Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Nov, 2025

By Robert Clark and Xylex Mangulabnan

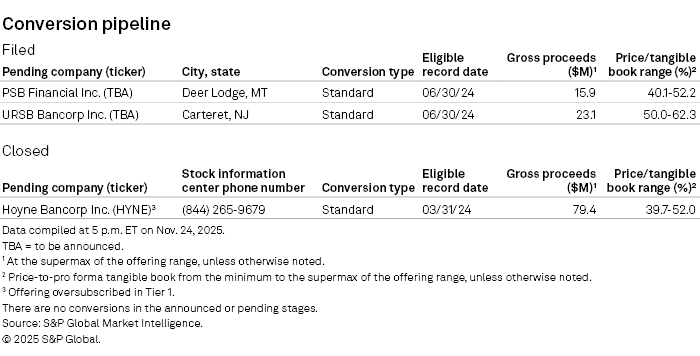

This feature has the latest news from the mutual bank conversion sector. As of Nov. 24, three conversions were in the pipeline.

Oak Park, Illinois-based Hoyne Bancorp Inc.'s mutual-to-stock conversion offering was oversubscribed in Tier 1. At the supermax of the offering, gross proceeds were $79.4 million.

On Sept. 23, PSB Financial Inc. filed a registration statement for a mutual-to-stock conversion. PSB is the proposed holding company for Pioneer State Bank, the successor to Deer Lodge, Montana-based Pioneer Federal Savings and Loan Association. The price to pro forma tangible book value as of June 30 was between 40.1% at the minimum of the offering range and 52.2% at the supermax.

In the filing, PSB said, "We are considering branching opportunities that may arise in our primary market area, including a potential branch office in western Montana in late 2026 or the first six months of 2027."

On Sept. 12, URSB Bancorp Inc., the proposed holding company for Carteret, New Jersey-based United Roosevelt Savings Bank, filed a registration statement for a mutual-to-stock conversion. Gross proceeds are estimated at between $14.9 million at the minimum of the offering range and $23.1 million at the supermax.

According to the filing, many of United Roosevelt's one- to four-family, multifamily, commercial and industrial (C&I), and consumer loans have been purchased rather than originated internally. As of June 30, the balance of purchased C&I loans from BHG Financial, formerly known as Bankers Healthcare Group LLC, was $35.9 million, or 13.7% of the bank's loan portfolio. United Roosevelt began buying C&I loans from BHG in early 2016. The bank also started buying participation interests in syndicated leveraged lending loans in November 2023 from BancAlliance Inc.; the balance of that exposure on June 30 was $3.3 million. Additionally, United Roosevelt began purchasing consumer loans from BHG and Woodside Credit LLC in the second quarter and from LendingClub Corp. in the first quarter.

Download a template showing the conversion pipeline, market performance of recent conversions, valuations of mutual holding companies and a list of conversion candidates.

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

Activist Holdco makes waves with plunge into bank sector

Fulton Financial acquiring Blue Foundry Bancorp in $243M all-stock deal

Activist investor calls for Blue Foundry Bancorp to change leadership or sell

Activist investor secures 5.2% stake in Louisiana-based Catalyst Bancorp

Massachusetts-based Mutual Bancorp to acquire in-state peer Bluestone Bank

First Federal Lakewood to acquire Ohio bank

Indiana-based Richmond Mutual, Farmers Bancorp announce $82M merger deal

SR Bancorp CEO to step down

Pioneer Bancorp acquires $73M advisory firm Brown Financial Management

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.