Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2025

By Karl Angelo Vidal and Shambhavi Gupta

The Baltic region recorded some of the highest private equity penetration rates across Europe, S&P Global Market Intelligence shows.

The penetration rate represents a country's private equity and venture capital-invested companies as a percent of its total private companies. Countries included in the analysis are the 27 members of EU, as well as the UK, Norway and Switzerland.

Latvia and Lithuania had the two highest percentages in their respective private business sectors, at 3.28% and 2.61%, respectively. Estonia came in fifth at 1.46%.

Switzerland was in third place with a penetration rate of 1.76%, while Finland came fourth at 1.48%.

Venture capital dominates

High penetration in the Baltics can be attributed to governments in the region strongly supporting the venture capital ecosystem, according to Vytautas Plunksnis, head of private equity at Lithuania-based INVL Asset Management.

"Government development agencies – ILTE in Lithuania, Altum in Latvia and KredEx in Estonia – are quite active in supporting the ecosystem," Plunksnis said. "They're writing comparably small checks, of €20 million or sometimes even lower. For a first-time manager, it's quite a significant limited partner commitment."

In Latvia, development finance institution Altum has invested in 16 funds. The Estonian Business and Innovation Agency provides venture capital through funds of funds to help grow Estonian startups.

The large number of smaller deals is reflected in the data. The aggregate total of private equity and venture capital-backed investments across the Baltics was down 56% year over year at $284.2 million for the first 10 months of 2025, according to Market Intelligence data. There were 57 deals between Jan. 1 and Oct. 31, 53 of which were rounds of funding.

"Venture capital is relatively larger in the Baltics than the rest of Europe," said Jonas Fagerlund, head of global private equity practice at consulting firm Arthur D. Little. "If we look at funds raised by fund stage, 70% to 90% of all funds in the Baltics go into venture capital over the last three years." That compares to 10% to 20% across all of Europe, he added.

|

– Download a spreadsheet with data in this story. – Read about UK private equity deal activity. – Explore more private equity coverage. |

For the EU as a whole, the penetration rate stood at 0.54%, higher than 0.49% in mid-2023. The UK, meanwhile, had a penetration rate of 0.36%, just a tick up from 0.35% in 2023.

Among the EU countries, Czechia saw the largest increase in penetration rate, climbing to 0.65% from 0.45% in 2023, while Bulgaria's penetration rate grew to 1.43% from 1.02%.

France has the most private equity-invested companies in the EU at 13,561. It has a penetration rate of 0.87%, up from 0.77% in 2023.

Tech, media and telecom most invested

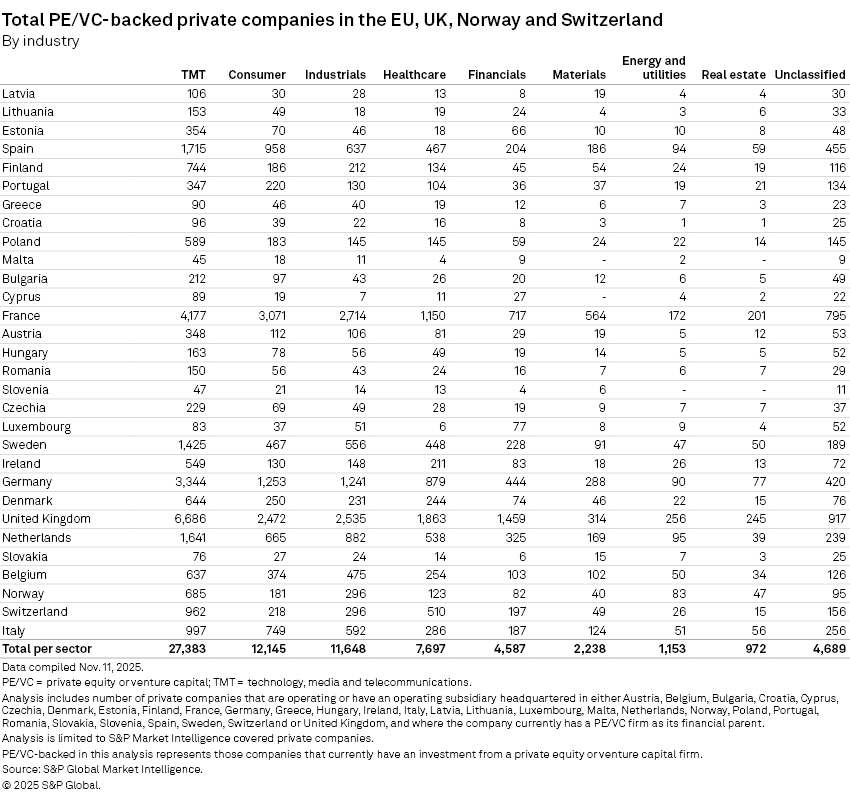

The technology, media and telecommunications sector has the largest number of private equity-backed companies across Europe, according to Market Intelligence data.

Private equity-backed TMT companies totaled 27,383 as of November, representing 38% of all private equity-backed companies across Europe.

The consumer sector had 12,145 PE-backed companies, while industrials had 11,648 such companies.

The uncertain direction of US tariffs created hesitation among investors to execute deals for the bulk of 2025, but the situation has largely settled, Fagerlund said.

"People are clear about where the market will grow, and therefore, that will lead to more investments also going forward," Fagerlund said.

Investments in defense-related companies in particular are expected to grow in the next couple of years.

"Two or three years back, many [private equity firms] were not allowed to invest in defense companies. Now, many firms are changing their status to allow them to invest because they see huge growth in this sector going forward," Fagerlund said. "Traditional PE fund groups are setting up new funds with a defense-focused strategy, or funds with the purpose of investing in civilian infrastructure and assets that possess both civilian and military applications."

Netherlands-based Keen Venture Partners LLP raised more than €150 million at the first close of its European defense and security technology fund. The venture capital fund, which secured commitments from the European Investment Fund and pension fund PME pensioenfonds, seeks to invest in European countries within NATO.

In June, French private equity firm Tikehau Capital launched a private equity fund focused on defense, cybersecurity and European security. The fund is in partnership with insurance companies Société Générale Assurances, CNP Assurances SA and CARAC Group.

Private equity investments in European defense might be hampered by the mandates of the limited partners, INVL's Plunksnis said.

"Some of the LP definitions don't allow this investment," he said. "More work needs to be done on the EU level to allow this capital to be directed towards like defense because you cannot breach your mandate."