Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2025

| Pure gold ore on the floor of a mine. Artisanal operations represent 20% of annual global gold supplies. Source: Oat Phawat/iStock/Getty Images Plus via Getty Images. |

The gold industry needs stronger due diligence standards for international trading hubs and greater engagement from gold-purchasing nations to combat a growing illicit trade, according to industry experts.

The call for industrywide reforms comes as previous measures to crack down on artisanal and small-scale mining in the Global South have largely failed to address the problem. Artisanal and small-scale mining operations represent 20% of the annual global gold supply and employ up to 80% of the global gold mining workforce, according to a 2024 report by the World Gold Council (WGC). Artisanal mining refers to small-scale, labor-intensive extraction operations that are typically unpermitted.

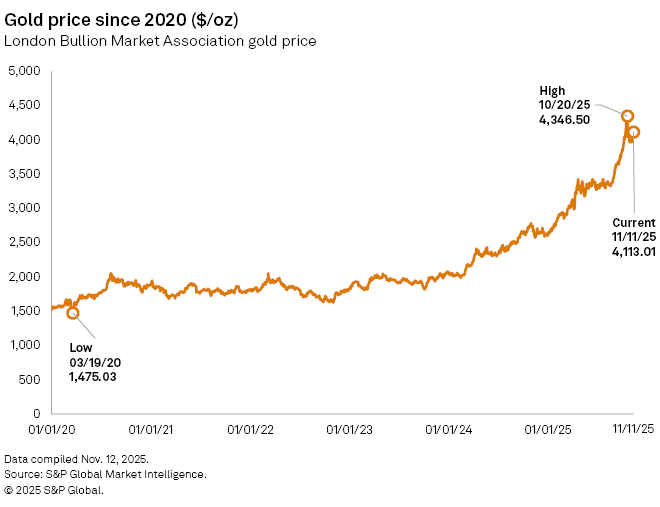

Gold prices have surged to unprecedented levels this year, surpassing $4,000 per ounce on Oct. 8 for the first time. Analysts project the gold price could climb higher as political uncertainty pushes investors to seek a safe haven in precious metals.

Bank of America forecast in mid-October that gold could reach $5,000/oz in 2026, and JPMorgan estimated in May that $6,000/oz by 2029 is possible if the current trend of asset reallocation from US bonds continues.

High prices incentivize ever more illegal gold mining, posing a challenge for the legal gold industry.

"We are not going to solve an illicit economy this big and powerful by simply sending out groups of police one day at a time to a mining site," said Julia Yansura, program director for environmental crime and illicit finance at the Financial Accountability and Corporate Transparency Coalition, a nonprofit.

"What is totally lacking is political leadership. Countries that are destinations for the gold and the proceeds need to step up and be part of that solution," Yansura said.

Trading hubs pipeline

Gold trading centers, including in the United Arab Emirates, India, Switzerland, the United Kingdom and Hong Kong, clear the path for unpermitted

"In the end, international gold hubs must start taking more robust measures," Dominic Raab, former British deputy prime minister and current head of global affairs at Appian Capital Advisory, told Platts, part of S&P Global Commodity Insights.

"If there are higher standards for checking the due diligence on the gold that is traded by the international hubs, it will be much harder for the international criminal actors to sell through those international hubs and then into the general market," Raab said.

The UAE, which replaced London as the world's second-largest gold hub in 2024, has become a major transit center for African gold. Until recently, Dubai followed few standards on whether the precious metal came from a conflict zone or smugglers, according to the WGC report.

The UAE bourse launched legally enforceable due diligence measures for all gold refineries in the country starting in 2023, followed by mandatory third-party audits in 2024, the WGC report said. The measures were strong enough for the country to be removed from a "grey list" managed by the Financial Action Task Force, an intergovernmental body that sets global standards to prevent illegal financial activity.

Other major trading centers are implementing their own reforms. The London Bullion Market Association, which facilitates trades worth more than $5 trillion per year, introduced a digital platform requiring accredited gold refineries to provide data starting in 2027 and revised its Global Precious Metals Code in late 2022.

These new rules may slow the flow of illicit gold, but they are too recent to judge and vigilant enforcement will be crucial, the World Gold Council said.

Industry experts suggest that financial incentives may be hampering broader reform efforts.

"I agree that reforms are vitally needed," said Yansura. "But, because these hubs benefit financially from the status quo, they often lack the political will to make necessary reforms."

Raab proposed that the Financial Action Task Force could develop a comprehensive framework for international hubs to follow, helping them to avoid greylisting or blacklisting while maintaining commercial competitiveness.

Political leadership slow to act

Gold-consuming countries are struggling to mount an effective coordinated response against illegal gold mining, despite having significant leverage through purchasing power as well as regulatory authority over financial institutions and gold dealers, industry experts said.

"G7 and G20 governments should formally recognize that the illicit financial flows from illegal gold mining represent a systemic threat to international security," Raab said.

Some progress has been made in enforcing rules for responsible gold trade at the regional level. The EU introduced its Conflict Minerals law on Jan. 1, 2021, which ensures that gold entering the 27-country bloc meets international responsible sourcing standards set by the Organisation for Economic Co-operation and Development. The regulation requires importers to conduct due diligence on their supply chains and verify that minerals are not financing armed conflict or human rights abuses.

In the US, Sens. Tim Kaine (D-Va.) and John Cornyn (R-Texas) introduced the US Legal Gold and Mining Partnership Act in February. The act would require the US secretary of state to develop a long-term strategy to combat illicit gold mining in Latin America and the Caribbean.

However, these efforts still do not address the full scope of the problem. Illegal gold mining operations continue to proliferate across multiple continents, generating billions of dollars in illicit revenues that often fund criminal organizations and contribute to environmental degradation.

"We are totally lacking progress at a policy level," Yansura said. "This is not an effective strategy that will win this war."