Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2025

Amid increasing electrification in the US economy, the nation's largest natural gas producer expects continued strong demand for the fuel throughout the nation's energy systems.

"Electrifying everything," ongoing coal-to-gas switching for power generation and energy security will be key drivers underpinning US gas demand in coming years, EQT Corp. President and CEO Toby Rice said at a Bipartisan Policy Center event.

"We've got really tangible demand signals that are saying we need to make our energy systems bigger, and there's even some larger demand signals that are just starting to materialize," Rice said at the Nov. 19 Future of Gas panel discussion.

Gas demand sources

Electrification — for vehicles and for residential and commercial applications — has gained momentum in recent years, in line with efforts to curb direct-use emissions, shifting energy demand patterns.

Rice sees this shift, along with the significant expected growth in power demand tied to data centers and artificial intelligence, as supporting future gas demand in the power sector. Rice said EQT expects AI-related need to drive 40% of power demand growth in the coming years.

Power demand for artificial intelligence could increase tenfold by 2030 in the US, according to the Electric Power Research Institute. And gas-fired generation could jump 260 TWh by 2035 to help power data centers, according to the International Energy Agency.

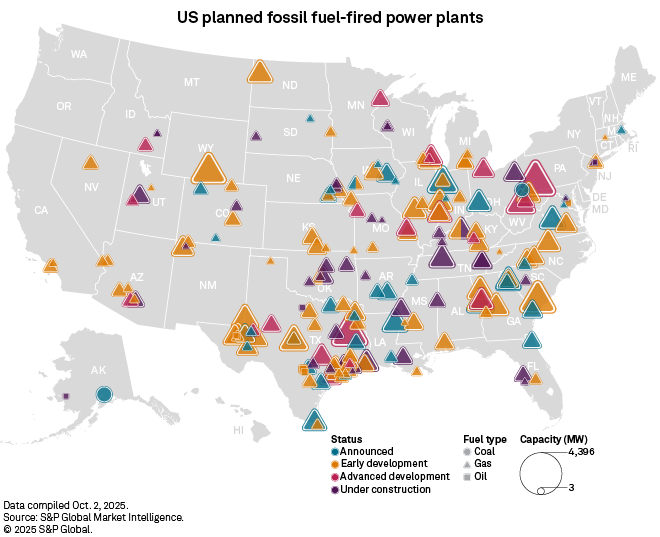

As of the end of the third quarter, US companies had plans to add 119.6 GW of new fossil fuel capacity between 2025 and 2030, data from S&P Global Market Intelligence showed. That is up from 80 GW announced or under construction during the first quarter, a 50% increase.

Rice touted gas's role in reliability in tandem with renewable power generation. "Natural gas not only can feed the 'electrify everything' and bring tremendous versatility to a more electrified world, but it can also make sure people get fed, housing gets built and modern economies can grow and have the resources to do that," he said.

Marty Durbin, the US Chamber of Commerce's senior vice president of policy and president of the Global Energy Institute, described fossil fuels and renewable energy as an "and proposition" rather than "either or" for meeting rising power generation needs.

"For the fuels that we continue to rely on like natural gas and even oil, what do we need to do to continue to reduce emissions and make those even cleaner and more reliable?" Durbin said.

Emissions considerations

The policy climate around emissions reduction has shifted significantly under the Trump administration.

While the Biden administration aimed to reduce the building sector's emissions 90% from 2005 levels by 2050 and had sought to regulate power plant greenhouse gas outputs, the US Environmental Protection Agency under the Trump administration announced plans to roll back its landmark greenhouse gas endangerment finding. The endangerment finding had provided the legal and scientific basis for the EPA's efforts to regulate climate-warming emissions under the Clean Air Act.

And though natural gas is the cleanest fossil fuel to burn, there are still methane emissions from the production process.

Ralph Cavanagh, former energy co-director of the Natural Resources Defense Council and member of the Bipartisan Policy Center's board of directors, highlighted EQT as a unique producer that has been able to keep its methane leakage rates below 1%.

EQT has achieved production segment Scope 1 methane emissions intensity of 0.0070%, "significantly surpassing our 2025 target of 0.02% by 65%," the company has said.

Rice said others in the industry could follow suit and lower their greenhouse gas emissions by drilling and completing wells more efficiently. EQT has replaced diesel-burning equipment with electric equipment, introduced electric fleets and replaced the piece of equipment producing the highest methane emissions — the pneumatic device.

"We've replaced over 9,000 of these devices in less than 18 months and we did it for less than $40 million," Rice said. "And the impact was over 350,000 tons of CO2 equivalent removed from our carbon footprint."

Panelists at the event said transparency in natural gas companies' emissions is a necessary step to verify actions to reduce carbon and methane output.

However, there is uncertainty over whether federal leadership from the EPA, Department of Energy and the National Petroleum Council will continue their monitoring processes.

Independent third-party verification of emissions and methane leak reduction must continue to enable this type of progress in this industry, Cavanagh said.

"The EPA and the DOE need to remain engaged on this so that we can continue to move toward a world in which it's the low-emissions natural gas that is taking over markets that care about this, and all of the markets do," he said.