Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2025

By Brian Scheid

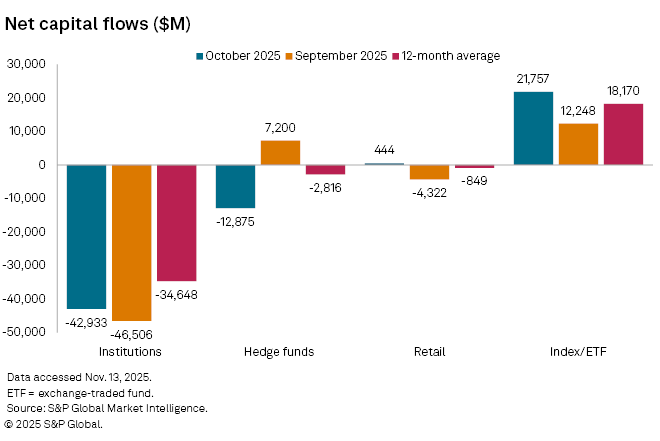

Climbing valuations kept institutional investors selling stocks in October, pulling a net $42.93 billion out of the stock market and pushing billions of dollars into passive investment vehicles as equity indexes soared to fresh highs.

That was below the $46.51 billion this group sold in September and above the $34.65 billion sold on average over the past 12 months, according to the latest S&P Global Market Intelligence data.

Institutions are expected to continue to sell into 2026 even as the S&P 500 set eight new all-time closing highs in October, said Julian van Rensburg, a senior analyst for Market Intelligence.

"We will likely continue to see institutional selling pressure in this environment," van Rensburg said. "With valuations so high against an uncertain macroeconomic backdrop, institutional investors are taking the opportunity to lock in profits on positions which have likely reached their respective price targets."

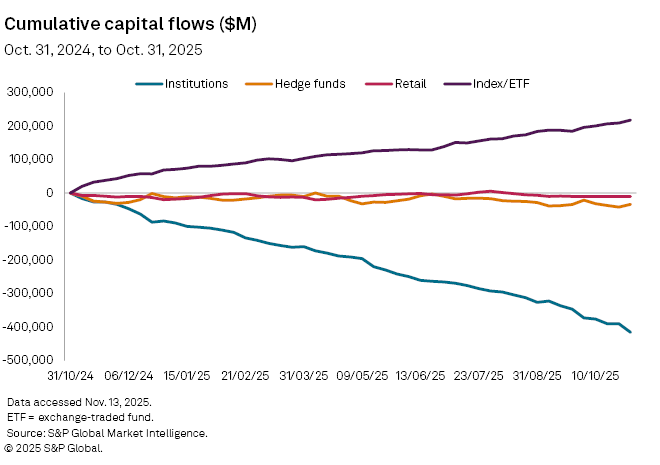

Institutions sold a net $332.17 billion in stocks from the end of 2024 through the end of October as the S&P 500 increased 16.3% over that stretch.

Meanwhile, index and exchange-traded funds (ETFs) bought a net $148.93 billion through the first 10 months of 2025 and purchased a net $21.76 billion in October, up from $12.25 billion in September and the $18.17 billion bought on average over the past 12 months, the data shows.

A large portion of these inflows into ETFs are coming from institutional investors looking for a more general exposure to the stock market, van Rensburg said. Hedge funds likely boosted capital flows into ETF products throughout March as well, van Rensburg said.

Hedge funds sold a net $12.88 billion in stocks in October, above the average of $2.82 billion in monthly selling over the past 12 months, the data shows.

"We see a lot of this active capital being shifted into passive vehicles so investors don't miss out on the rally, but in terms of holding individual securities with a specific investment thesis, institutional capital is showing a clear preference for generalist market exposure instead," van Rensburg said. "This will prevail, if not accelerate, in the absence of a healthy moderation in valuations."

Institutions will likely remain bearish on equities as the market remains "AI-obsessed" with the risks of holding individual securities with high valuations too high for many investors, van Rensburg said.

In October, institutions decreased their exposure in the consumer discretionary sector 0.6% after increasing it 0.6% in September, the largest month-to-month swing in flows for this group as it looked to book profits.

"Institutions may have felt it was an opportune time to realize gains, especially given the strong performance metrics observed in leading stocks within this sector," said Matthew Albert, a senior specialist with Market Intelligence.

Institutions rotating into passive investment strategists often need to reallocate capital from outperforming sectors, Albert said. This adjustment was likely also at play as institutions were net buyers in the IT sector, boosting exposure 0.4% in October after reducing it 0.4% in September, Albert said.