Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Nov, 2025

By Ben Dyson

|

The Prudential Regulation Authority, part of the Bank of England, is exploring whether insurers need to hold more capital for funded reinsurance. |

UK life insurers face losing a mainstay of their risk management toolkit in the latest push to regulate its use.

The UK Prudential Regulation Authority (PRA) is considering imposing higher capital requirements for funded reinsurance, which UK life insurers use to support their underwriting of pension risk transfer business, a big source of growth in recent years. The regulator is hosting a series of roundtables with insurers to explore whether new rules are needed.

In a Sept. 18 speech setting out the plans, PRA director for prudential policy Vicky White said the regulator was not aiming to prohibit the use of funded reinsurance as "a modest part" of insurers' overall funding strategy. She also acknowledged some use of funded reinsurance can provide a "valuable source of patient loss-absorbing capital" as well as access to assets that would otherwise be difficult to source.

But, in a worst-case scenario, the new rules could act like a ban. While noting there is a range of potential outcomes, "it is possible that the capital changes that... [the regulators] make would have the same effect... that it just no longer makes sense for insurers to do it," Gavin Smith, a principal in the pensions actuarial and risk transfer teams at consulting firm Lane Clark & Peacock LLP (LCP), said in an interview.

A new twist

White's speech is the latest in a line of increasingly urgent-sounding messages about the dangers of overusing funded reinsurance. The PRA first made its concerns known in 2022.

The regulator's concerns have been mounting because of the rapid growth of UK pension risk transfer business, known locally as bulk purchase annuities (BPA), in recent years as more defined benefit pension schemes have become suitable for insurance thanks to higher interest rates. Under the deals, insurers take on responsibility for paying the schemes' pensioners, either by providing a policy to the scheme that covers payments to some or all of its pensioners, known as a buy-in, or assuming the scheme's assets and liabilities and issuing policies to the pensioners directly, known as a buy-out.

Use of funded reinsurance, which transfers both assets and liabilities to a reinsurer — typically based in an offshore center such as Bermuda — varies among the nine insurers active in the UK pension risk transfer market. Some, such as Rothesay Life PLC, do not use it at all. Overall, use is thought to be between 10% and 20% of business written.

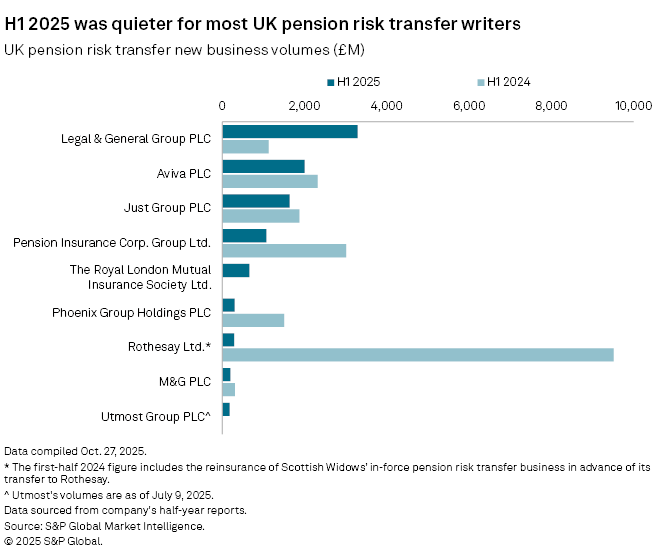

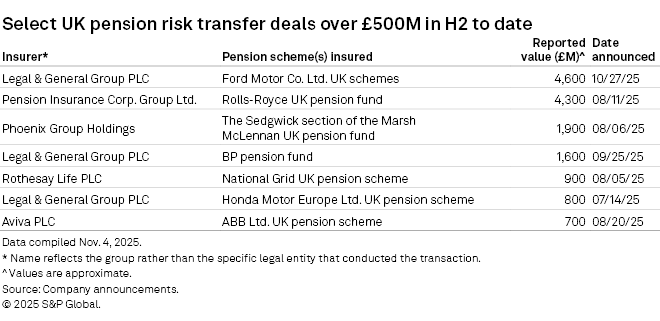

Insurers wrote £47.8 billion of UK pension risk transfer business in 2024, after writing £49.1 billion in 2023, according to figures from consultancy Hymans Robertson LLP. Most insurers had a quieter first half of 2025 than in the previous year, but they have made positive statements about their pipeline for the second half. Several deals worth more than £1 billion have been announced in the second half to date, including Legal & General Group PLC's £4.6 billion buy-in of Ford's UK pension schemes and £1.6 billion buy-in of BP's pension fund, and Pension Insurance Corp. Group Ltd (PIC)'s £4.3 billion buy-in of Rolls-Royce's pension scheme.

But while the regulator's previous efforts have focused on ensuring that insurers are managing counterparty risk appropriately and are prepared to take back the ceded assets and liabilities if a reinsurer should fail, the latest intervention is more concerned with whether the UK's insurance capital regime, Solvency UK, is too lenient on funded reinsurance.

Funded reinsurance is a combination of reinsurance and a funding element. The insurer pays a large upfront premium to the reinsurer, which then invests this in a portfolio of assets. The reinsurer uses the proceeds from these assets to pay the insurer to cover any pension obligations.

The PRA argues that insurers can get a similar outcome to funded reinsurance by buying longevity reinsurance, commonly used by life insurers to cover the risk of policyholders living longer than expected, and using proceeds from a collateralized loan it has issued as the funding element. However it says that under this arrangement, the loan would require additional regulatory capital under Solvency UK to account for its risk, but the funding portion of funded reinsurance is essentially treated as risk free by the solvency regime because it is labelled as reinsurance.

In the roundtables, the regulator is exploring with insurers whether it is possible to "unbundle" the two elements of funded reinsurance — that is, valuing them separately on an insurer's balance sheet.

The effect of any new rules will hinge on the amount of additional capital the PRA decides that funded reinsurance needs. Because insurers use funded reinsurance in part to provide capital relief, the greater the capital charge, the less attractive it will be. "It very much depends on whether you're talking about a marginal impact to capital or a significant step change as to whether that will change behavior and change the attractiveness of funded reinsurance as a transaction that they might look to do," Lara Desay, head of the risk transfer solutions team at consulting firm Hymans Robertson, said in an interview.

'Broadside attack'

Insurers broadly welcomed the PRA's previous risk management-focused interventions on funded reinsurance. They have said little publicly so far about White's speech. The selection of pension risk transfer writers contacted by Market Intelligence either declined to comment or did not respond to a request for comment. The Association of British Insurers, UK insurers' trade body, also declined to comment.

There are signs, however, that the industry is less happy with this most recent twist. Some in the market have characterized it as "a broadside attack on reinsurance as a tool," Colin Dutkiewicz, senior director in broker Willis Towers Watson PLC's insurance consulting and technology division, said in an interview.

Some providers of funded reinsurance have criticized the efforts to curtail the product's use. "At a time when the UK pensions market needs investment, it is counterproductive to be restricting reinsurance, a tool which has traditionally been used to manage and diversify risk while bringing capital to the insurance market," Emma Ferris, senior managing director for UK and Ireland at US-based reinsurer Reinsurance Group of America, Incorporated, said in an emailed statement.

The unbundling proposal in particular is thought to be a contentious point. "My sense is that they view the funded reinsurance as a reinsurance contract, and so think that the capital treatment should be akin to a reinsurance contract, and actually aren't clear on how you could separate out the risks and treat them separately from a capital perspective on a very technical basis as well," Desay said.

Insurers will get the opportunity to make their concerns known, either when answering the PRA's questions at the roundtables, or during the consultation that would be required when making changes to Solvency UK.

They could also take some comfort from the regulator's willingness to consult with them. "It is actually encouraging to see the PRA continue to engage so openly with the industry," Wei Hou, head of life and health for the UK and Ireland at Gallagher Re, said in an interview, adding that this may not be the case in other markets.

However, those hoping for a complete reversal of the current situation are likely to be disappointed. "I'm not quite clear on what the resulting option could be, but I don't think the status quo will remain," Desay said.

The PRA is engaging with insurers in "a genuinely collaborative nature," according to Smith, but he added that regulators "need to see some very strong arguments that they haven't already heard to not make any changes at all from here."

Desay does not expect the roundtables to reach a conclusion on the way forward. "I feel like there will be a consultation in Q1 next year, which I understand would be the next step around what those capital proposals should or shouldn't be," she said.

Looking elsewhere

Even if insurers lost the use of funded reinsurance, the UK pension risk transfer market should withstand the blow. The reinsurance, while useful, is not essential for the market's operation. The loss "would slow down the BPA market. It might make prices a little bit more expensive. But it wouldn't stop happening what's going to happen. So it's not cataclysmic for the industry," Dutkiewicz said.

The market can get by without the additional capital funded reinsurance provides. Supply of insurance capital "still comfortably outweighs demand," for pension risk transfer deals, according to LCP's Smith. "If some of that supply gets drawn back a little bit, and it would just be a little bit in terms of the overall proportion, I don't think that would massively change that dynamic at all."

The access to assets funded reinsurance provides may be a bigger loss, as finding enough suitable assets to back pension liabilities is a persistent challenge for insurers. But insurers' own abilities to source assets are ramping up. Brookfield Wealth Solutions Ltd.'s pending acquisition of Just Group PLC and Athora Holding Ltd.'s planned purchase of PIC is expected to give the two target insurers access to their new parents' asset origination capabilities. Just Group will be able to tap Brookfield Wealth Solutions' sister company, Brookfield Asset Management Ltd., and PIC will be able to use the capabilities of global asset manager Apollo Global Management Inc., which part-owns Athora. Legal & General, which already has an in-house asset manager, entered a partnership with Blackstone Inc. in July that gives it access to the global asset manager's private credit origination platform.

"It's not like the insurers are sitting around just wanting to rely on funded reinsurance," Smith said.