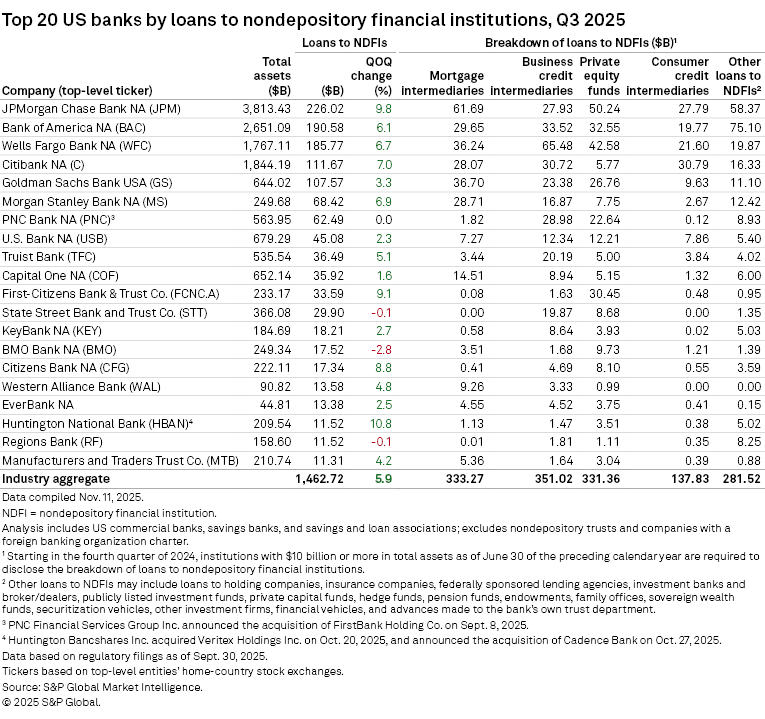

CHART OF THE WEEK: US banks boost loans to private equity

⮞ US bank loans to private equity funds increased to $331.36 billion in the third quarter, up 9.6% from the second quarter, according to a Market Intelligence analysis of federal regulatory filings.

⮞ Loans to nondepository financial institutions (NDFIs) — a broader category that includes mortgage, business credit and consumer credit intermediaries in addition to private equity funds — rose 5.9% quarter over quarter to $1.463 trillion in the third quarter.

⮞ Bank losses tied to NDFI loan exposures have prompted greater scrutiny of NDFI lending data, which US banks have been required to report since the fourth quarter of 2024.

TOP DEALS

– Smith Ventures LLC is buying the nonbank assets and operations of financial technology platform Green Dot Corp. from CommerceOne Financial Corp. for $690 million in an all-cash deal set to close in the second quarter of 2026. Stephens Inc. is financial adviser to Smith Ventures, while and King & Spalding LLP is legal adviser. Citi is the financial adviser and Wachtell Lipton Rosen & Katz is the legal adviser of Green Dot. Sullivan & Cromwell LLP is legal counsel to CommerceOne.

– KKR & Co. Inc. and Public Sector Pension Investment Board invested in Lighthouse Learning Pvt. Ltd., an Indian education service provider. KKR made the investment from its KKR Asian Fund IV and other managed capital.

– EQT AB (publ) is set to transfer control of French nursing home company Colisée Group SAS to creditors, including Blackstone Inc. and KKR, due to the company's heavy debt load, London's Financial Times reported. The creditors will inject over €250 million in new debt into Colisée to eliminate a third of its €1.8 billion of existing debt and take full equity control of the company. EQT's own offer to recapitalize Colisée with €250 million of equity was rejected by creditors earlier this year, according to the report.

TOP FUNDRAISING

– Unigestion Asset Management held a final close for Unigestion Secondary VI, reaching its hard cap of €1.7 billion. USEC VI has already deployed capital, completing 22 secondary investments to date. The fund strategy comprises limited partner stakes, general partner-led transactions and direct secondaries.

– The Carlyle Group Inc. plans to raise roughly $300 million for the CAP VI India fund. The vehicle seeks to invest in large-cap and upper middle-market companies in India. The International Finance Corp. will invest up to $60 million in the vehicle.

– Future Standard raised more than $200 million for its FS Mid Market Private Equity Fund. The new semi-liquid strategy focuses on secondaries, coinvestments and primary investments in US and European midmarket companies.

– August Global Partners Pte. Ltd. raised $150 million for AGP Healthcare Fund. The vehicle invests in companies specializing in precision medicine innovation, AI-powered health technologies and patient-centric care.

MIDDLE-MARKET HIGHLIGHTS

– Courizon Partners LLC acquired waste management technology company Air Burners Inc. Pillsbury Winthrop Shaw Pittman LLP and Paul Weiss Rifkind Wharton & Garrison LLP were legal advisers to Courizon on the deal, and D.A. Davidson & Co. was financial adviser.

– Sullivan Street Partners Ltd. sold UK-based civil engineering company Octavius Infrastructure Ltd. in a deal with RSK Group Ltd. Sullivan Street carved out the company from Geoffrey Osborne in 2021. Alvarez & Marsal was financial adviser to Sullivan Street on the transaction, while Taylor Wessing was legal counsel.

– An H.I.G. Capital LLC affiliate reached a deal to sell Italian IT company Project Informatica SRL to EMK Capital LLP. Project Informatica's management and H.I.G. will reinvest in the company alongside EMK. The deal is subject to regulatory approval.

FOCUS ON: SOUTH KOREAN PRIVATE EQUITY SELF-REGULATION

South Korean private equity group Korea PEF Association is working on a new code of conduct that would serve as self-regulation among its members, Bloomberg News reported.

Seoul-based private equity firm MBK Partners received public backlash over its management of supermarket chain Homeplus Co. Ltd., which filed for court receivership in early 2025.

Private equity- and venture capital-backed investments in South Korea totaled $3.84 billion in the first 10 months of 2025, less than one-third of $11.75 billion for full year 2024, according to Market Intelligence data.

The number of deals totaled 359, versus 579 deals for full year 2024.

______________________________________________

For further private equity deals, read our latest "In Play" report , which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter