Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Nov, 2025

By Brian Scheid

This holiday season stands to be a little less merry for lower-income Americans as slower wage growth and rising prices squeeze their disposable income.

S&P Global Market Intelligence economists forecast holiday retail sales will increase 4.8% from 2024 with holiday prices expected to rise 1.6% this year after two years of flat-to-falling retail prices. Real holiday sales are forecast to rise just 3.2% this year, compared to 4.8% in 2024.

Holiday buying plans, however, may be dependent more than ever on employment and wages. Wage gains for lower-paying jobs stalled, hiring stagnant, tariffs hitting previously lower-priced consumer goods hardest, and record stock market gains are accelerating wealth disparity. These factors have created two distinct groups of consumers.

"If you have a job right now, it's a good economy. You're still enjoying decent wage gains and increases in income, so you have little to no incentive to cut back this year," said Michael Zdinak, director of US economics at S&P Global Market Intelligence. "If you're looking for a job … you're living in a much different economy. It's a bad time."

The US looks to be in a "K-shaped" economy, one where the gap between higher- and lower-income households widens by the day. Lower-income households, who saw their wages jump as the US emerged from the COVID-19 pandemic and business owners struggled to fill job openings, are now themselves struggling as wage growth slows and businesses have pull back on hiring.

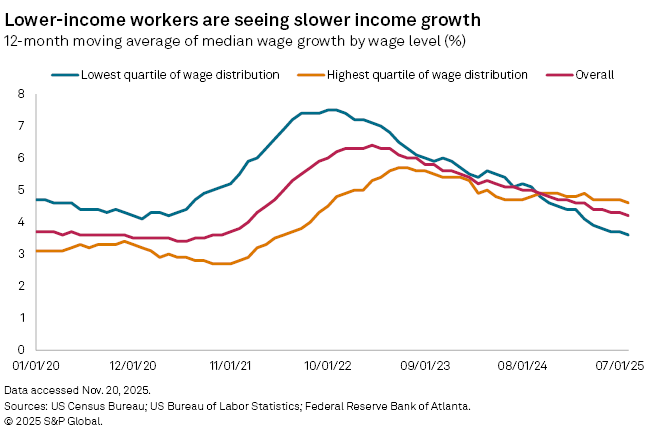

The lowest paid quartile of US workers saw their rate of wage growth fall to 3.6% in August, the lowest level since 2016, according to the latest data from the Federal Reserve Bank of Atlanta. Wage growth for this lowest-paid group was high as 7.5% in late 2022, which was the largest gain in wages for any group during the post-pandemic recovery.

Meanwhile, higher-income households are now seeing a rate of wage growth of 4.6%, the highest rate of any quartile, after lagging behind all the other groups for nearly the whole post-pandemic recovery. These higher-income households are also benefiting from recent record highs in stock markets. More than 87% of corporate equities and mutual fund shares were held by Americans in the top 10% of wealth in the US, according to the latest Federal Reserve data.

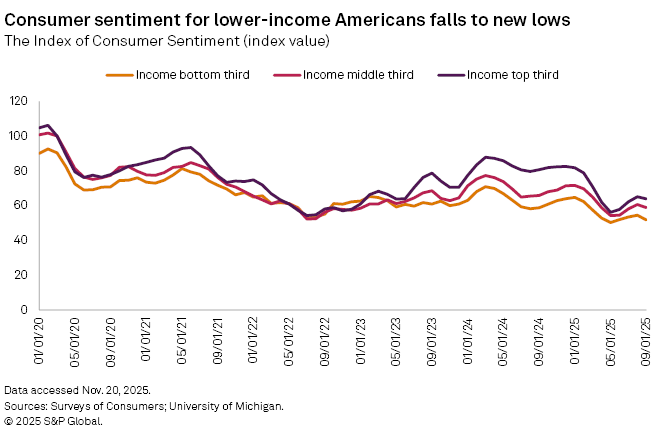

As wage growth slows for lower-income Americans, economic expectations and spending plans are also falling. Consumer sentiment for households in the bottom third of income fell to the lowest level on record in September, according to the latest survey from University of Michigan.

"If you look at GDP, if you look at unemployment, relatively speaking, the economy is OK," said Taylor Bowley, an economist at the Bank of America Institute. "But then you look at things like consumer sentiment and the vibes are just not good."

The top 20% of US households by income now account for more than 40% of all spending, said James Knightley, chief international economist for ING. These households will likely drive spending this holiday season and may buy more than they did a year ago.

"Inflation is an irritation rather than a constraint on spending, incomes are high, and there is a sense of job security, while they hold significant housing and equity wealth that has risen strongly," Knightley said.

Households in the bottom 60% are now spending more of their wages on physical goods vulnerable to higher tariffs and rising insurance costs. Fears of rising unemployment are also top of mind for this group, Knightley said.

"People who are financially struggling are having to make choices," Knightley said. "Some may choose to use high-cost consumer credit to get through the holiday season. But others may choose to economize and scale down the holiday season spending."

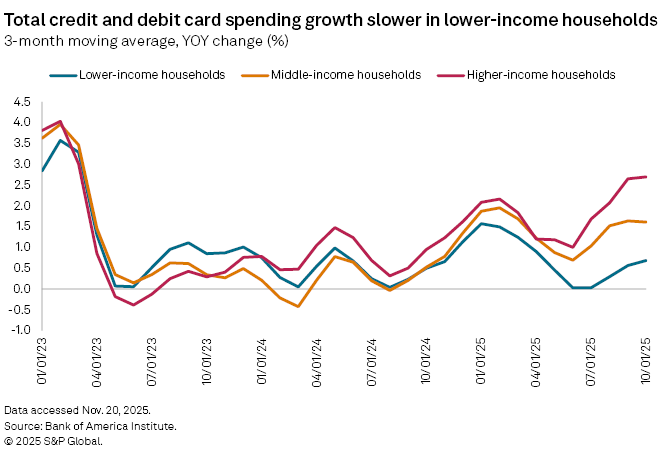

The crossroads for lower-income households is starting to show up in spending data. That group increased total credit and debit card spending by just 0.7% in October, well below the 2.7% growth in spending by higher-income households, according to the latest Bank of America data.

A higher-income household, if faced with slowing wage growth and declining job prospects, can "trade down," by moving their shopping from high-end retailers to bargain outlets, an option lower-income households do not have, Bowley said.

"Lower-income households were already shopping at the bargain place," Bowley said.

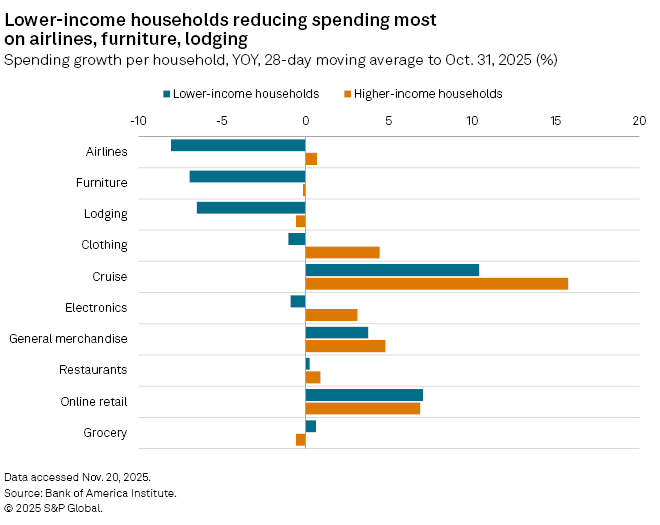

The largest gaps between higher- and lower-income spending per household are in bigger ticket discretionary categories like travel, furniture, electronics and lodging, data shows. Spending on clothing is diverging substantially with higher-income households boosting spending in this category by about 4.4% and lower-income households reducing it by about 1%.

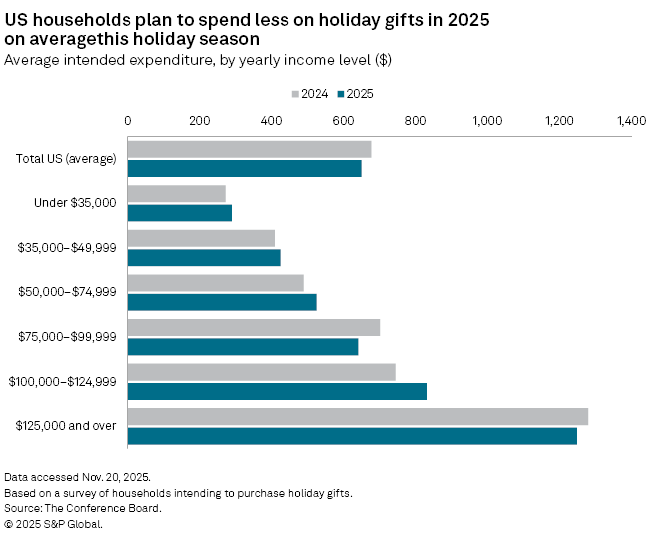

US households will spend, on average, $650 on gifts this holiday season, down from $677 a year earlier, according to an estimate from The Conference Board.

Consumers understand that tariffs mean higher prices, faster inflation and potentially layoffs, said Dana Peterson, chief economist at The Conference Board. Those at the lower end of income will likely cut back on discretionary spending and costlier goods and services, but those at the upper end may perceive little effect.

"There is always a K-shaped economy: Those who are in upper income brackets who do not alter their spending when the economy goes into an actual or perceived slump, and the rest of the population that does," Peterson said.