Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2025

By Audrey Elsberry and Annie Sabater

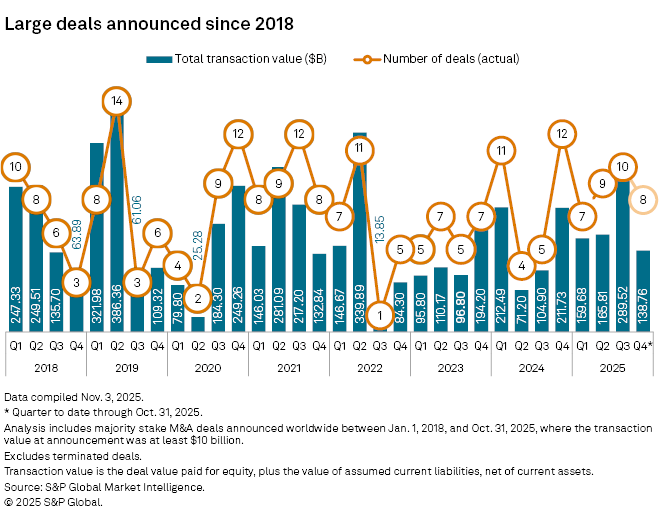

Eight M&A deals with transaction values greater than $10 billion were announced in October, marking the busiest month for large M&A deals worldwide since May 2022.

Half of the deals announced during the month were among the 20 largest of the past 12 months, covering sectors such as technology, industrials and healthcare. The October activity gave the fourth quarter a strong early start, putting it only two deals behind the third quarter, which had 10 announced deals. October also produced more deal announcements than the entire first quarter of 2025.

The largest deal announced in October was the sale of Texas-based Aligned Data Centers LLC, a company that designs, builds and operates data centers, to an investor group that includes tech giants Microsoft Corp. and NVIDIA Corp.

The deal is the sixth-largest announced transaction since October 2024, with a value of $40 billion, according to S&P Global Market Intelligence data. Aligned Data Centers' sale is also the largest data center deal by enterprise value, according to the Oct. 15 merger announcement. The company is being sold by Macquarie Group Ltd., which in December 2024 divested its stake in another data center company, AirTrunk Operating Pty. Ltd., to an investor group.

Besides Microsoft and NVIDIA, the group purchasing Aligned Data Centers includes MGX Fund Management Ltd., Global Infrastructure Management LLC, X.AI LLC, Temasek Holdings (Pvt.) Ltd., Kuwait Investment Authority and BlackRock Inc.

The second-largest deal of the month, American Water Works Co. Inc.'s planned merger with Essential Utilities Inc. was announced Oct. 27 with a transaction value of $20.01 billion. The deal will create the leading regulated water and wastewater utility in the US, Essential Utilities Chairman and CEO Christopher Franklin said in a deal call on the day of announcement.

"The combined company's scale, operational expertise and regulatory diversification are all helpful as we make needed investments in our systems with a keen eye towards customer affordability," American Water Works President and CEO John Griffith said during the call.

Two healthcare deals were announced in October, including the $18.51 billion sale of medical equipment company Hologic Inc. by an investor group, announced Oct. 21.

The investor group includes Blackstone Inc., GIC Pte. Ltd., Abu Dhabi Investment Authority and TPG Global LLC. Hologic shareholders will receive $76 per share in cash and a contingent value right of up to $3 per share upon achieving certain revenue milestones, according to an investor presentation about the deal. The transaction is expected to close in the first half of 2026.

The other healthcare deal announced in October is the planned purchase of US-based clinical-stage biotechnology company Avidity Biosciences Inc. by Swiss pharmaceutical company Novartis AG in a transaction valued at $10.15 billion.

The deal "has a strong strategic fit for the company, builds our presence in neuromuscular diseases, builds our RNA technology platform and materially improves the medium and long-term growth profile of Novartis," Novartis CEO Vasant Narasimhan said during a deal call with analysts on Oct. 27.

|

– View – Read the M&A and equity offerings research paper. – Read more |

Investment holding company Multiply Group PJSC on Oct. 15 announced a proposal to acquire 2PointZero and Ghitha Holding through a transaction valued at $18.23 billion. 2PointZero is an investment company with scalable assets in energy, mining and financial services, while Ghitha Holding is a conglomerate spanning agriculture, food production and distribution operations.

The first financials deal with a transaction value of more than $10 billion since April is Fifth Third Bancorp's acquisition of regional bank Comerica Inc. for $10.85 billion. Announced Oct. 6, this would the largest completed US bank deal since 2021.

The last bank transaction of more than $10 billion was Mediobanca Banca di Credito Finanziario SpA's $19.83 billion sale to Banca Monte dei Paschi di Siena SpA, which was announced in January and completed in September.

Greece-based Organization of Football Prognostics SA and Swiss firm Allwyn International AG are merging in a $10.67 billion transaction, announced Oct. 13.

"Together, the two companies will become a global lottery and gaming champion," Organization of Football Prognostics Chairman and CEO Jan Karas said during a conference call after the deal's announcement.

California-based Skyworks Solutions Inc. and North Carolina-based Qorvo Inc. announced in October that they agreed to merge in a $10.34 billion transaction.

Under the terms of the deal, Qorvo shareholders will receive $32.50 in cash and 0.960 of a Skyworks common share for each Qorvo share held at the close of the transaction, according to the companies' investor presentation. Skyworks shareholders will own about 63% of the combined company, while Qorvo shareholders will own about 37%.

The combined company will be a "US-based global leader in high-performance radio frequency, analog and mixed-signal semiconductors," Skyworks Solutions President and CEO Philip Brace said during an M&A call with analysts.