Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Nov, 2025

By Zoe Sagalow and Hussain Shah

Fifth Third Bancorp hopes to avoid deposit divestitures and branch sales related to its proposed acquisition of Comerica Inc.

|

The Cincinnati-based company estimates it will have to divest between $50 million and $60 million in deposits as a result of the transaction, but it hopes regulators will consider nonbank competition to lessen that amount and avoid branch sales, a source familiar with the acquisition said in an interview. Specifically, Fifth Third plans to argue to regulators that credit unions should be included in the competitive analysis, which would prevent the bank from having to sell any branches, the source said.

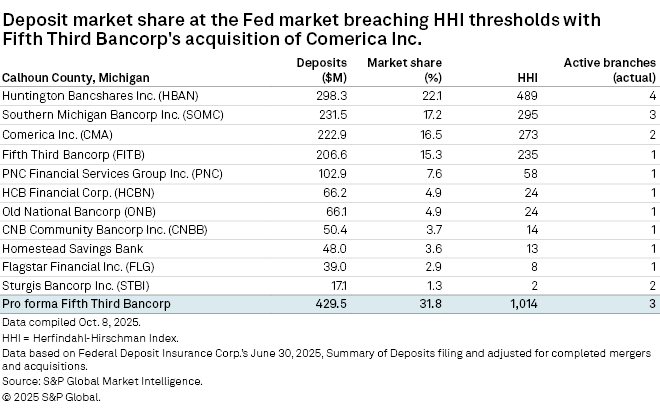

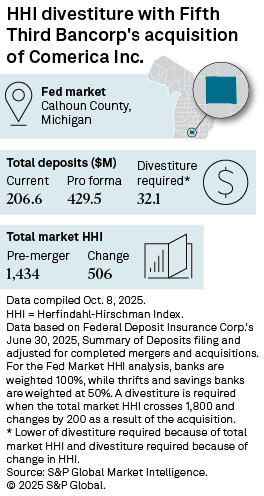

According to an analysis by S&P Global Market Intelligence, Fifth Third would exceed the US Justice Department's maximum "change in market" and "total market" Herfindahl-Hirschman Index (HHI) levels in one market, Calhoun County, Michigan, potentially requiring a $32.1 million deposit divestiture. In that county, Fifth Third has $206.6 million in deposits and one branch, ranking fourth in deposit market share.

With the addition of Comerica, Fifth Third's deposits in the market would rise to $429.5 million between three branches, jumping to the top bank by deposit market share at 31.8%, according to Market Intelligence. Huntington Bancshares Inc., with four branches and 22.1% deposit market share, currently ranks No. 1. Fifth Third and Comerica rank fourth and third, respectively.

Another market, Jackson, Michigan, would rise above the Justice Department's maximum "total market" HHI level of 1,800 after the deal, but does not trip the "change in market" maximum, according to Market Intelligence analysis. To require divestitures, a bank's deposits must exceed both the "change in market" and "total market" HHI maximums.

Fifth Third has 75 active branches that are within two miles of a Comerica one, while Comerica has 96 active branches within two miles of a Fifth Third branch.

While the HHI analysis that is conducted by the Justice Department does not include nonbanks, it is just one part of the overall competitive analysis conducted by a bank's primary federal regulator. Ultimately, the federal bank regulators rule, based on their competitive analysis, whether the merger presents concentration concerns; then, the Justice Department can contest that ruling if it disagrees.

The federal bank agencies have discretion to consider other competitors in their overall competitive analysis, and they often take them into account, bank advisers said. The agencies ask banks for that information, with the last question of the interagency bank merger application providing a space for the buyer to discuss nonbank competition from credit unions, finance companies, government agencies and more.

"Nondepository institution competition is not included in the HHI analysis, but often is considered as part of the overall analysis," Chip MacDonald, managing director of MacDonald Partners LLC, told Market Intelligence in an email.

It is common for bank agencies to consider nonbank competitors in smaller, rural markets where one branch can make a big difference.

"The agencies can do additional analysis if the HHI is not accurately reflective of the reality of the market, which happens a lot in small counties, small markets. That's pretty common because one branch changing hands will significantly affect the HHI versus in New York City," said Matthew Bornfreund, a partner advising banks and fintech companies on regulation and more at Morrison & Foerster LLP and former attorney at the Board of Governors of the Federal Reserve System, in an interview.

Typically, the federal bank regulators consider deposits from other commercial banks at a weight of 100% and credit unions at 50%, while thrift bank deposits vary between 50% and 100% based on how active they are in commercial lending, MacDonald said.

Including such entities in the HHI analysis has been a hot topic in the industry for some time and is the focus of a pending House bill.

The exclusion of those competitors in the HHI analysis is a "challenge," said Anthony Badaracco, partner focused on antitrust law at Dorsey & Whitney LLP.

For the bank industry, it makes sense to include "credit unions, fintechs, private credit providers, debt funds, other types of businesses that are structured differently and that you wouldn't think of as banks, but then in some cases, are offering products that consumers or businesses legitimately are kind of choosing between and deciding how they want to do business," Badaracco said.