Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Nov, 2025

By Sheikh Rishad and Ronamil Portes

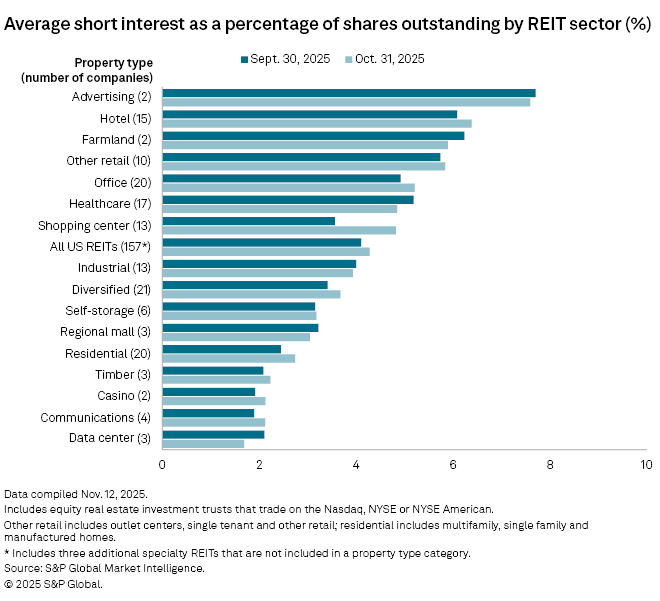

The average short interest for US equity real estate investment trusts saw a slight uptick in October to 4.3% of shares outstanding, with an increase of 18 basis points from the last month, according to S&P Global Market Intelligence data.

In October, among all US equity REIT sectors, advertising REITs posted the highest average short interest of 7.6% of shares outstanding, down from 7.7% in September.

Hotel REITs surpassed farmland REITs to generate the second-highest average short interest of 6.4% of shares outstanding in October, a 30-basis-point increase from September.

The farmland sector rounded out the top three sectors with an average short interest of 5.9% of shares outstanding, a decline of 34 basis points from the previous month.

– Set email alerts for future Data Dispatch articles.

– Download data featured in this story in Excel format.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

Data center REITs had the lowest average short interest of 1.7% of shares outstanding, followed by the communications and casino sectors, both at about 2.1%.

Timber REITs posted an average short interest of 2.2% of shares outstanding.

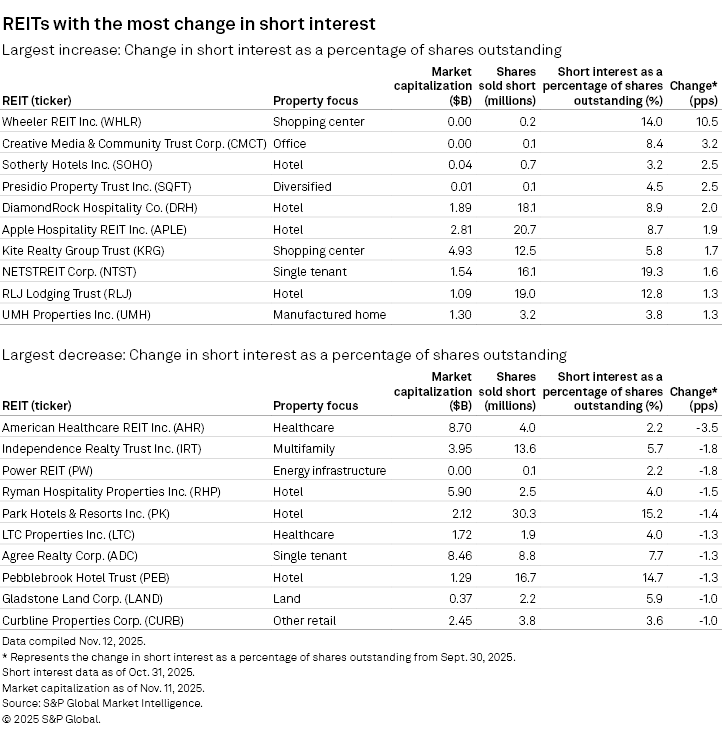

REITs with the most change in short interest

Shopping center REIT Wheeler REIT Inc. had the largest month-over-month rise in short interest among all REITs, with a 10.5-percentage-point increase to 14.0% of shares outstanding in October.

Short interest in Creative Media & Community Trust Corp., an office REIT, climbed by 3.2 percentage points to reach 8.4% of shares outstanding, representing the second-largest month-over-month increase across all US REITs. Meanwhile, Sotherly Hotels Inc., a hotel REIT, experienced the third-largest short interest increase among all REITs with a rise of 2.5 percentage points to 3.2% of shares outstanding in October.

Diversified REIT Presidio Property Trust ranked fourth, with a 2.5-percentage-point increase in short interest to 4.5% of shares outstanding.

Three other hotel REITs with the largest increase in short interest included: DiamondRock Hospitality Co. posting a short interest increase of 2.0 percentage points to 8.9% of shares outstanding; Apple Hospitality REIT Inc. recording a short interest increase of 1.9 percentage points to 8.7% of shares outstanding; and RLJ Lodging Trust posting a short interest increase of 1.3 percentage points to 12.8% of shares outstanding.

In October, healthcare REIT American Healthcare REIT Inc., among all REITs, recorded the largest decline of 3.5 percentage points in short interest to 2.2% of shares outstanding.

Multifamily REIT Independence Realty Trust Inc. had the second-largest drop, with a 1.8-percentage-point month-over-month decrease in short interest to 5.7% of shares outstanding in October.

Energy infrastructure REIT Power REIT followed, with a 1.8-percentage-point decline in short interest to 2.2% of shares outstanding.

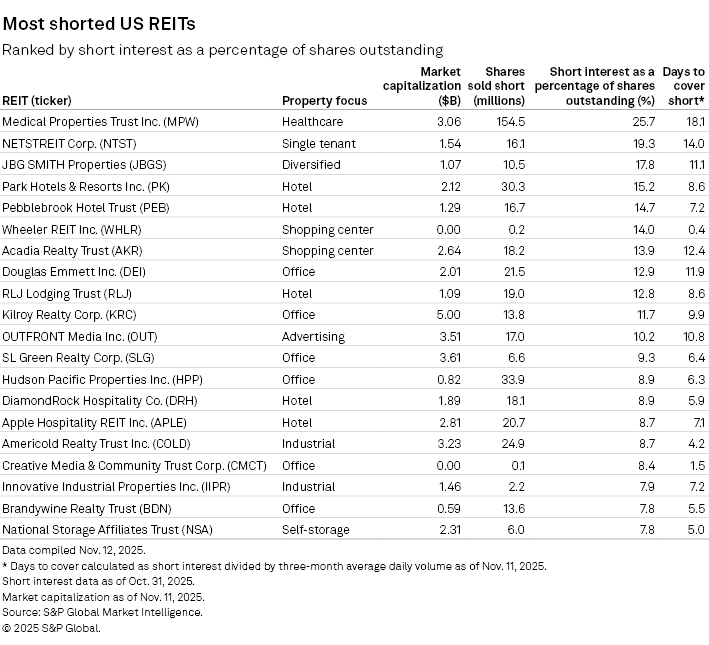

REITs with the largest short positions

Healthcare-focused Medical Properties Trust Inc. was the most-shorted US equity REIT as of Oct. 31, with 154.5 million shares sold short or 25.7% of shares outstanding.

Among US REIT stocks, single tenant REIT NETSTREIT Corp. ranked second, with 19.3% short interest of outstanding shares and 16.1 million shares sold short. Following closely was diversified REIT JBG Smith Properties, which had 17.8% of its outstanding shares in short positions.