Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Nov, 2025

By Brian Scheid

Disproportionately high joblessness among young Americans and Black workers, along with concentrated job growth, is expected to weigh heavily on the Federal Reserve's next interest rate decision as central bank officials see clear signs of a worsening labor market.

Overall US employment rose to 4.4% in September, the highest since October 2021, but still well below the joblessness seen in other groups being closely watched by the Fed as it decides whether to cut rates again at its December meeting.

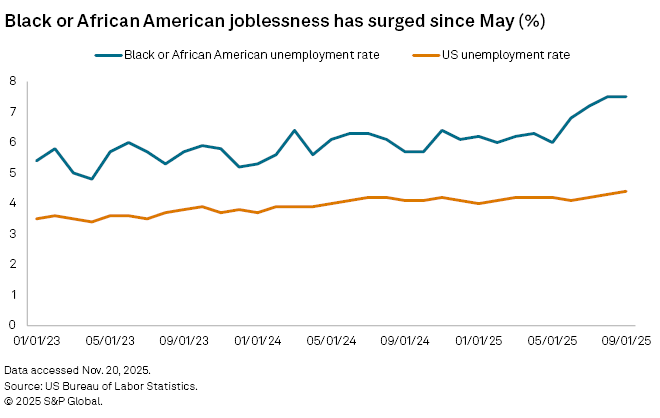

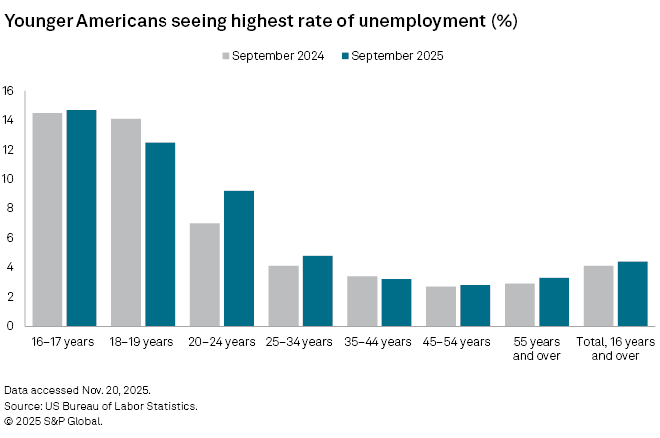

The unemployment rate for Black or African Americans was 7.5% in September, unchanged from August, but a significant increase from May when it was 6%, the US Bureau of Labor Statistics reported Nov. 20. Meanwhile, the unemployment rate for 20- to 24-year-old Americans was 9.2% in September, the bureau reported, up from 7% a year earlier and well above the 3.7% joblessness rate for prime-age workers, those ages 25 through 54.

Data on Black and younger workers frequently fluctuate since sample sizes tend to be relatively small. But since these high unemployment rates match those seen this summer, parts of the domestic labor market are clearly withering, said Dean Baker, senior economist at the Center for Economic and Policy Research.

"Seeing [these high numbers] again in September indicates we really are seeing a marked worsening of the labor market situation for these disadvantaged groups," Baker said. "That is likely an indicator of broader labor market weakness down the road, or given the lag, maybe now."

The September labor market report was delayed nearly seven weeks by the federal government shutdown, the longest in American history. The government will not release an October jobs report due to the shutdown and will delay the release of its November jobs report to Dec. 16, nearly a week after the rate-setting Federal Open Market Committee's December meeting.

At that meeting, Fed officials will consider cutting the benchmark federal funds rate by 25 basis points for the third time since its September meeting. The odds of a cut at the December meeting, seen as a near certainty about a month ago, were below 40% on Nov. 20, according to CME FedWatch.

The rate decision could hinge on just how much Fed officials believe the jobs market has worsened, and as the minutes of the Fed's October meeting show, some of these officials are closely monitoring joblessness for younger and minority Americans.

"A few participants viewed the rise in the unemployment rates for groups historically more sensitive to cyclical changes in economic activity, or the concentration of job gains in less-cyclical sectors, as signaling potential broader labor market weakness," according to the minutes, released by the Fed on Nov. 19.

The latest jobs numbers showed labor conditions for the groups more sensitive to cyclical changes "holding steady and not getting worse," said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

"But as the shutdown, not to mention trade tension, dragged on in October and November, the less attached likely bore the brunt," Tang said.

Companies remain reluctant to hire, and if layoffs and firings ramp up, the overall unemployment picture could quickly worsen, Tang said.

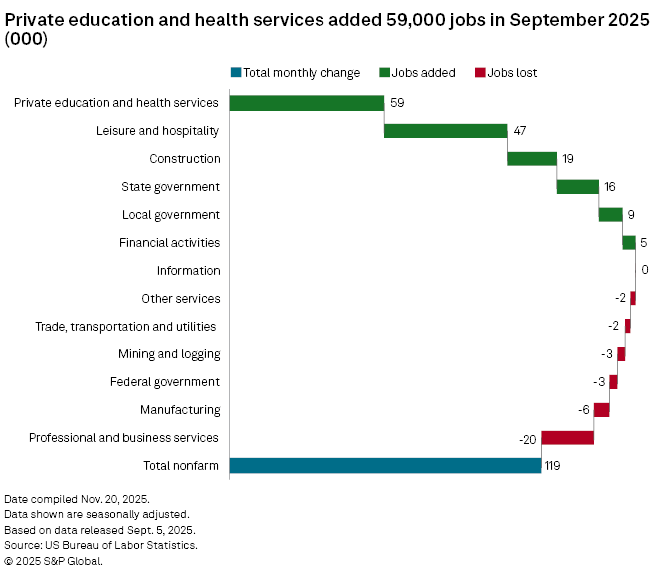

Concentration of growth

The concentration of job gains that Fed officials are also concerned about was apparent in the September data, which showed 119,000 jobs added, but nearly 90% of those gains were in just two sectors: private education and health services, which added 59,000 jobs, and leisure and hospitality, which added 47,000.

A Fed rate cut in December could be driven by officials "increasingly nervous about the slower and narrowing breadth of job gains," said Oren Klachkin, a financial market economist at Nationwide.

Still, other Fed officials are likely to press for rates to remain unchanged into 2026 as inflation persists above the central bank's 2% goal.

"It's quite the dichotomy at the moment," Klachkin said.

Klachkin said he still expects a cut in December, but said consensus within the Federal Open Market Committee (FOMC) could be difficult with key data delayed until later next month.

"With the chorus questioning the need for another cut growing louder, the FOMC may vote to keep rates steady next month and wait till the data fog lifts," Klachkin said.