Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Nov, 2025

Global private equity and venture capital deal value in October grew 49% year-over-year to $111.44 billion and has already exceeded the full-year totals of 2023 and 2024, according to S&P Global Market Intelligence data.

However, during the month, the number of deals fell to 833 from 1,212 in October 2024.

A similar pattern is revealed when looking at the year to Oct. 31, when transaction value grew to $749.76 billion from $588.40 billion in the first 10 months of 2024. The deal count dropped to 10,606 from 11,236 during the measured period.

– Download a spreadsheet with data in this story.

– Read about global venture capital rounds of funding in October.

– Explore more private equity coverage.

Top sectors

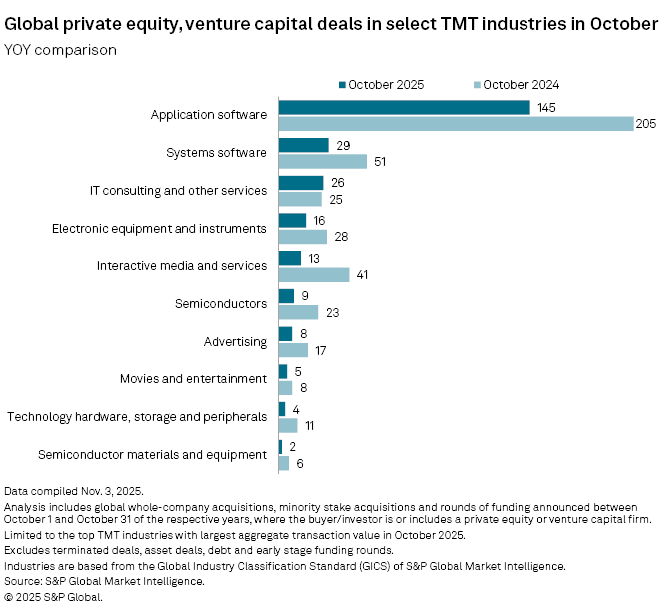

Technology, media and telecommunications remained the most active sector in October, with 282 private equity-backed announced transactions, more than a third of all deals during the month.

Application software led the sector with 145 deals, although the total count decreased from 205 in October 2024.

Systems software followed with 29, and IT consulting and other services with 26 deals.

Largest deals

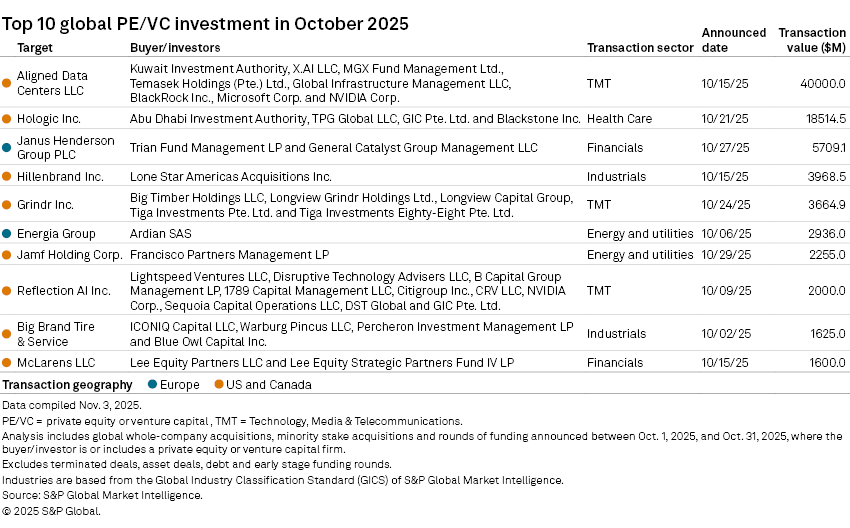

Thirteen deals with transaction values of at least $1 billion were announced in October.

In the largest transaction of the month, an investor group, including BlackRock Inc.'s Global Infrastructure Management LLC, NVIDIA Corp., Microsoft Corp., X.AI LLC, MGX Fund Management Ltd. and Kuwait Investment Authority, agreed to acquire Aligned Data Centers LLC from Macquarie Group Ltd. The transaction values the data center company at approximately $40 billion.

Guggenheim Securities LLC served as the financial adviser to the sellers, with Wells Fargo, TD Securities, Deutsche Bank, Goldman Sachs & Co. LLC, J.P. Morgan, Citizens JMP Securities LLC and BofA Securities Inc. also serving as financial advisers. Latham & Watkins served as legal counsel to the sellers, while Sterlington PLLC advised Aligned's management team.

The second-largest deal was a consortium led by Blackstone Inc. and TPG Global LLC's announced acquisition of medical technology company Hologic Inc. for $18.51 billion. Abu Dhabi Investment Authority and GIC Pte. Ltd. will make minority investments.

Goldman Sachs & Co. LLC is the financial adviser to Hologic, and Wachtell Lipton Rosen & Katz is legal counsel to the company. Citi is the financial adviser, Kirkland & Ellis LLP is legal counsel, and Ropes & Gray is healthcare regulatory counsel to the consortium.