Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Nov, 2025

By Brian Scheid

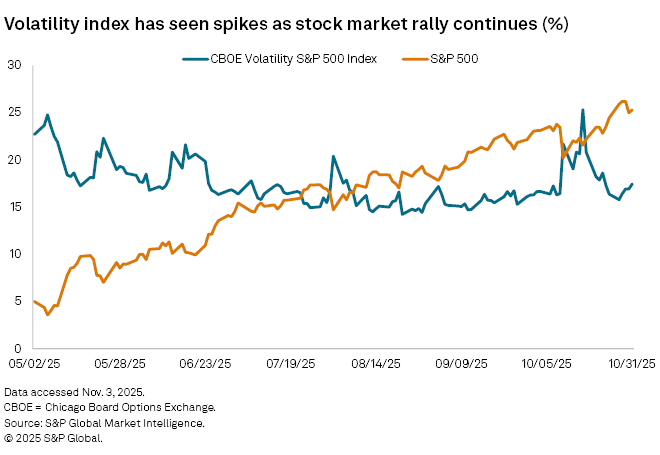

The S&P 500 closed at all-time highs eight times in October and 36 times since the start of the year. The index's ongoing bull run, however, has become increasingly volatile.

The Chicago Board Options Exchange (CBOE) volatility S&P 500 index (VIX), which measures the market's volatility expectations based on options activity and has been dubbed the stock market's "fear gauge," dipped in late August to its lowest levels since the end of 2024 before spiking again in mid-October.

Persistent risks of new and higher tariffs, fears of a weakening labor market, inflation that refuses to fall, and concerns over rising stock valuations and a potential bubble in AI have fueled a rise in market volatility.

"There's a lot going on at face value and under the surface with volatility right now," said Tyler Richey, a co-editor with Sevens Report Research.

The volatility gauge continues to turn higher as the S&P 500 continues to break new record highs, resulting in loose but measurable, positive correlation between the large-cap stock index and the VIX, Richey said.

This correlation is not typical and is historically unsustainable, Richey said. It is also occurring as the VIX continues to see steady intraday increases. Signs are emerging that some shorter volatility trades are getting crowded and at risk of a new squeeze, and the VIX is starting to accelerate higher and begin to outpace active futures contracts, Richey said.

The VIX in a typical bull market is at about 8 to 12. In 2017, for example, the S&P 500 rallied about 22%, while the VIX remained below 10 for much of the year. On Nov. 3, the fear gauge was trading above 18.

Still, this higher level in the VIX may not indicate a wobbling rally, said Arnim Holzer, a global macro strategist at Easterly EAB.

"I think volatility is appropriate given the number of known and unknown variables in the market," Holzer said. "Typically, in a bullish market you'd expect volatility to be lower, but the unorthodox nature of the current issues, combined with secular changes and associated risks, has kept volatility elevated."

Current equity market volatility is largely tied to the effect of policy on corporate earnings and the broader economy, Holzer said.

"Markets are less worried about the bottom line and more focused on how fiscal, tariff and monetary policies shape the environment in which those earnings are generated," Holzer said. "That policy-effect uncertainty is the main driver of ongoing volatility."

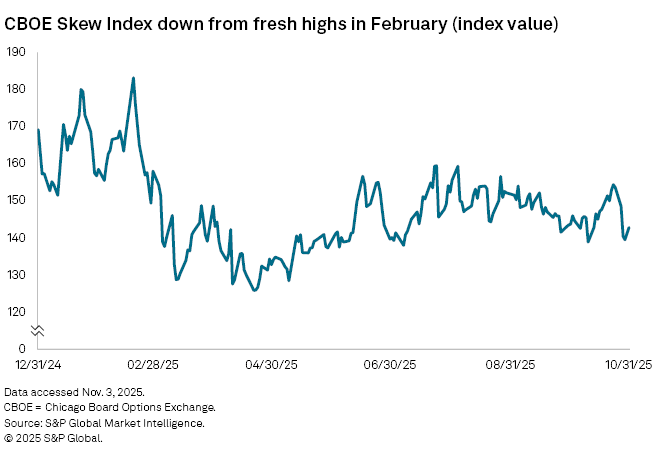

The CBOE Skew index, which measures the expectations of rare and extreme moves in the S&P 500, has also seen recent and sudden spikes. The index, which is derived from out-of-the-month S&P 500 put options and acts as an indicator of potential "Black Swan" events, offers insight into changes in institutional investors' general long equity exposure, Richey said.

The Skew rose steadily into mid-2021, when long exposure by institutions in the S&P 500 peaked. It then steadily declined until institutions began buying again as the large-cap stock index fell for much of 2022.

The current movement in the Skew index is reminiscent of late 2021 and early 2022, suggesting the market may be in the middle of another institutional distribution phase, which typically presents volatile and lasting downturns, Richey said.

"Each of those developments in the derivatives space are noteworthy by themselves but not necessarily a reason to panic, however simultaneously combined, they are a more meaningful source of concern," Richey said.

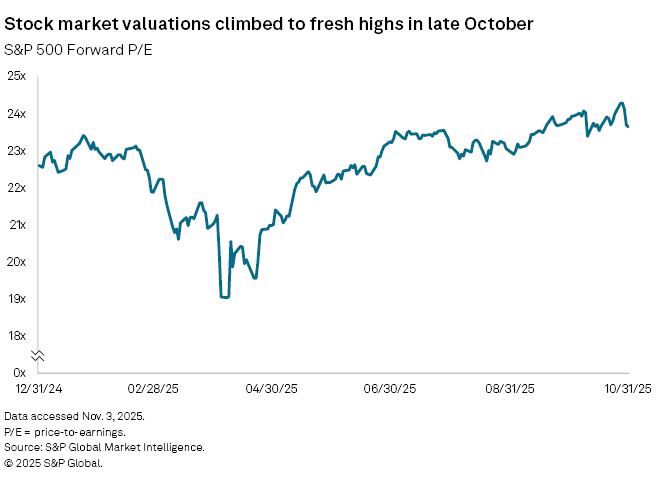

This concern is particularly elevated as valuations continue to get stretched to record highs, risks of higher and additional tariffs rise, and investors have little government data to view the state of the economy with the federal government shut down.

"To say that downside equity market risks are underappreciated right now would be a severe understatement," Richey said.

Volatility could be turbulent in the coming weeks as tariff risks remain; a bearish view from strategists and economists grows; and concerns over private credit, valuations and speculation rise, said Jim Worden, chief investment officer at The Wealth Consulting Group. A weakening jobs market and stubbornly higher inflation pose additional risks to volatility.

"It is unusual to see all-time highs for gold, equities and cash levels when the Federal Reserve is cutting rates," Worden said.

Still, this may not signal the end of the bull market.

"Some mistakenly think that if all asset classes are near all-time highs, something needs to break. I wholeheartedly disagree with that notion," Worden said. "We could be in a period akin to the early to mid-90s where innovation ramps up exponentially for a period."