Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Nov, 2025

By Yuzo Yamaguchi and Cheska Lozano

Japan's three megabanks are likely to further grow their net interest margins after revising their full-year earnings targets, as they aim to benefit from expected rate hikes and rising demand for loans.

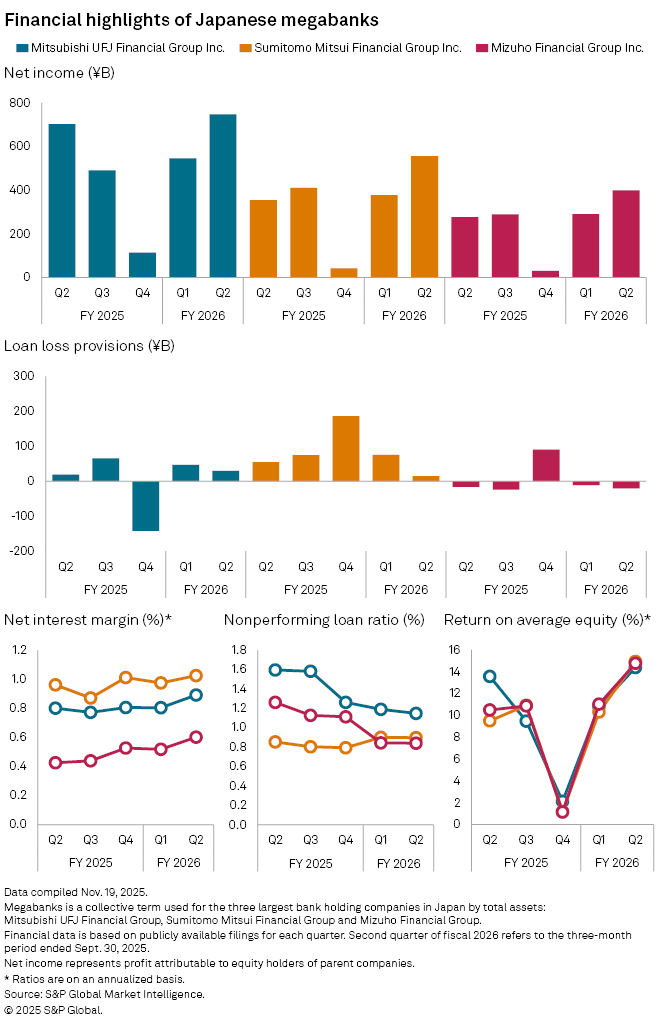

Mitsubishi UFJ Financial Group Inc. (MUFG), Sumitomo Mitsui Financial Group Inc. (SMFG) and Mizuho Financial Group Inc. posted their highest net interest margins (NIMs) and net incomes in at least five quarters earlier in October, according to data compiled by S&P Global Market Intelligence.

"Their NIMs should continue to improve further as there are no reasons to reverse it," said Toyoki Sameshima, a senior analyst at SBI Securities Co. While expected rate hikes by the Bank of Japan will be a tailwind for the banks, any move from the US Federal Reserve to loosen its monetary stance will help reduce funding costs for lending outside Japan, which would also support higher NIMs, Sameshima said.

Rising margins

MUFG increased its NIM to 0.89% in the July-to-September quarter, up from 0.80% a year earlier, while SMFG's margin widened to 1.03% from 0.96% during the same period, according to Market Intelligence. Mizuho's margin improved to 0.60% from 0.43%.

Credit demand from Japanese corporates is growing as Sanae Takaichi, who became Japan's prime minister in October, aims to pursue economic measures, including tax cuts, to incentivize capital investments. Banks typically extend loans at floating rates to large companies in Japan, and higher policy rates will allow them to charge more from their bigger customers.

Many economists expect the Bank of Japan to raise its policy rate by 25 basis points to 0.75%, possibly in December or January, after the central bank kept rates unchanged for the sixth consecutive monetary policy review meeting in October. Concerns about the impact of US tariffs on the Japanese economy have receded after the two nations signed a trade deal in July.

"Japan's megabanks will 'get a boost from a 25-basis point hike that won't chill the capital demand,'" said Hideo Oshima, a senior economist at The Japan Research Institute.

MUFG and SMFG each expect a 25-bps hike in the policy rate to contribute an additional ¥100 billion in net interest income per year, while Mizuho expects to generate an additional ¥120 billion, mainly from its domestic lending portfolio, which accounts for 60% or more of its total loans.

Lending boost

MUFG's outstanding total loans at home were almost unchanged from a year earlier at ¥74.4 trillion as of Sept. 30, the end of its fiscal first half. However, its loans to private companies increased 4.8% to ¥54.6 trillion during the same period, while lending to government-related organizations slid 33.3% to ¥5.4 trillion, according to a bank statement.

SMFG's overall domestic loans increased 8.6% to ¥69.2 trillion during the same period, while Mizuho's total lending in Japan edged up 0.9% to ¥56.9 trillion, according to their fiscal first-half results.

"The corporate demand for raising funds is very strong in Japan," SMFG CEO Toru Nakashima said during a Nov. 14 press conference after the lender reported earnings for the fiscal first half ended Sept. 30. "I expect this to continue into the second half of the year."

Nakashima attributed the increase in corporate loan activity partly to reduced concerns about the US tariffs on Japan. "The tariffs are becoming less risky."

MUFG on Nov. 14 raised its net income outlook for the fiscal year ending March 2026 to ¥2.1 trillion from its initial goal of ¥2.0 trillion, after the bank reported a 2.8% year-over-year increase in net income to ¥1.292 trillion for the April-to-September period.

SMFG lifted its full-year earnings estimate to ¥1.5 trillion from its earlier projection of ¥1.3 trillion, following a 28.7% jump in fiscal first-half net income to ¥933.50 billion. Mizuho raised its full-year earnings target to ¥1.13 trillion from its previous projection of ¥1.02 trillion after its net income for the first half climbed 21.8% to ¥689.9 billion.

As of Nov. 26, US$1 was equivalent to ¥156.35.