Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Nov, 2025

By Tyler Hammel and Jason Woleben

An Obamacare sign is displayed outside an insurance agency on Nov. 12, 2025, in Miami.

Source: Joe Raedle/Getty Images

With the extension of enhanced Affordable Care Act tax credits still in limbo, customers in states like Colorado are facing significant rates increases while regulators are scrambling to find solutions.

The enhancements, including broadened eligibility for the Affordable Care Act tax credits, expire Dec. 31, and enrollees have seen significant premium hikes since open enrollment for 2026 began Nov. 1.

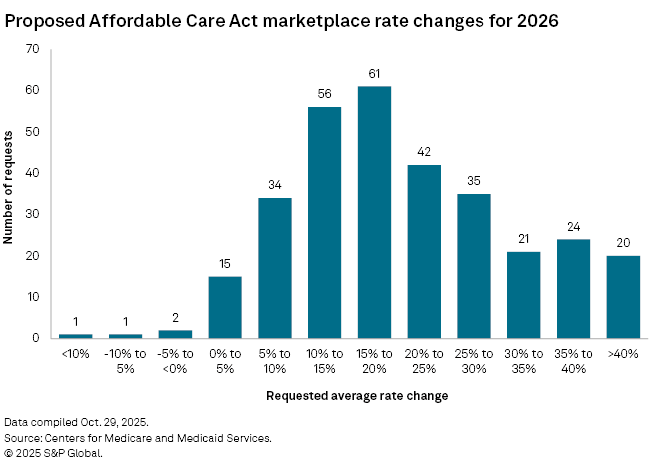

Not every state is represented in the ACA marketplace to the same extent, and rate increases for each differ, although nearly half are facing rate increases exceeding 20%, according to an S&P Global Market Intelligence analysis of Centers for Medicare & Medicaid Services (CMS) data.

Regulators, like Michael Conway, Colorado insurance commissioner, expect the consumer impacts to be significant.

"It's not too late, but we need Congress to act," Conway said in an interview with S&P Global Market Intelligence. "If not, then we're going to have an abject disaster on our hands."

A rocky road

The ACA, also known as Obamacare, allows individuals to purchase private health insurance through federal or state-run platforms, rather than through an employer. Disagreement over extending COVID-era tax credits led to the longest US federal government shutdown, which ended Nov. 15 with no extension in place.

While Colorado — a "blue" state controlled by the Democratic Party — is now facing an average 26.5% increase to exchange plans according to CMS data, the impact could have been worse, Conway said. Legislation passed in the Rocky Mountain state earlier this year allows for the sale of up to $125 million of insurance premium tax credits and corporate income tax credits for the current fiscal year, allowing qualifying companies to pay certain state taxes early at a discount.

That legislation reduced the net premium increase to 101% from 175%, but it will still negatively affect consumers, according to Conway.

"It's terrible for Colorado consumers, and it's going to cause a lot of pain," Conway said.

Colorado is among the relatively few states to operate a state-based exchange marketplace, which Conway said allows the state to offer more assistance programs than if they used the CMS site. However, even with innovation and mitigation efforts, Conway said he expects about 75,000 individuals in the state to disenroll from their ACA plans due to higher rates.

"Those 75,000 folks are still going to get sick, they're still going to end up in the hospitals, and that's going to all become uncompensated care for those hospitals, which will then be passed back through to the rest of the commercial market," Conway said.

In Colorado, only 4.8% of the population is estimated by the CMS to be covered by exchange plans, but the financial impacts on these consumers will be severe, according to Conway.

In the red

While the majority of states have fewer than 10% of their population enrolled in exchange plans, six states exceed 10%, all of which are Republican-controlled or "red" states. The state with the largest population covered by exchange plans is Florida, with an estimated 20.4% of the population enrolled, while New York has the smallest percentage at approximately 1.1%.

Despite eight members of the Senate Democratic Caucus joining the Republican majority to pass a budget bill that ended the shutdown without extending the tax credits, other Democrats are now calling Republican alternatives, such as expanding Health Savings Accounts or issuing direct checks, inadequate in addressing the affordability issue.

"That's why Democrats insist that one of the best things we can do right now is extend the ACA premium tax credits, because when people talk about costs, healthcare is near the top of the list of worries, if not the very top," Senate Democrats said in a Nov. 20 press release.

Reports have emerged that President Donald Trump will propose a two-year extension; however, further details have yet to be released.

Another "red state" with high participation is Georgia, with the second-highest estimated enrollment percentage at 13.5%. The Office of the Commissioner of Insurance and Safety Fire for Georgia acknowledged forthcoming rate increases in a letter to constituents ahead of the open enrollment season, but insisted that "affordable health insurance options are still available."

The regulator, which two years ago launched its own state marketplace for insurance dubbed Georgia Access, did not respond to a request for comment regarding efforts to combat rate increases. The state faces a rate increase of 27.9%, according to CMS data, among the 10 highest estimated increases.

"Georgia Access remains dedicated to our core mission to expand access to affordable health insurance for Georgians," said Cheryl Gardner, executive director of Georgia Access, in the release. "It's vital that consumers review their health insurance options carefully and take action during open enrollment."

Health insurers feel the pain

But consumers are not the only ones feeling the pain. Health insurers are also expected to be affected by any reduction in ACA participation, with some insurers likely to be impacted more than others.

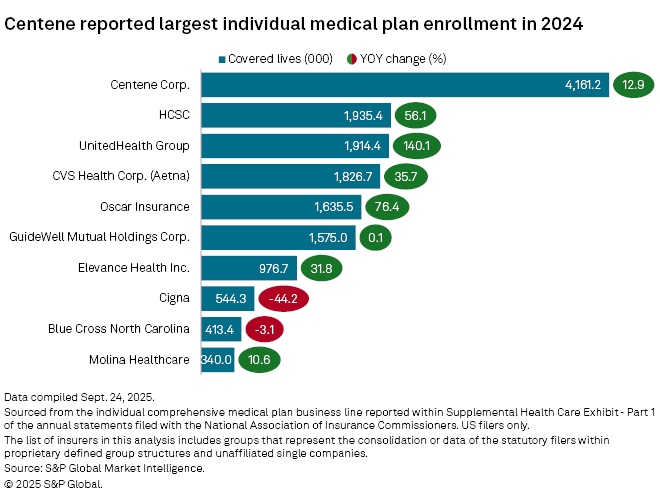

Centene Corp. was the leading provider of individual health insurance plans in 2024, with 4.16 million members enrolled, up 12.9% from the prior year, according to an analysis by S&P Global Market Intelligence. Health Care Service Corp. had the second-largest individual plan membership in 2024, with 1.9 million members, followed by UnitedHealth Group Inc. with 1.9 million members. Individual health insurance plans include ACA plans and those offered off-exchanges.

During an Oct. 29 earnings call ahead of Congress' vote to end the shutdown, Centene CEO Sarah London said the company has already repriced its marketplace plans for year-over-year margin improvement but still advocated for extending the tax credits.

"While our products are priced to support year-over-year margin improvement in the scenario where [the tax credits] expire, we believe these tax credits offer critical support for hard-working Americans, small business owners and rural healthcare infrastructure, and we are hopeful Congress can find a path forward," London said.

Rates on the rise

As year-end and the expiration of tax credits loom, health insurers have already factored in premium increases, with the highest number of requested rate increases ranging from 15% to 20%, according to an S&P Global Market Intelligence analysis of CMS data.

Of the approximately 312 requests for rate changes filed by Oct. 29, only 53 fell below 10%, with 203 exceeding 15%.

Insurers have done what they need to do to get additional rate increases in place for 2026, with the assumption that the enhanced subsidies will expire and the impacts on membership remain unknown, according to James Sung, director of insurance ratings for S&P Global Ratings.

"There's a wide range of viewpoints on where it could end up, anywhere from a percentage drop in the teens to 50%," Sung said. "Each company has a different view based on their marketplace footprint, which also reflects different levels of rate increases across different states."

While companies are concerned about the membership drop, some of that will be countered by the premium rate increases, Sung said. However, the marketplace membership is likely to see significant changes as the subsidies expire and enrollments drop, Sung said.

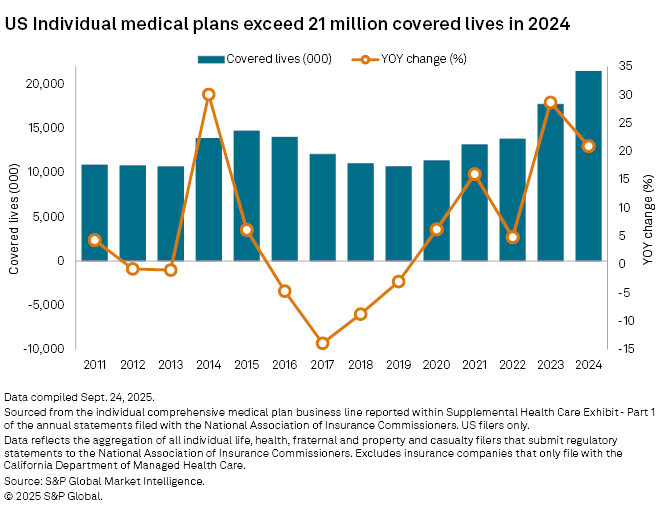

Individual medical plans have seen significant growth since 2020, reaching 21.5 million covered lives in 2024, according to an analysis of regulatory documents by S&P Global Market Intelligence. Individual plans increased 28.7% from 2022 to 2023, coinciding with the resumption of Medicaid redeterminations. Growth continued from 2023 to 2024, with total covered lives rising 20.9%.

"It's going to cause short-term dislocation in the ACA markets for 2026 and also possibly 2027," Sung said. "But assuming that all plays out, the market is going to shrink to where it was before the enhanced subsidies or maybe even smaller, but eventually should stabilize and still remain a viable place for consumers to get coverage."