Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2025

By Nick Lazzaro

JPMorgan Chase Chairman and CEO Jamie Dimon speaks onstage during the America Business Forum on Nov. 6, 2025, in Miami. Following two high-profile bankruptcies in September, Dimon warned analysts during an October earnings call of further potential weaknesses in US credit markets. Jitters have since subsided amid ongoing resiliency in public credit markets. Source: Alexander Tamargo/Getty Images Entertainment via Getty Images. |

Robust US corporate credit markets have justified low high-yield credit spreads despite several bouts of volatility this year.

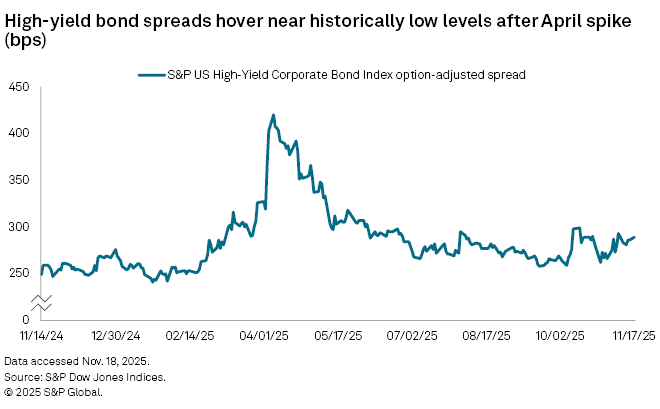

The option-adjusted spread of the S&P US High Yield Corporate Bond Index closed at 289 basis points on Nov. 17, according to S&P Dow Jones Indices data. The spread has traded within a range of 260 bps to 300 bps since early June, slightly above the 10-year low of 241 bps recorded in January. The index tracks corporate bond debt issued by speculative-grade companies with credit ratings below BBB-. Spreads measure risk premiums for bonds in relation to US Treasurys, with tighter spreads generally reflecting lower perceived bond risk and higher bond prices.

High-yield US corporate bond spreads have mostly returned to levels near January's low after spiking in April amid international trade tensions and global market turmoil. Debt markets faced renewed caution in September as regional banks highlighted potential systemic risks and fraud related to a handful of high-profile bankruptcies. Analysts characterized those bankruptcies as isolated events that are largely outweighed by solid underlying credit market fundamentals, although stretched bond valuations remain vulnerable to ongoing economic uncertainty.

"With the growing list of risks tilted to the negative, are bond markets too frothy? Based on our data, we don't believe so," Nick Kraemer, head of ratings performance analytics at S&P Global Ratings, said in an email.

Recent years of resilient economic growth and corporate earnings expansion have buoyed corporate bond demand and tight spreads, according to Kraemer. Defaults have also posed minimal risk.

"Defaults are slightly above their long-term average, but now roughly two-thirds of defaults are distressed exchanges, which carry higher recovery rates than traditional ones such as bankruptcies," Kraemer said. "If bond spreads reflect both default likelihood and loss given default, even a 'sticky' default rate can lead to tighter spreads if recoveries are greater."

Risk vulnerabilities

Given market conditions, high-yield corporate bond spreads appear fairly valued, but are unlikely to tighten further amid expectations for slowing global economic growth and weaker labor market conditions, according to Clayton Triick, head of portfolio management for public strategies at Angel Oak Capital Advisors. However, bond markets could be influenced by critical economic data once again being published following the recent end of the US government shutdown.

"This will start bringing back economic data, which will either show continued economic deceleration, or short-term support, both of which we think could create more near-term capital market volatility," Triick told Market Intelligence. "High-yield corporate spreads remain vulnerable at current levels."

With spreads still at historically tight levels, they are likely to be sensitive to headline risks in the coming months to the same degree as they were in April.

"Any negative surprise, whether macroeconomic or issuer-specific, can weigh heavily on spreads that are priced to perfection," Jay Menozzi, chief investment officer and senior portfolio manager at Easterly Orange, told Market Intelligence. "We call it negative spread convexity as, while spreads could slowly grind tighter, sharp and abrupt moves are most likely to happen in a widening scenario."

High-yield corporate bond spreads could also widen if persistently high inflation influences the US Federal Reserve to reconsider its current program of interest-rate cuts, which the market could perceive as a negative surprise, Menozzi said.

"We believe that, on a volatility-adjusted basis, high-yield corporates do not provide enough spread," Menozzi said.

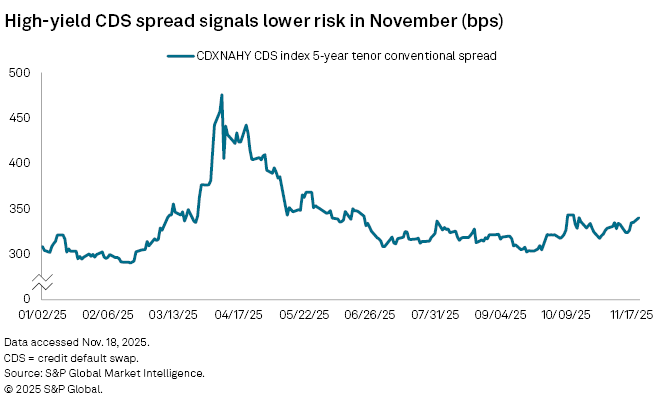

The spread for the CDX North American High Yield index has reflected a lower relative level of perceived risk in recent months, trading mostly within the range of 300 bps to 350 bps since June after climbing to over 450 bps in early April, according to Market Intelligence data. The index aggregates credit default swap pricing for a basket of debt issued by speculative-grade companies with credit ratings below BBB-.

Credit default swaps are instruments issued as protection against the default of a borrower, and their spreads offer another gauge of credit risk pricing, with wider spreads indicating a higher perceived risk of default.

Maturity wall concerns limited

Speculative-grade credit resiliency is expected to remain largely unaffected by upcoming bond maturities in the coming years due to diligent refinancing efforts and increasingly strong credit quality among speculative-grade debt.

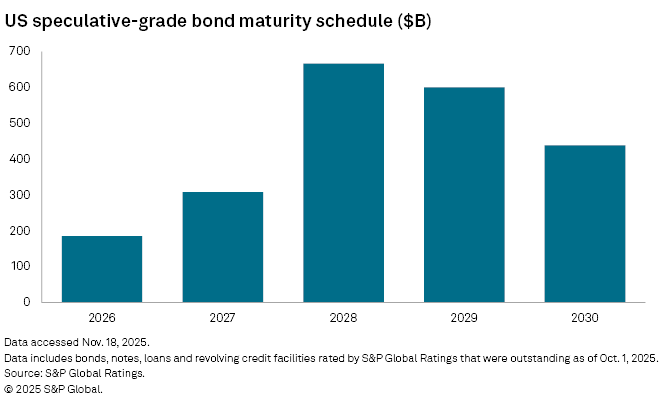

"The maturity wall in 2026 is immaterial and won't even come into play until 2028," Tim Leary, managing director and senior portfolio manager for the BlueBay Fixed Income team at RBC Global Asset Management, told Market Intelligence. "That said, we've seen recent new deals proactively refinancing their 2028 maturities. The maturity wall of worry is more of a stepping stone at this point."

Speculative debt maturities in the US are expected to peak at nearly $667 billion in 2028. Only $185 billion in debt is due in 2025.

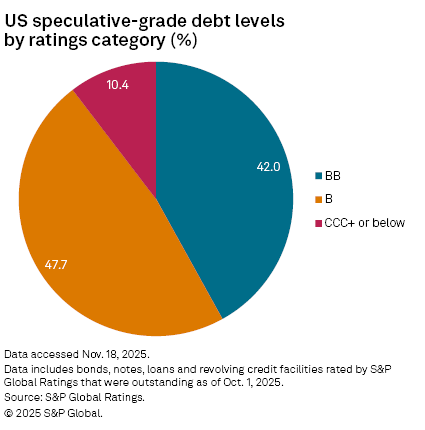

The US high-yield credit market is also mainly composed of companies in the higher BB and B credit rating spectrums, with only about 10% rated CCC and lower, according to S&P Global Ratings data as of Oct. 1. Low spreads have reflected both this stronger credit composition and the way in which companies have managed their debt issuance, Leary said.

"The vast majority of high-yield bond deals have been issued to repay debt as opposed to funding for leveraged buyouts or dividend deals," Leary said. "Spread should be tight in high yield as the market is larger, more liquid and contains less 'junk' than it ever has."

Moreover, companies with the riskiest credit profiles are increasingly obtaining their funding in the private credit market, leaving the public high-yield market with better quality credits, according to Easterly's Menozzi. Expanding liquidity, easing borrowing rates and solid debt ratio metrics among speculative-grade companies have also contributed to market strength, Menozzi said.

"We do not foresee significant problems with debt refinancing unless a recession or significant economic distress takes place in the near future," Menozzi said.