Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Nov, 2025

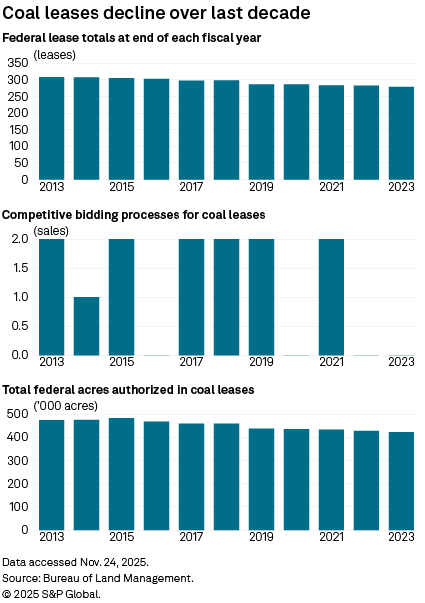

The Trump administration's efforts to revive federal coal leasing in the US stumbled this fall after three coal lease sales failed to attract acceptable bids, underscoring the limits of policy amid a decades-long decline in demand, industry experts said.

The US Interior Department outlined plans April 8 to end a coal-leasing moratorium to support President Donald Trump's efforts to revive the US coal sector. The Trump administration has implemented pro-coal policies, including boosting coal-fired power generation, opening public lands to mining and fast-tracking permitting.

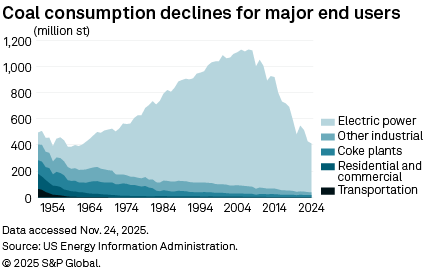

Rising power demand from data centers has helped lift coal power and given hope to coal producers, but not enough to inspire long-term investments in US coal reserves.

"The idea that there's demand out there, or that increasing the availability of new leases to the coal industry is going to turn it around, doesn't address the fundamental problem that there aren't customers," Seth Feaster, an energy data analyst at the Institute for Energy Economics and Financial Analysis, told Platts, part of S&P Global Energy.

Early excitement ends

The Bureau of Land Management held two successful thermal coal lease sales in September

But the next three thermal coal leases for western tracts failed to move forward.

The Bureau of Land Management rejected a $187,000 bid from Navajo Transitional Energy Co. LLC in October for land in Montana containing 167.5 million short tons of coal. The bid represented less than a penny per short ton of coal. The Interior Department told Platts that the bid did not meet requirements under the Mineral Leasing Act, which states that companies must pay fair market value for coal mined on public lands.

The agency received one bid, deemed insufficient, for the October sale of the Little Eccles tract in Utah, and postponed a sale in Wyoming later that month following another rejected bid.

"The fact that these three lease sales in the west failed is a very strong signal that there is not a lot of demand for new leases because there isn't a lot of demand for coal," Feaster said.

A spokesperson for the Interior Department said the weak bidding "underscored the lasting damage from the Obama-Biden administration's decades-long war on coal," but said the administration is "restoring trust between government and industry."

"As demand for reliable, dispatchable power grows, coal remains a critical component of ensuring affordable and dependable energy for the American people," the agency said.

The Interior Department has no future coal lease sales currently scheduled.

Coal's long decline

Coal power, the primary market for western thermal coal, declined 64.3% in 2024 compared to its peak in 2007, according to data from the US Energy Information Administration. The prospect of new demand from data centers is not expected to reverse the trend.

"The future for the thermal coal industry is very bleak and the companies seem to realize that," said Bob LeResche, a board member at the Powder River Basin Resource Council.

Coal's trajectory depends less on political shifts and more on electricity demand growth, which remains uncertain, said Ian Lange, an economics and business professor at the Colorado School of Mines.

"There could be speeches saying that coal is important and we need to have more of it, but that doesn't really matter until some some money changes hands," Lange said.

The Bureau of Land Management's National Environmental Policy Act Register shows no filings for the construction of new coal plants, and the administration recently used an emergency order to stop the retirement of the J.H. Campbell coal-fired power plant in Michigan.

"If you have to resort to emergency orders to keep coal plants open, it's a sign of the extreme the government has to go to in order to help the coal industry," Feaster said.

Coal leasing in the Powder River Basin, which produces more than 85% of the coal produced from federally leased lands, has been "largely stagnant" for more than a decade because of federal coal leasing moratoriums, said Matt Vincent, executive director of the Montana Mining Association.

But producers do not need more reserves, meaning companies do not need to obtain new coal leases, analysts said.

"No one has wanted a coal lease," LeResche said. "Basically, Trump got in and decided it would have been an exciting thing to have a coal lease and it would have helped the coal industry and the result was what you see — the real players in the coal industry said, 'No thanks, we're good.'"

US coal producers Core Natural Resources Inc. and Alliance Resource Partners LP did not respond to requests for comment on why they did not submit bids. Peabody Energy Corp. declined to comment.

The National Mining Association trade organization blamed the Biden administration's anti-coal policies.

"It's therefore no surprise that some of these initial sales reflect how challenging it has been for coal producers," said Ashley Burke, the association's senior vice president of communications. "But the fact that sales are restarting is a first step to encourage future, long-term investments in America and in American coal."

Met coal more favorable

At least one lease could be counted as a success for the administration: Alabama-based Warrior Met Coal Inc. secured a bid for a lease area in Alabama containing 53 million short tons of recoverable metallurgical coal, which is used for steelmaking. The company bid $46.8 million for 14,050 acres of federal mineral estate.

Met coal trades at higher prices than thermal coal and it has overseas customers, Feaster said.

"Thermal coal is much less competitive in terms of exports and most thermal coal is used in the United States," Feaster said. "The US market for thermal coal, which is almost entirely consumed by the power sector, is still in decline."

But one met coal lease does not reverse the trend.

"There have been some changes that tried to make coal more economical, but those other forces are just gigantic," said Josh Linn, a professor at the University of Maryland and a senior fellow at Resources for the Future, an environmental research nonprofit.