Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Nov, 2025

By Brian Scheid

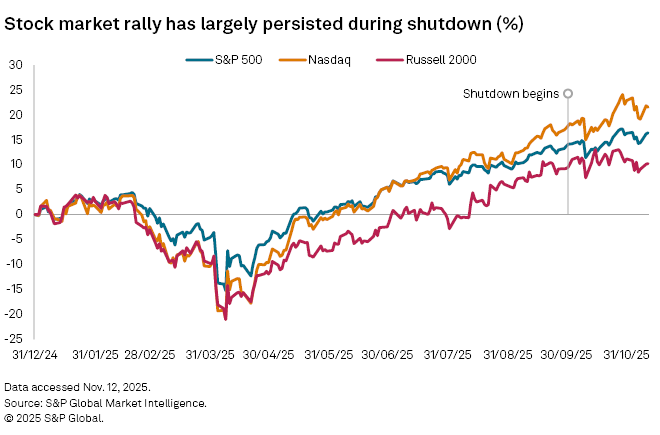

The US stock market continued its monthslong rally this fall amid the longest US government shutdown in American history, even as federal workers lost pay, food benefits recipients missed payments, and staffing shortages snarled air traffic.

The S&P 500, which had rallied more than 34.2% between a recent trough on April 8 and the start of the shutdown on Oct. 1, added nearly another 2.4% between Oct. 1 and Nov. 11. The tech-heavy Nasdaq, which had climbed more than 48.4% between April 8 and Oct. 1, added about 3.6% between Oct. 1 and Nov. 11. The small-cap Russell 2000, which had jumped nearly 38.4% in the pre-shutdown rally, added 0.9% between Oct. 1 and Nov. 11.

The government impasse appeared close to a resolution on Nov. 12, when the US House of Representatives was expected to vote on a funding package that had earlier passed the Senate.

"As it so often does, the stock market anticipated the reopening of the US government in advance, reversing higher on Friday and extending to near record highs so far this week," said Matt Weller, global head of market research with StoneX and FOREX.com.

Weller said the biggest impact of the federal government reopening will be the release of economic data, including inflation and jobs figures, which could influence the Federal Reserve's rate-cut decisions at its December meeting and, in turn, impact the direction of the AI-driven rally in stocks.

While the market's historic bull run has slowed since the start of the government shutdown, market strategists said the shutdown itself is likely not the cause.

"I'm not sure the shutdown is having a direct impact on the economy or the market right now," said Sonu Varghese, a global macro strategist with Carson Wealth Management Group.

Rather, the slowdown in stock gains is largely due to expectations about the Federal Reserve's rate-cut plans, which have been scaled back as inflation remained persistently above the central bank's target, and ongoing weakness in the domestic labor market, Varghese said.

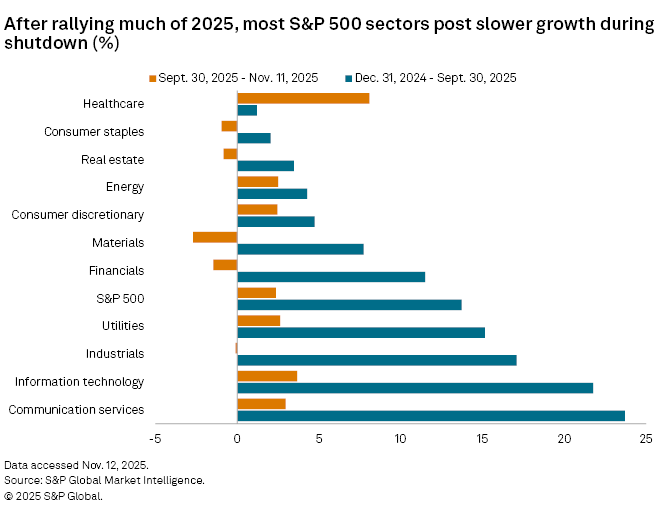

Most S&P 500 sectors continued to see gains during the shutdown, albeit at a slower pace than during the first nine months of the year.

Had the shutdown dragged on much longer, cyclical stocks, particularly consumer discretionary stocks, would have been hit the hardest due to the impact on aggregate income growth, which would have pulled down consumption at the margin, Varghese said.

Investors have historically brushed off government shutdowns as short-term noise, although the current impasse was starting to appear as a bit of an outlier due to its historic length, said Bret Kenwell, a US investment and options analyst at eToro.

The shutdown was never a top concern for the stock market, which is facing a growing list of potential headwinds, Kenwell said.

"Uncertainty is increasing across the board right now, whether that's around tariff policy, the labor market, the Fed's interest rate policy, or the government shutdown," Kenwell said. "This combination is weighing on consumer confidence and doing so as we head toward the all-important holiday season. Throw in corporate commentary on how lower-income consumers are struggling right now, alongside valuation concerns for stocks, and there are multiple reasons to justify this market dip."

The stock market may continue to see some additional weakness as AI stocks see a "healthy and expected pullback" from all-time highs, said Paul Schatz, president of Heritage Capital.

"The bull market isn't over," Schatz said. "More new highs are coming, but cracks have developed beneath the surface, and that's a story for 2026."