Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2025

By Hailey Ross and Jason Woleben

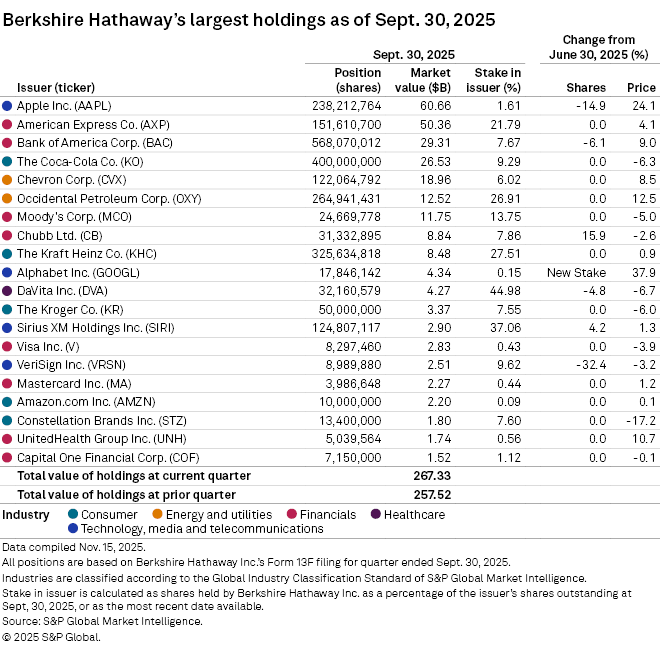

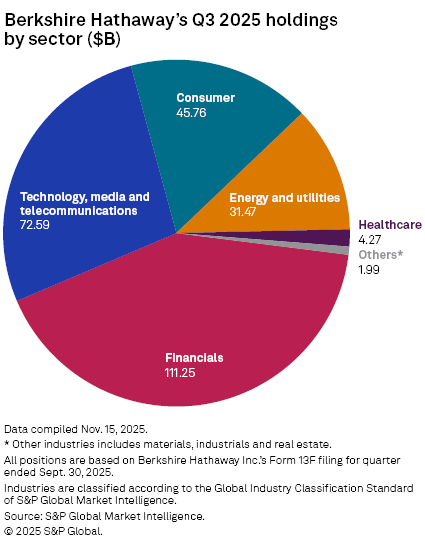

Berkshire Hathaway Inc. had a busy third quarter as it increased its stake in Chubb, further reduced its position in Bank of America Corp. and placed a large first-time bet on Google parent company Alphabet Inc.

According to its latest Form 13-F filing, the Warren Buffett-led conglomerate picked up roughly 4.3 million additional shares in property and casualty insurer Chubb, reflecting an increase of about 15.9% from its previous position. Berkshire's holdings in Chubb were worth about $8.8 billion as of the end of the third quarter, up from approximately $7.8 billion a quarter earlier.

Chubb shares were down roughly 2.6% for the third quarter, though they did jump skyrocketed on the insurer's release of its most-recent earnings results, which beat analyst expectations and also saw the insurer hit record levels of core operating and property and casualty underwriting income.

Berkshire also again slash its holdings in Bank of America, lowering its stake by 6.1% with the sale of about 37.2 million shares. As of the end of the third quarter, Berkshire's position in BofA was valued at about $29.3 billion, up from $28.6 billion as of the end of the second quarter. The bank's stock closed the third quarter at $51.59, up from $47.32 at June 30.

Tech investments

Berkshire forged a new path with a first-time entry into Alphabet, buying about 17.8 million shares during the third quarter. The position was worth about $4.3 billion as of the end of the third quarter.

The use of generative AI tools is rapidly expanding in the US, and Alphabet's Google Gemini AI is one of the industry's most popular applications. According to an S&P Global Market Intelligence analysis, technology spending intent is also projected to surge in the fourth quarter in the US.

Berkshire pulled back a bit from Apple Inc. as it sold about 41.8 million shares during the third quarter. Berkshire's Apple position was valued at roughly $60.7 billion as of the end of the third quarter. Apple's stock soared 24% in the third quarter and the company is still Berkshire's largest holding.

Changes ahead

Chairman and CEO Warren Buffett, who has long manned the helm at Berkshire, will be stepping down at the end of the year at the age of 95. Greg Abel, vice chairman of non-insurance operations, is set to succeed the mogul.

In a Nov. 10 letter to shareholders, Buffett reminisced on his life while offering advice to shareholders and speaking on the changes to come. Even though leadership is shifting, Berkshire will continue to be "managed in a manner that will make its existence an asset to the United States," Buffett said.

"I will no longer be writing Berkshire's annual report or talking endlessly at the annual meeting," Buffett said. "As the British would say, I'm 'going quiet.'"