Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Nov, 2025

By Yuzo Yamaguchi and Cheska Lozano

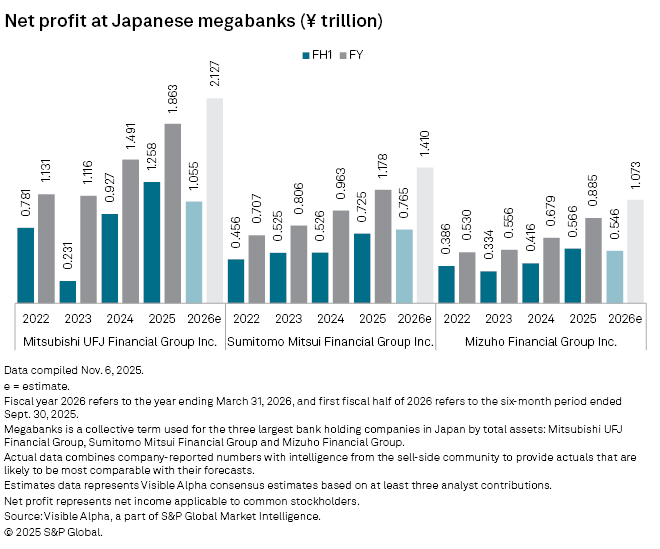

Two of Japan's three megabanks are likely to report a decline in their fiscal first-half 2025 earnings, mainly due to one-time gains in the same period of 2024. For the fiscal year ending March 2026, all three banks are expected to exceed their income targets amid rising interest rates.

Mitsubishi UFJ Financial Group Inc. (MUFG), the largest lender by assets, is forecast to report ¥1.055 trillion in net income for the fiscal first half on Nov. 14, a 16% decrease from a year earlier, according to analyst estimates from Visible Alpha. The expected earnings decline reflects the one-time gain from the sale of equity holdings in the previous year.

Mizuho Financial Group Inc.'s fiscal first-half earnings are likely to have declined by 3.5% year over year to ¥546 billion, according to analyst estimates from Visible Alpha, reflecting the previous year's reversal of its loan-loss provision. Sumitomo Mitsui Financial Group Inc. is forecast to report a 5.5% year-over-year increase in net income to ¥765 billion, supported by higher interest rates. Most Japanese companies follow an April-to-March fiscal year.

"It looks like MUFG forced itself to make higher profit last year," Toyoki Sameshima, a senior analyst at SBI Securities Co. "Mizuho's earnings may show a reaction to last year's reversal of its credit cost." Looking ahead, Sameshima expects all three megabanks to exceed their full-year earnings targets.

Rate hikes

Market expectations are rising that Japan will resume rate hikes. The Bank of Japan is expected to raise its policy rate by 25 basis points to 0.75%, possibly in December or January, before the end of the banks' current fiscal year on March 31, 2026. The central bank maintained its benchmark rate at 0.5% for the sixth consecutive meeting in October, after exiting its negative interest rate policy in 2024.

"[The megabanks] could get further momentum from rate hikes," said Tsuyoshi Ueno, senior economist at NLI Research Institute. "They could also get support from the yen's depreciation as they have exposure to overseas markets."

The yen's recent depreciation against the US dollar, driven partly by Japanese Prime Minister Sanae Takaichi's intention to embrace a loose fiscal policy, is expected to provide a tailwind for the lenders as they convert US dollars earned outside Japan into yen.

"The yen could remain at low levels given the government's push into loose fiscal and monetary policies and the uncertain prospects for US rate cuts," said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. "That would help banks perform better."

The three megabanks set their full-year earnings outlook based on the exchange rate of ¥140 earlier this year, compared with the current rate of about ¥154.

Full-year gain

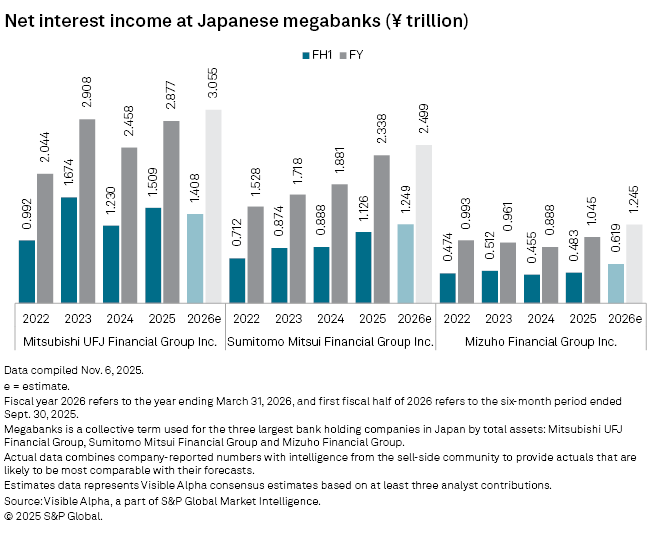

MUFG is estimated to earn ¥2.127 trillion in net income for the fiscal year ending March 2026, exceeding the bank's target of ¥2.0 trillion, according to analyst estimates from Visible Alpha. The stronger bottom line is supported by projected higher net interest income of ¥3.055 trillion, up 6.2% from the previous year, according to the data.

Sumitomo Mitsui Financial Group is forecast to generate ¥1.410 trillion in full-year net income, beating the bank's target of ¥1.3 trillion. Its net interest income for the 12 months is estimated to increase 6.9% year over year to ¥2.499 trillion. Mizuho's full-year earnings are projected at ¥1.073 trillion, above the bank's projection of ¥1.02 trillion. Its full-year net interest income is estimated to climb 19.1% year over year to ¥1.245 trillion.

As of Nov. 12, US$ was equivalent to ¥154.76.

Visible Alpha is a part of S&P Global Market Intelligence.