Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2025

By Tyler Hammel and Jason Woleben

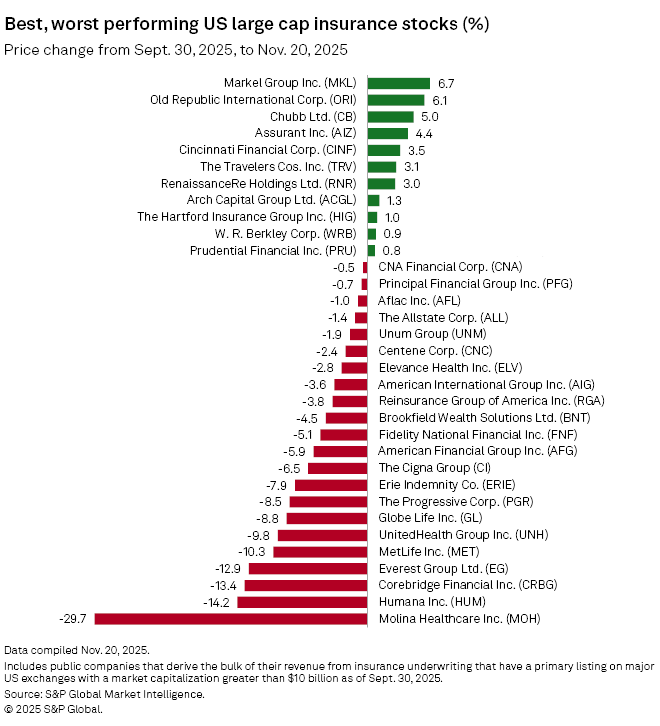

Markel Group Inc., Old Republic International Corp. and Chubb Ltd. rank among the top-performing US insurance stocks in the fourth quarter, while many managed care insurers lag behind after reporting mixed third-quarter earnings.

From Sept. 30 to the close of business Nov. 20, Markel Group led US insurers as the highest-performing stock, with a 6.7% increase following the release of strong earnings for the third quarter.

"In all of the businesses we own and oversee, our CEOs have continued to run their businesses with professionalism, long-term focus and extreme skill, navigating through volatile and uncertain economic conditions to deliver strong returns on capital and profitability," Markel Group CEO Thomas Gayner said during an Oct. 30 earnings call.

Markel's third-quarter earnings showed growth in personal lines, general liability, international lines and reinsurance professional liability segments, according to a research note from Jefferies analysts.

"Markel is showing signs of improvement with a focus on core areas with stronger return potential and is improving disclosures," the note said.

Old Republic's stock was the second-best performer in the period, rising 6.1% as the company reported better-than-expected title earnings, corporate earnings and underwriting results, according to a research note from Piper Sandler analyst Paul Newsome.

Chubb's 5% stock gain during the period similarly followed the release of third-quarter earnings that reflected significant year-over-year growth across key metrics while also beating analyst expectations.

The P&C insurer's third-quarter results surpassed the company's previous records for core operating income, P&C underwriting income and combined ratio, according to Chubb's earnings release.

Citizens analyst Matthew Carletti highlighted Chubb as a "top pick" in an Oct. 21 note, adding that the company's "larger-than-peers exposure to global markets" will lead to higher long-term growth. In the near term, "we are in the middle of a global cycle turn," Carletti said, noting that some property insurance markets with bigger risks are "past-peak" while most casualty markets seem to have "significant legs remaining."

"We cannot think of a company that has a better mix of business lines, geographies and talent to successfully navigate the dynamic environment than Chubb," Carletti wrote.

Managed care lags

Health insurers represented an outsized portion of the worst-performing insurance stocks in the period, as their medical costs grew during the third quarter, resulting in mixed responses from investors.

Molina Healthcare, Inc. experienced the sharpest decline of any insurance stock, falling 29.7% during the period amid a "very challenging medical cost environment," according to comments made by CEO Joseph Zubretsky during an earnings call.

As costs have risen, Medicaid rates may not be adequate, which remains an ongoing challenge for managed care insurers, Zubretsky said.

"Our early 2025 rate increases were sufficient at the beginning of the year, but as medical cost trends increased beyond those rates, our [medical cost ratio] increased each quarter," Zubretsky said. "The rate updates we received later in the year and risk corridors did not provide an adequate buffer."

Molina's Medicaid medical cost ratio reached 92% during the quarter, according to Zubretsky, while its senior-aimed Medicare plan hit 93.6% as high levels of utilization continued. However, even Molina's marketplace plans were not immune to rising costs, as plans purchased through state exchanges had a medical cost ratio of 95.6%, significantly higher than expected, according to the CEO.

Alongside Molina, fellow managed care insurers Humana Inc. and UnitedHealth Group Inc. saw notable share price declines of 14.2% and 9.8%, respectively, while The Cigna Group and Elevance Health Inc. saw more modest declines of 6.5% and 2.8%, respectively.

Industry leader UnitedHealth joined the chorus of companies pointing to rising costs associated with its Medicaid plans, which according to UnitedHealth leadership, experienced heightened acuity levels since state-led procedural disenrollment resumed in March 2023 following the COVID-19 pandemic.

The path to Medicaid recovery will be challenging as states have not funded the program in line with actual cost trends, according to Tim Noel, CEO of UnitedHealthcare, UnitedHealth's insurance arm.

"While we're making steady progress in bridging this gap with states, the mismatch between rate adequacy and member acuity will likely extend through 2026," Noel said during an earnings call.

Among the worst-performing insurance stocks, Centene Corp. posted one of the smallest declines during the period, falling 2.4%.

Centene's share price declined during a period of uncertainty for the insurer, as much of its customers are enrolled in Affordable Care Act marketplace plans.

ACA plans, which are offered through state-based marketplaces and directly by insurers rather than through employers, have come under scrutiny as the extension of tax credits to reduce plan costs became a key issue during the recent federal government shutdown.

Prior to the shutdown, most insurers had already priced in expectations that tax credits would not be extended.